The most typical pitfalls for Odoo in Germany are:

DATEV export

As the most widely used accounting software, DATEV is the unofficial standard in German tax offices. The integration of Odoo and DATEV is therefore extremely important for the smooth transfer of your accounting data.

German Translations

They are rather poor in the Odoo standard and some improvements are needed to achieve a professional language level.

Documents & Templates

There is still room for improvement here too. Odoo's standard templates are hardly usable for German companies, as important mandatory invoice information is missing.

Our solution - The Odoo apps for Germany!

DATEV export/import + image files

For €1.000,-

Compliant invoices & templates

For €500,-

German translations, Public holidays &

amortisation tables

For €500,-

Total €2.000,-

Odoo DATEV export & import

DATEV is the most widely used software for tax consultancies. With our Germany starter package for Odoo, you receive all interfaces for automated data exchange with your tax advisor. Whether import or export, with or without invoice images: We offer all the integrations you need.

The main functions include:

- The recognition of automatic accounts

- The option to specify (custom) posting codes

- The option to add debtor and creditor numbers

- Fully configurable according to customer wishes or tax consultant requirements:

- Column names

- Column content

- Length of the G/L and subledger accounts

Document configuration for German standards

The Odoo standard templates do not fulfil German requirements

Standard Odoo documents such as quotations, orders, invoices, purchase orders, and delivery notes are not tailored to the German market. They cannot be used well in their default form.

With our Document Configuration Module for Odoo, you gain extended configuration options that allow you to adapt your Odoo documents to German standards, including layouts according to DIN 5008.

This way, your business documents meet German requirements while still staying flexible for your specific needs.

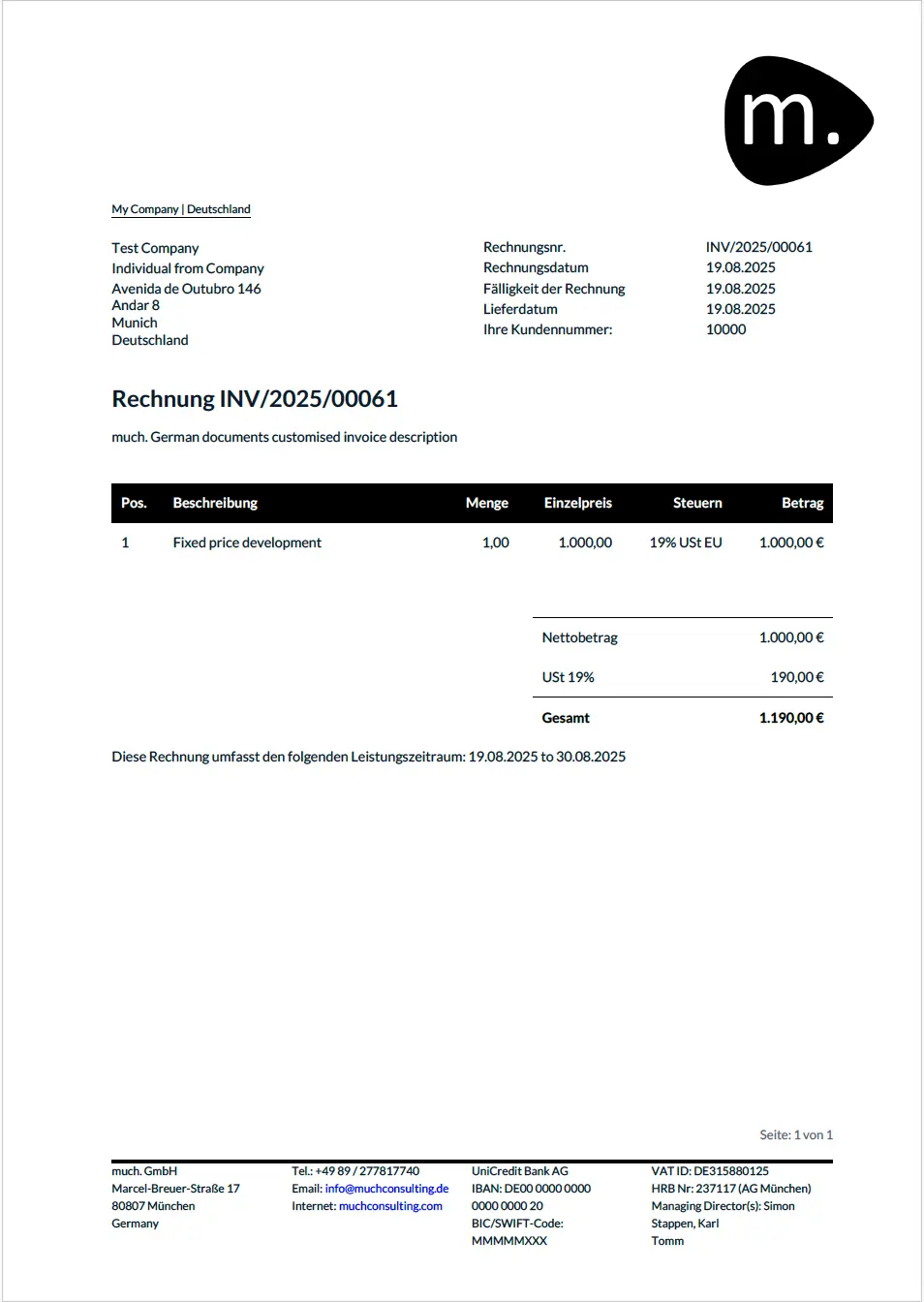

See a direct comparison here:

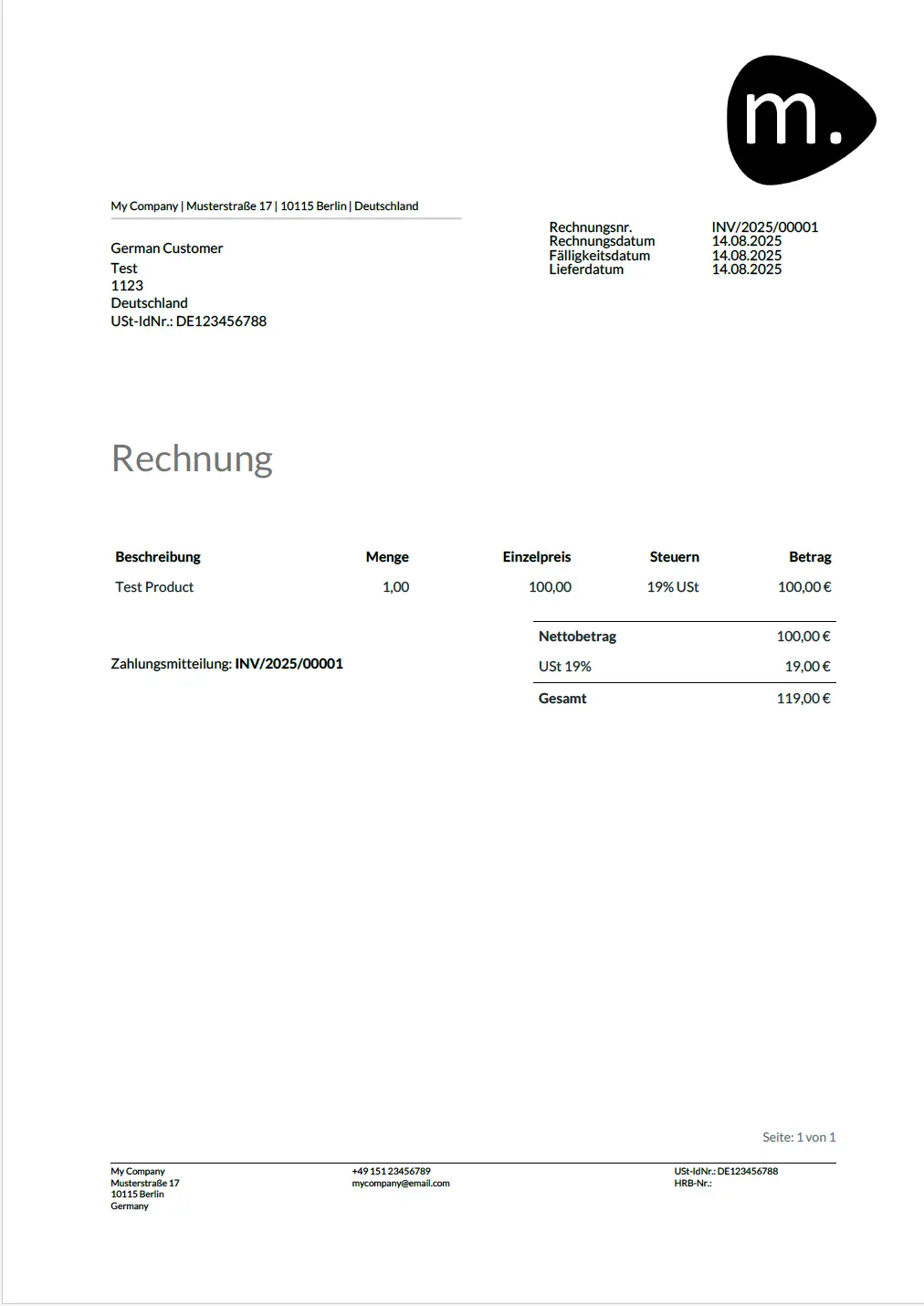

An Odoo standard invoice…

…and one configured with our module according to German standards.

Core Features:

Types of documents:

- Invoices

- Offers/Quotations

- Sale Orders

- Purchase Orders

- Delivery Slips

Adapted Footer with:

- Company address

- Managing director

- Bank details

- Commercial register number

- Tax number

- VAT identification number

Adapted head section with:

- Reference

- Invoice number

- Order number

- Customer number

- Tax number

- Customer VAT identification number

Separate service & invoice period:

In Germany, we distinguish between invoicing and service delivery periods. They can take place at different times and must be specified separately accordingly.

Make your Odoo fluent in German:

Our starter pack includes improved translations!

By default, Odoo's translations are rather clumsy. For this reason, we have made countless improvements for documents of all kinds to ensure a professional standard in German as well.

Corrected German translations for Odoo:

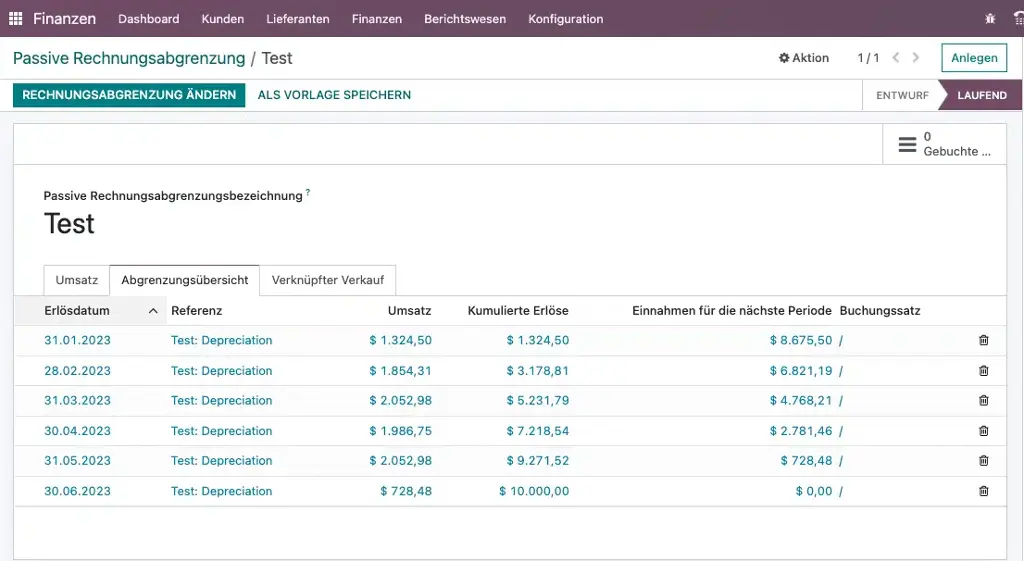

Example: Accrued expenses and deferred income in Odoo 16 without start pack

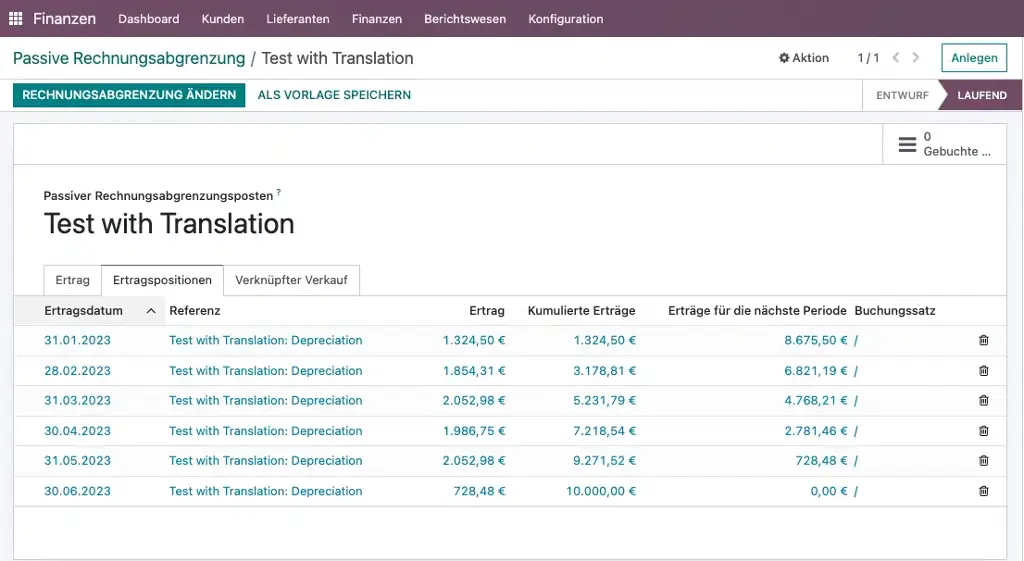

Example: Accrued expenses and deferred income in Odoo 16 with start pack.

German public holidays & amortisation tables

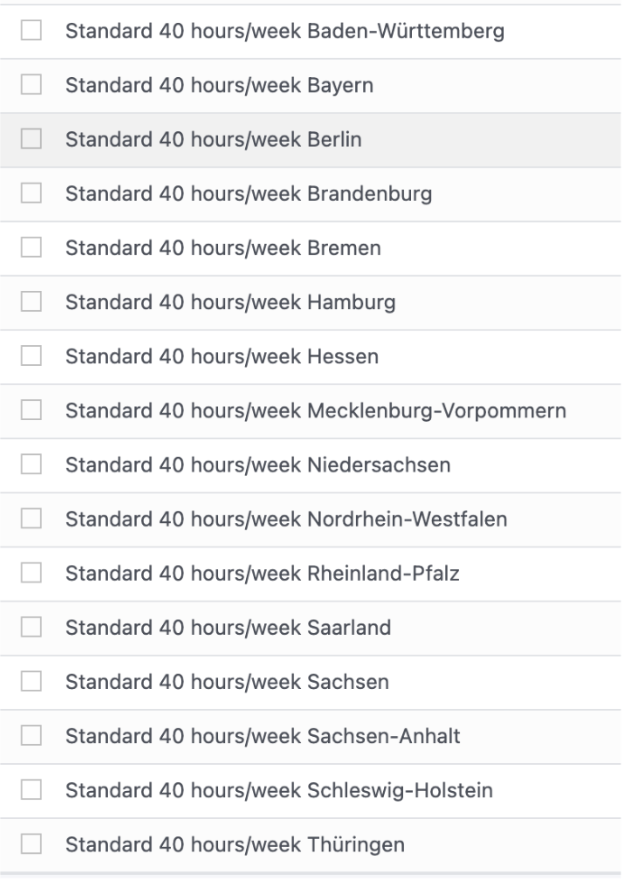

In Odoo, calendars containing public holidays must be assigned to employees. The German public holidays have to be entered manually. Our solution saves time here by importing calendars that contain the respective public holidays for all federal states up to 2030.

List of working hours for the different federal states.

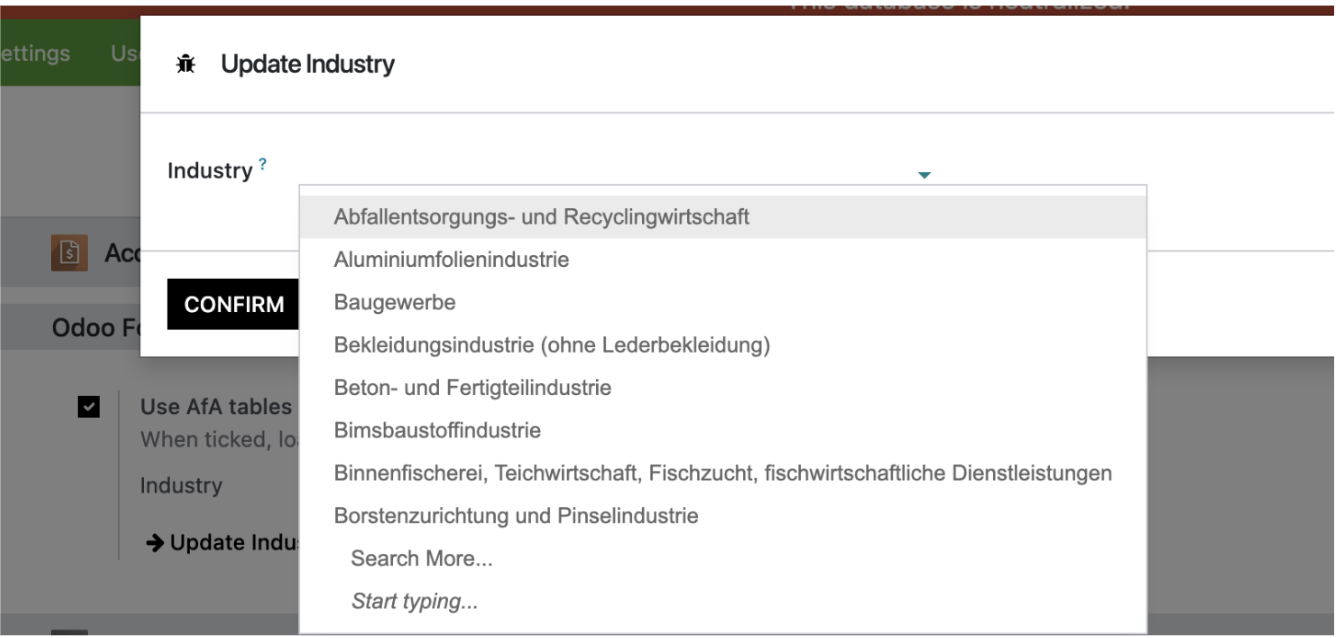

The German amortisation tables (AfA) are also imported by our solution. If the fixed asset feature (Assets) is used in Odoo, our solution saves a lot of time.

Selection menu for the amortisation tables of various industries.

We are happy to meet you in person!

Victor Popov

Senior Solutions Consultant

Nuhash Kinzel

Senior Solutions Consultant