In this article, we cover the most important points of German accounting in and with Odoo. We will examine the basics, GoBD compliance, typical workflows, DATEV integration, and reporting. The aim is to provide a clear overview of German accounting with Odoo.

Table of contents

Basics of German accounting in Odoo

Odoo offers extensive accounting functionalities for over 30 countries, including Germany.

For Germany, specific fiscal localisation packages are available, which pre-configure the system according to German tax laws. When creating a new Odoo Online database, SKR03 is installed by default.

Both common charts of accounts, SKR03 and SKR04, are supported. You can check which chart of accounts is installed under Accounting ‣ Configuration ‣ Settings in the Package field under Fiscal Localisation.

Please note that changing the package is only possible as long as no accounting entries have been created.

Odoo is GOBD-compliant

GOBD compliance is an important aspect of accounting. Odoo 18 is certified according to the German GOBD standard (IDW PS 880). Relevant documentation is available online. However, the responsibility for the complete and exhaustive retention of tax-relevant data lies with the taxpayer themselves.

Odoo offers extensive functions for compliance with accounting regulations and GOBD conformity:

Accounts

The "Accounts Feature" allows for a detailed analysis of bookings. Through various reports, you can trace which bookings were made on a specific account, when, and by whom. Additionally, an analysis of the applied tax rates based on accounts is possible.

Journals

The "Journal Feature" provides the ability to view the bookings within a journal. You can trace which tax rates and tax amounts were used in this journal. In the latest Odoo version, an additional "Journal Report" functionality has also been added.

Entries and bookings

The "Journal Entry Feature" ensures a clear audit trail of all changes and actions on entries. Each entry can be uniquely identified by a running sequence.

Period locks

Odoo allows for the definition of period lock dates to either close a period for tax purposes or to close it completely (e.g., after the annual financial statements).

Dual control (four-eyes principle)

For sensitive changes, such as new outgoing bank accounts, approvals based on the four-eyes principle can be set up.

Field change tracking and logging

Odoo additionally tracks field changes and logs them completely.

Data access for auditors

Odoo offers three possibilities for data access for auditors:

- Frequently, DATEV is used as the final accounting solution, and the audit takes place directly in DATEV.

- The export of journal entries or master data in a structured CSV or XLSX format is possible (field configuration for the export can be customised individually).

- There is the possibility to create a user with the "Auditor" access rights group, who is granted full access to the accounting section of the system at any time as read-only access.

Support of the 6 criteria of audit security

Odoo supports the 6 criteria of audit security:

1. Traceability and verifiability (GoBD Chapter 3.1): Odoo has a history and tracking of all changes. This also records when and by whom changes were made.

2. Completeness (GoBD Chapter 3.2.1): The complete recording of all documents can only be supported by an ERP and mainly refers to the uploading of all relevant documents. In this regard, the list of relevant documents is particularly important to note.

3. Accuracy (GoBD Chapter 3.2.2): Odoo ensures that with correct configuration, the correct accounts are used, and control mechanisms between orders and invoices reflect the business reality.

4. Timely recording and documentation (GoBD Chapter 3.3): Financial data is largely generated automatically by transaction objects, which ensures timely booking and recording.

5. Orderliness (GoBD Chapter 3.4): Financial data is orderly by default and can be sorted by various fields, enabling structured and clear data management.

6. Immutability (GoBD Chapter 3.5): The German Odoo localisation is configured by default in such a way that the immutability clause can be adhered to. Changes are logged and cannot be made unnoticed.

Typical use cases and workflows in Germany

Odoo is frequently used in Germany in connection with DATEV to easily transmit data to authorities. A "stand-alone" use is possible but rarely occurs in practice.

Workflows in Odoo

- Outgoing invoices are created, posted & sent in Odoo.

- Incoming invoices are processed and posted within Odoo.

- Automatic) accruals can also be created for this purpose.

- Import of bank statements from banks and payment service providers and reconciliation with open items (payment matching).

- Export of payments and collective transfers.

- Fixed asset accounting and depreciation postings. In Odoo, asset classes with specific depreciation methods and durations can be configured. The associated accounts for depreciation and the posting in the balance sheet and income statement can also be stored.

- Automatic inventory valuation postings.

- Various special posting records (e.g., loans, provisions, …).

- Management reporting with ongoing balance sheet, profit and loss statement, and cash flow.

- Verification of Value Added Tax Identification Numbers (VIES interface).

- Support for digital invoices with X-Rechnung, ZUGFeRD 2.0, and Peppol. Odoo supports a wide selection of e-invoice formats and enables the direct sending and receiving of invoices via Peppol. When importing EDI invoices (Electronic Data Interchange), Odoo can automatically read the e-invoice and fill in the fields in the e-invoice. A standard e-invoice format can be stored in the partner.

- Archiving with audit reports.

Supporting processes in Odoo (from an accounting perspective)

- Cost accounting

- Budget tracking

- Invoice approval

- Time tracking

- Sales orders

- Purchase orders

The following processes can take place in DATEV / Addison or Odoo

- VAT return (USt-VA): download and upload via Elster Client

- Intrastat: download and upload on the portal

- EC sales list report (ZM-Meldung) - still needs Elster account

- Year-end closing entries (via DATEV process or closing entry in Odoo)

Usually not handled in Odoo

- Payroll in Germany.

- Electronic balance sheet transfer/export to the government (possible via ELSTER).

Typical task distribution between Odoo & DATEV

Tasks within the company (not at the tax advisor) | In Odoo | Transmission to DATEV |

Only preliminary accounting | Incoming invoices, outgoing invoices, payment matching, payment reminders & follow-ups | Documents only (via Unternehmen Online) or documents with posting proposal |

Internal accounting without annual financial statements or internal accounting with annual financial statements in DATEV | + All operational postings | Documents with posting proposal or documents with fixed posting |

Internal accounting with annual financial statements and DATEV for submission | + Year-end closing entries | Documents with fixed posting or fixed postings |

Odoo DATEV interface

The DATEV export/import facilitates data transfer between Odoo and DATEV, the standard software for accountants and tax advisors in Germany.

An interface is necessary to grant the tax advisor insight into the company's documents and postings, to verify completeness, and to ensure correct account allocation. This also guarantees GoB (Generally Accepted Accounting Principles) compliance.

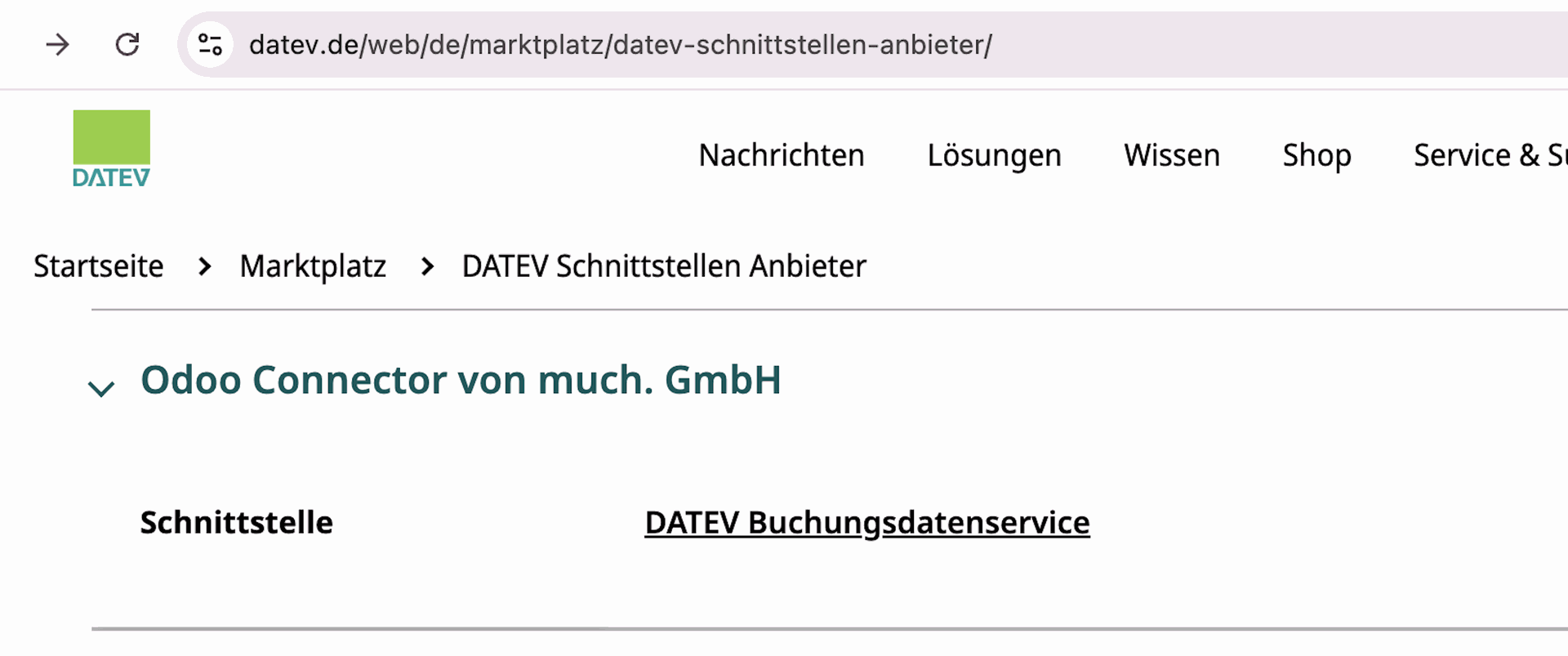

much. Consulting offers an API-based, certified DATEV interface for Odoo since 2024.

The benefits:

- Easy & secured login: With integrated SmartLogin and logout safeguards.

- Automated data transfer: Scheduled export of master data, journal entries and supporting documents.

- Customisable export: Journals to transfer, export frequency, and fields to include.

- Comprehensive logging: Track errors with detailed logs and help links.

- User-friendly interface: Intuitive design directly integrated in Odoo.

Besides the the automated API, you can still:

- Download files in CSV or XML

- Reconcile transactions (OPOS)

- Manage Analytic Accounts

- Auto-generate partner accounts numbers

- Import DATEV files & more!

Reporting

Odoo offers Germany-specific reports in the Enterprise model: Balance Sheet, Profit and Loss Statement, VAT Return (Umsatzsteuervoranmeldung), EC Sales List (EG-Verkaufsliste), and Intrastat.

The VAT Return (USt-VA) and the Intrastat report can be downloaded and uploaded via the respective portals (Elster Client for VAT Return).

There is the possibility to create customised reports, e.g., tax reports, balance sheets, and profit and loss statements with specific groupings and layouts.

The export of the SAF-T report is possible under Accounting ‣ Reports ‣ General Ledger via the PDF button (select SAF-T). In Luxembourg, a FAIA file export (similar to SAF-T) can be carried out under Accounting ‣ Reporting ‣ Audit Reports ‣ General Ledger ‣ FAIA.

Under Reporting, the Tax Report can be found, which can be exported for the VAT Return in PDF and XLSX format.

Important notes

The fiscal localisation should be set correctly before the first journal entries are made, as this cannot be changed later.

Odoo is globally compatible, and fiscal localisation packages configure the database according to country-specific taxes, fiscal positions, and chart of accounts.

For more complex accounting questions, it may be advisable to seek professional advice. Topics here can include taxes on documents, budget management, DATEV, manual bookings, fixed assets, deferred items, consolidation, annual financial statements, customs, government reporting, and the chart of accounts.

much. Consulting is an ERP consulting company specialised in Odoo, with a dedicated Financial ERP Consulting team and experience in implementing accounting for various GAPs, IFRS, and the USA. We are an Odoo Gold Partner and certified according to ISAE 3402 Type 1 and 2.