Financial processes & accounting represent the backbone of any ERP system. So if you are considering implementing Odoo in your company, most likely you will need to know what exactly Odoo Accounting offers in terms of capabilities and functionalities. The answer is, in a nutshell: everything. Odoo enables you to map your entire bookkeeping. Accounting from A to Z. Yet, in order to give you an overview of the key aspects quickly, we summarized the most essential features of Odoo Accounting in the following.

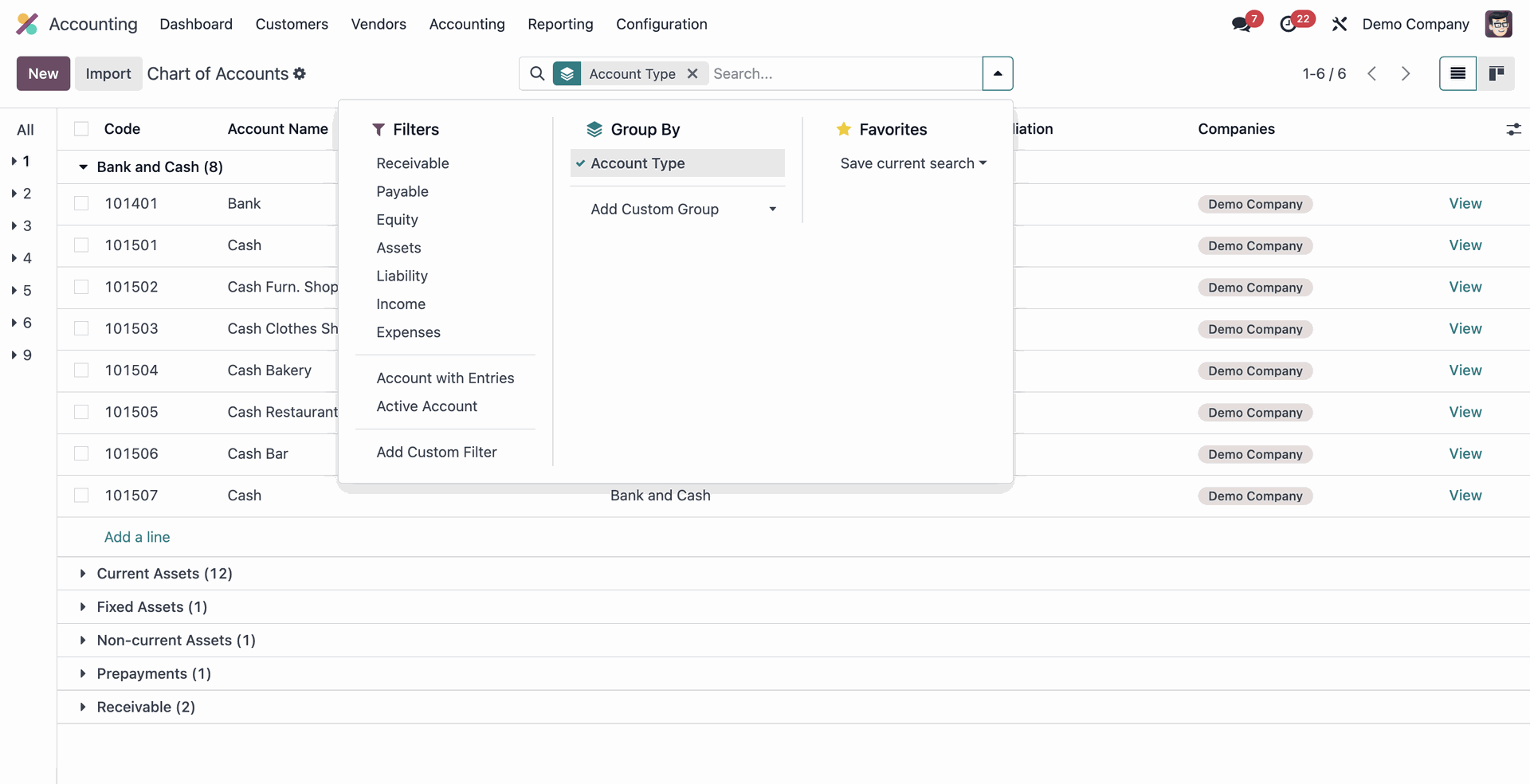

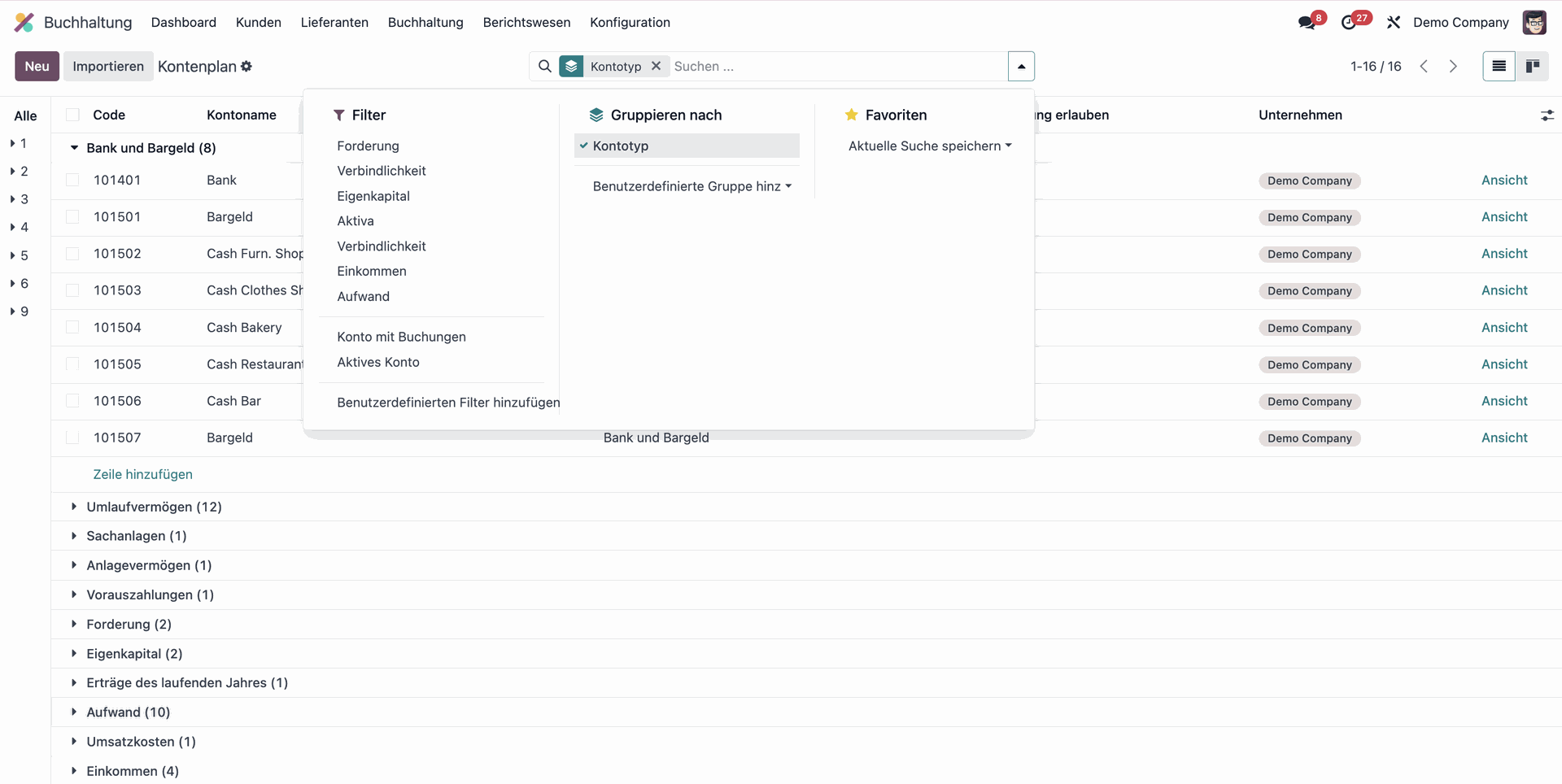

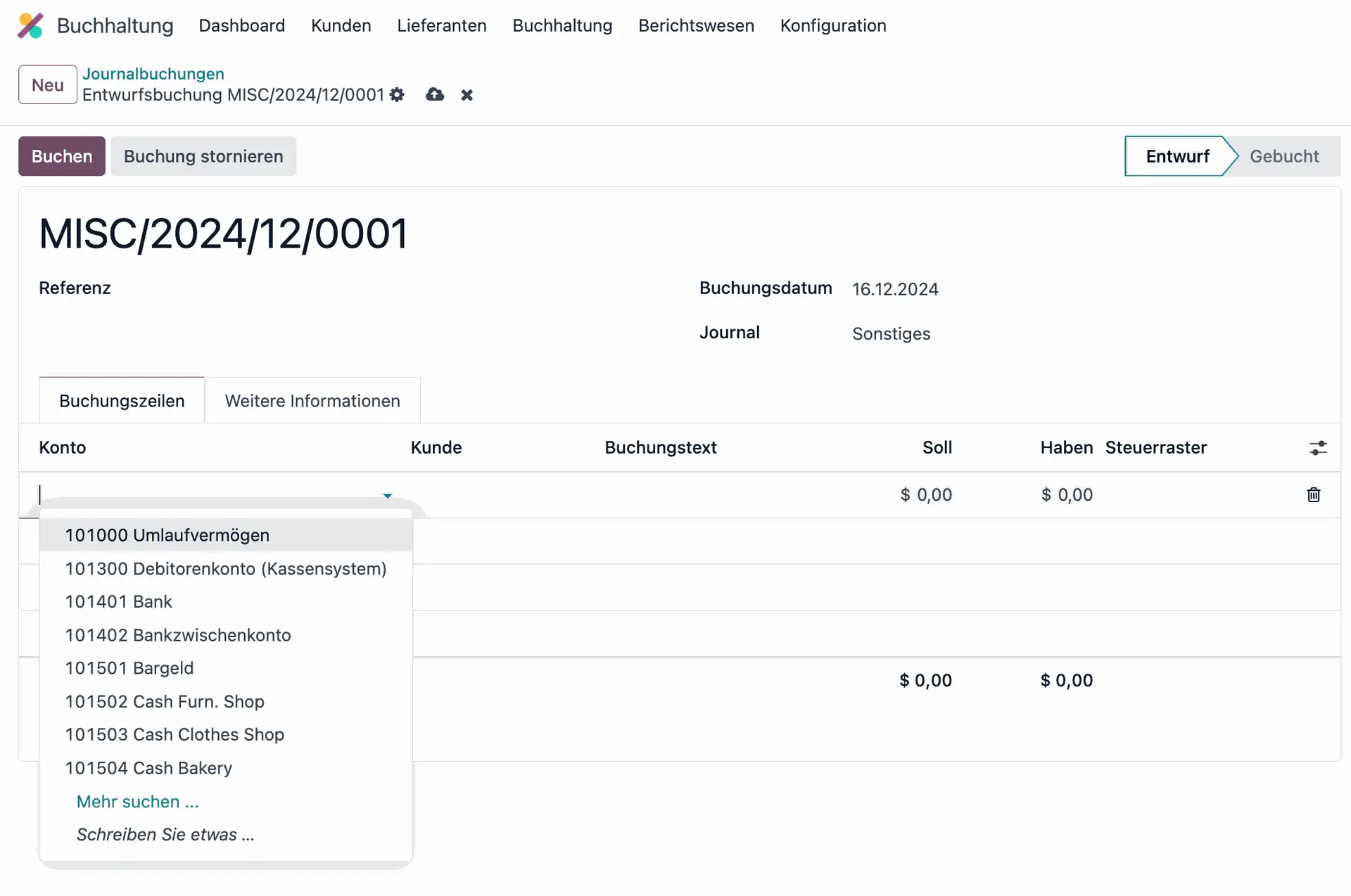

Customizable Chart of Accounts

The customizable chart of accounts feature in Odoo Accounting allows businesses to tailor their financial reporting to their specific needs, categorize transactions, and generate custom reports, using individual charts of accounts or creating individual accounts afterward. This feature offers several benefits for businesses, including:

- Accurate and relevant financial reporting

- Improved financial analysis and decision-making

- Better financial management and tracking

- Informed decision-making regarding budgeting, investments, and cash flow

- Flexibility to adapt to changes in the business environment without extensive reconfiguration of the accounting system

- Standard reports and chart of accounts for over 80 countries, supporting businesses worldwide.

Easy localization for accounting compliance across the Globe

Whether you’re operating in the US, Europe, or Asia, Odoo Accounting has you covered with comprehensive localization features tailored to each country’s accounting standards and regulations. This includes automatic tax calculation, support for multiple currencies, and the ability to generate financial statements according to local standards. Additionally, Odoo Accounting supports multiple languages, making it easy to use for businesses operating in multilingual environments. Odoo Accounting can help streamline your accounting processes and ensure compliance with local regulations, no matter where you do business.

For example – Features for localization in Germany include:

- Support for DATEV interface, which is widely used by tax consultants and accountants in Germany, with an export module

- Compliance with the GoBD principles for proper accounting and record-keeping in electronic form

- Includes a chart of accounts based on SKR03 and SKR04, which are commonly used standards in Germany

- Ability to generate financial statements according to German accounting standards

- Multiple currency support for businesses that operate in international markets

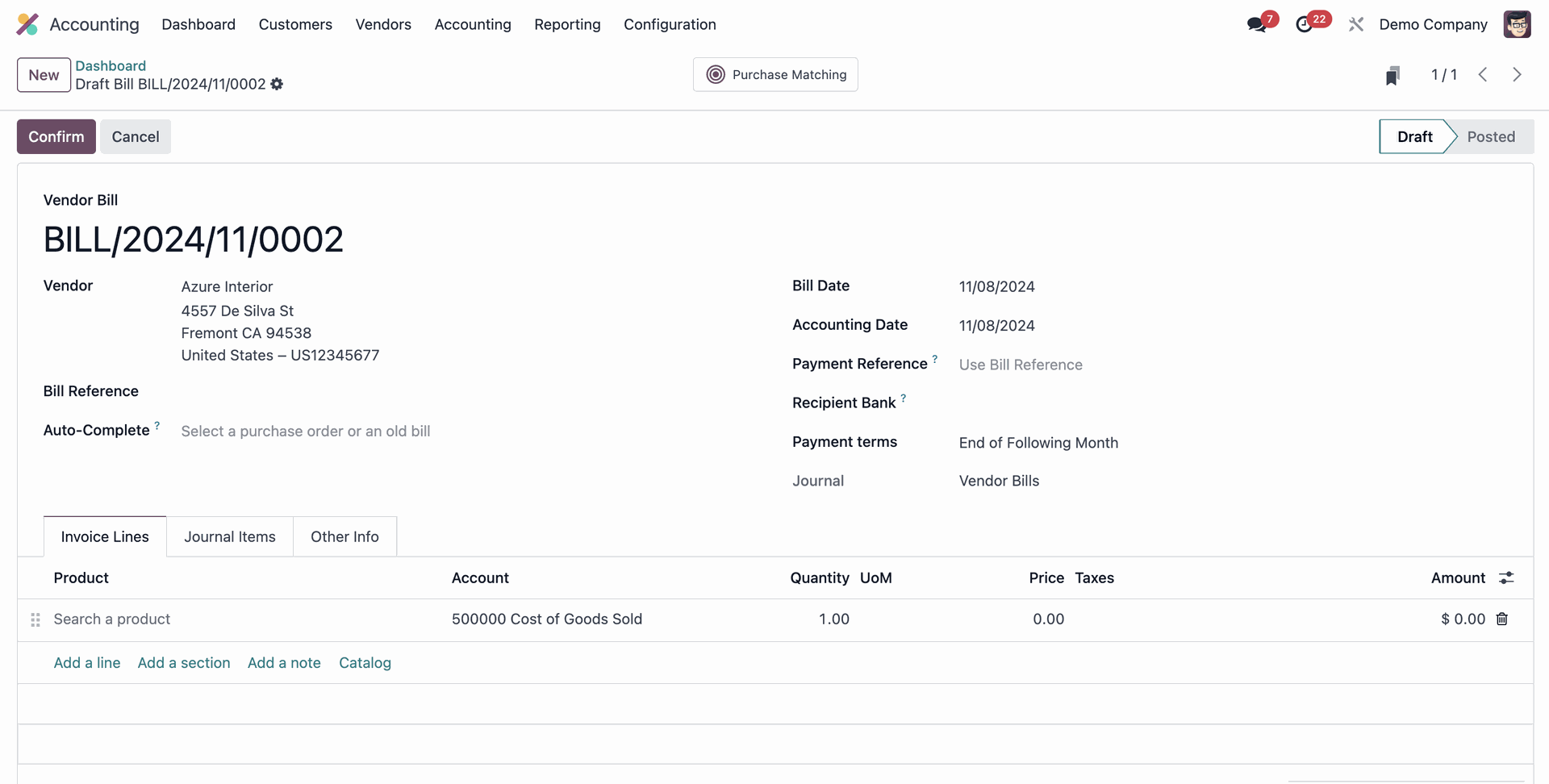

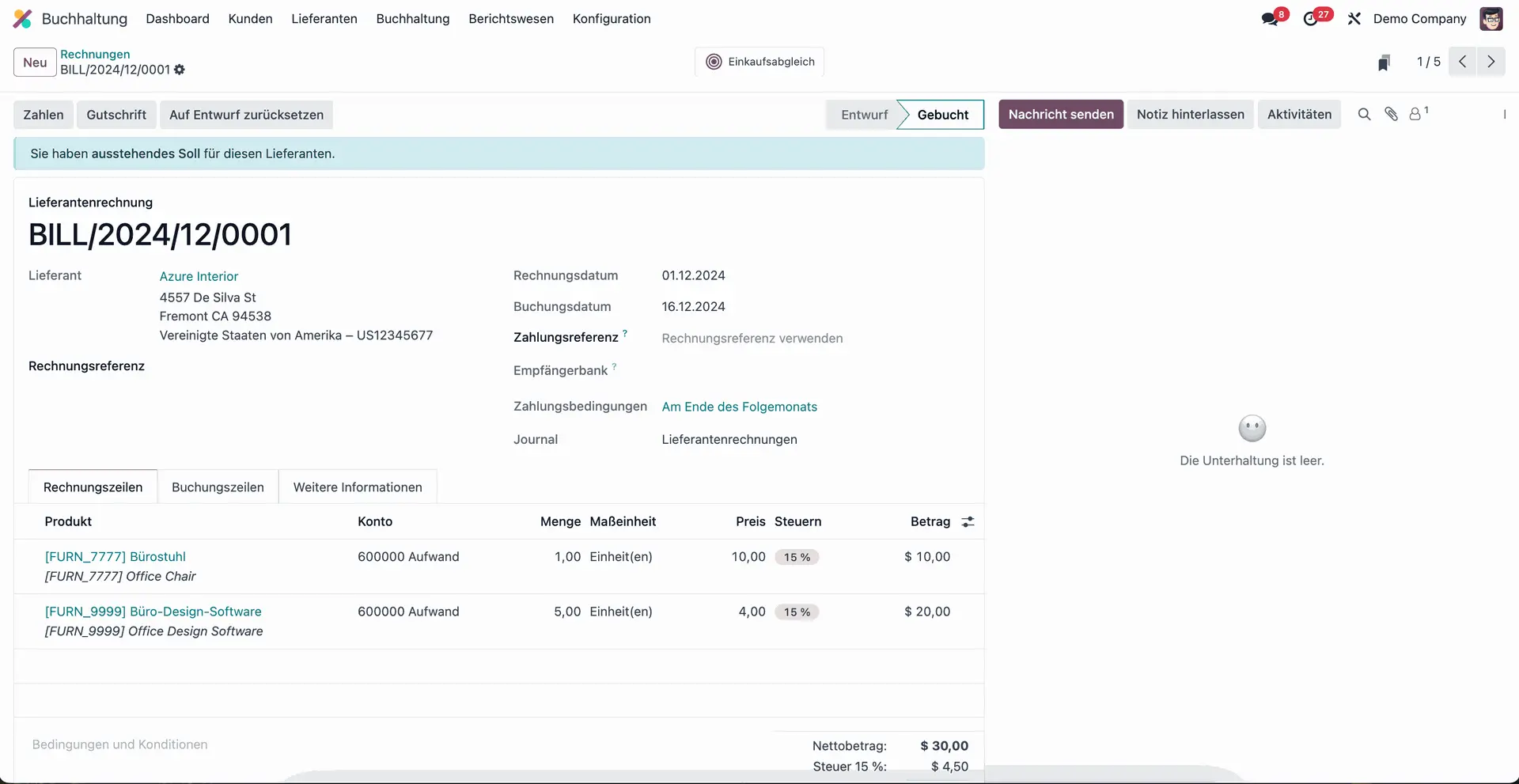

Automated incoming/outgoing invoice management & dunning process

One of the standout features of Odoo Accounting is its automated incoming/outgoing invoice management and dunning process. With this, you can automatically create invoices for incoming payments and register outgoing invoices for payments due, making it easy to track your cash flow. Additionally, the dunning process automates the reminder process for overdue payments, ensuring that you receive payments on time and minimize any cash flow disruptions. Overall, this feature can save you time and reduce the risk of errors in your accounting processes, helping you to maintain financial stability for your business.

A closer look: incoming invoices in Odoo

Incoming invoices, which are automatically recognized, are pre-assigned and linked to the original document.

- Create invoices manually or upload them as PDF.

- Automatic document capture via OCR and artificial intelligence

- Detect and connect invoices to purchase orders automatically

- Posting suggestions and manual processing

- Validate invoices and mark as due

- Export/pay invoices in one payment run

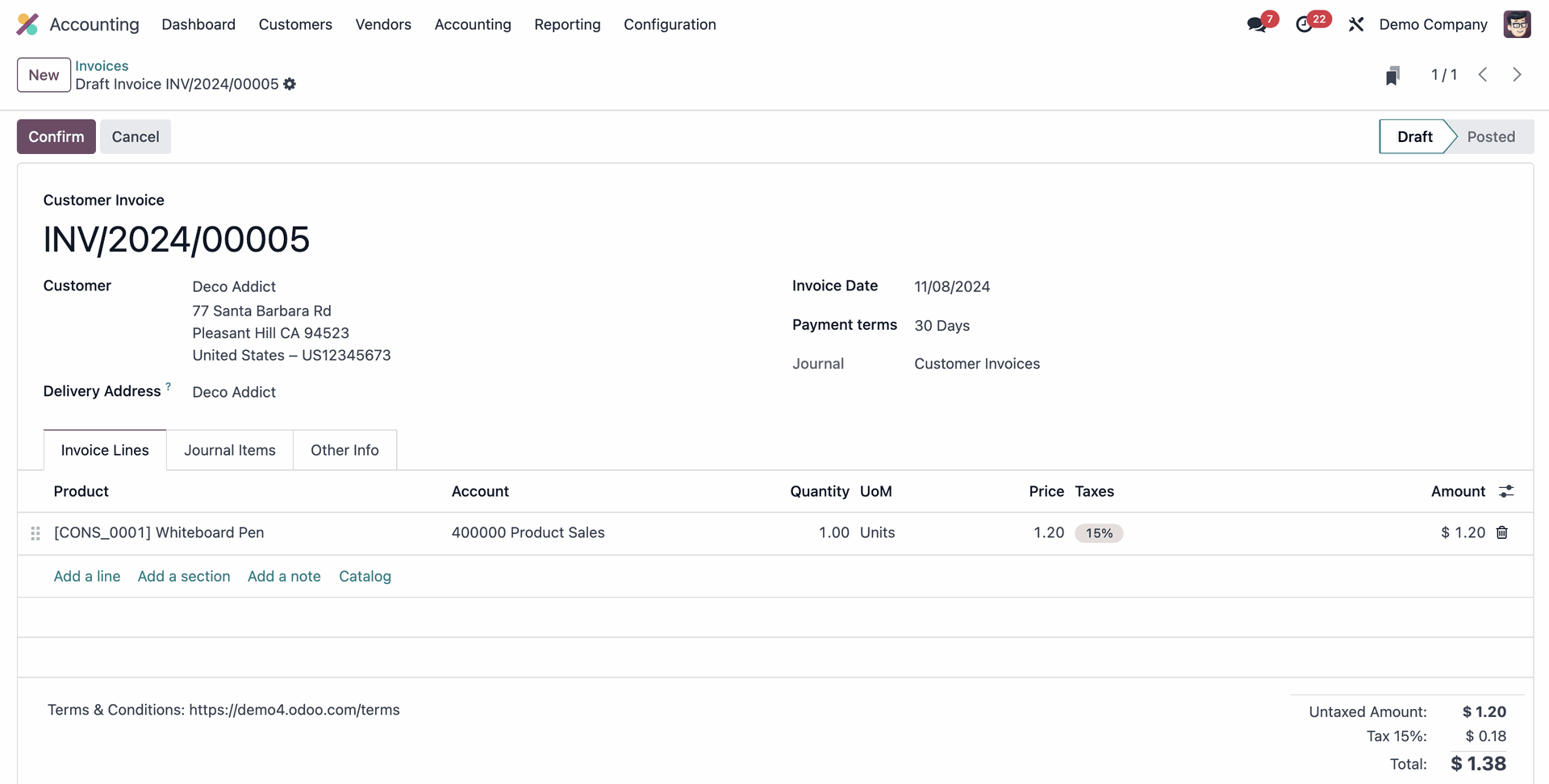

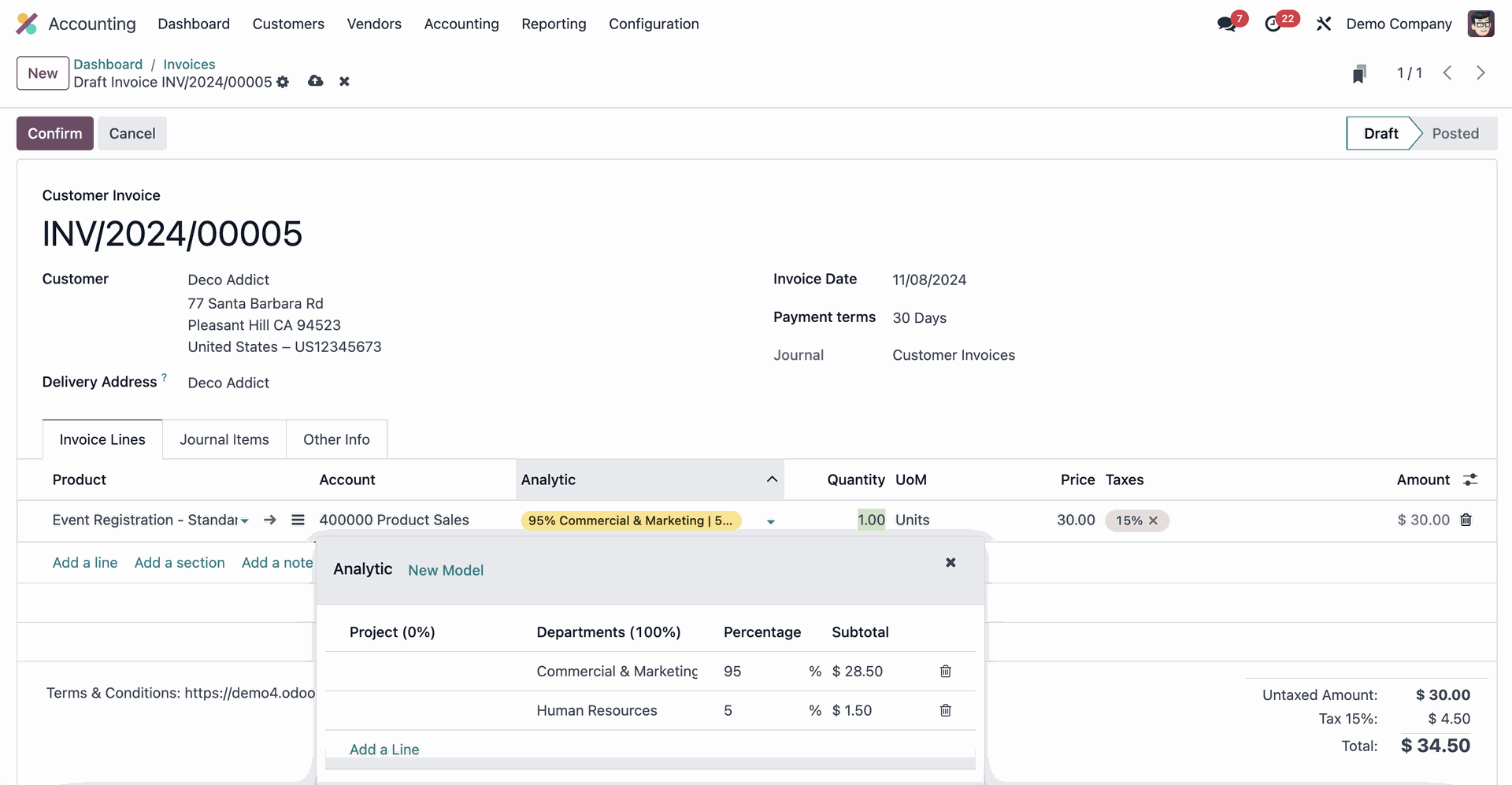

A closer look: outgoing invoices in Odoo

Thanks to customizable invoice templates, you can personalize your invoices to reflect your company’s unique branding. Moreover, with automated posting suggestions for accounts, you’ll save much time on manual data entry. Plus, sending invoices directly to your customers has never been easier! Keep track of paid and outstanding invoices with ease via the partner books feature. All of this goes hand in hand with an automated dunning process at various levels.

- Automatically & easily create invoices from sales orders

- Customizable, individual invoice design & layout

- Directly set payment target, invoice date, postings

- Post invoices directly

- Send invoices to the customer automatically

- Overview of overdue invoices

- Automated dunning running on different levels

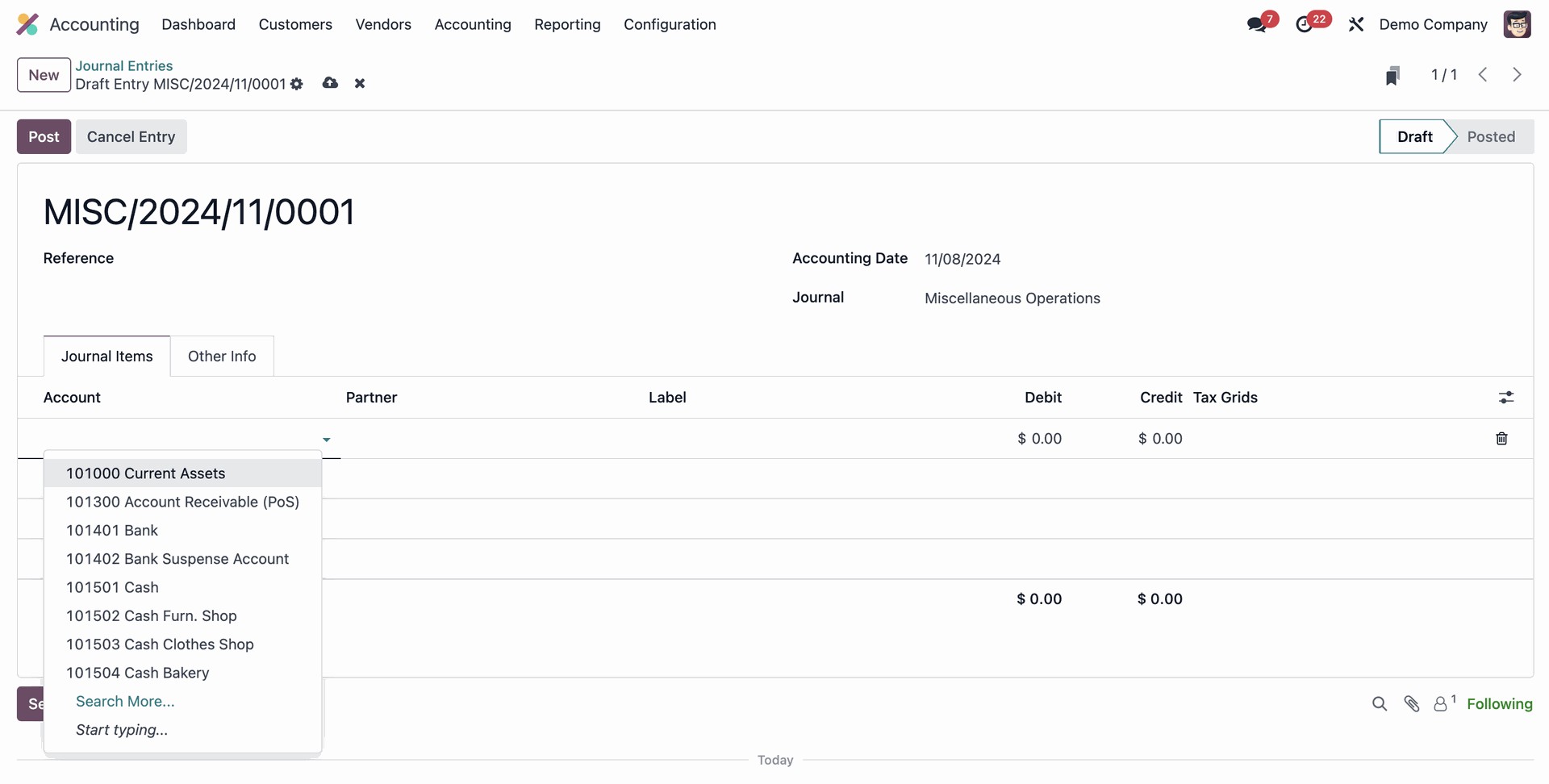

Note: Apart from vendor invoices and customer invoices, you can of course also generate classic accounting records, e.g. as part of the monthly or annual financial closing.

A closer look: Manual posting in Odoo Accounting includes

- Postings for monthly and year-end closing

- Accrual postings

- Fixed asset accounting incl. depreciation run

Automated depreciation

Delimit costs or sales and streamline your asset accounting with an automated depreciation run. Plus, with the ability to assign bookings to individual cost centers, you’ll get detailed insights into your expenses and revenue streams.

A closer look: cost centers in Odoo Accounting includes

- Easy creation cost centers

- Creation cost center groups

- Evaluation at cost center level

Automated bank synchronization

In Odoo Accounting you can easily link your bank accounts and automatically synchronize bank movements at regular intervals. This means you’ll always have up-to-date information on your balances, transactions, and more. Plus, with the ability to assign and settle supplier and customer invoices via bank details, you can streamline your payment processes and avoid manual data entry errors. And when it comes time to make payments, Odoo Accounting has you covered with the ability to create payment files for online banking and corresponding banks.

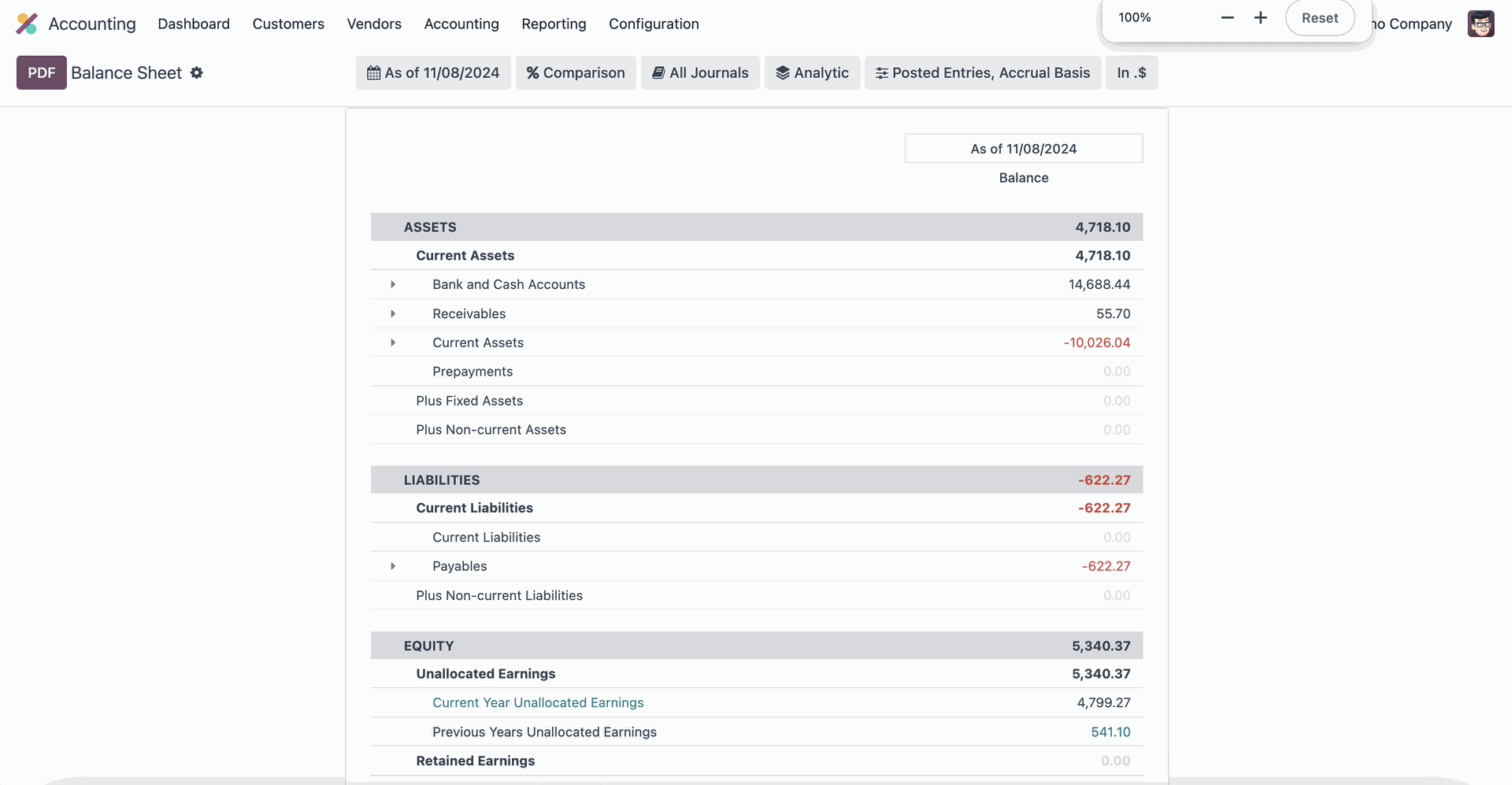

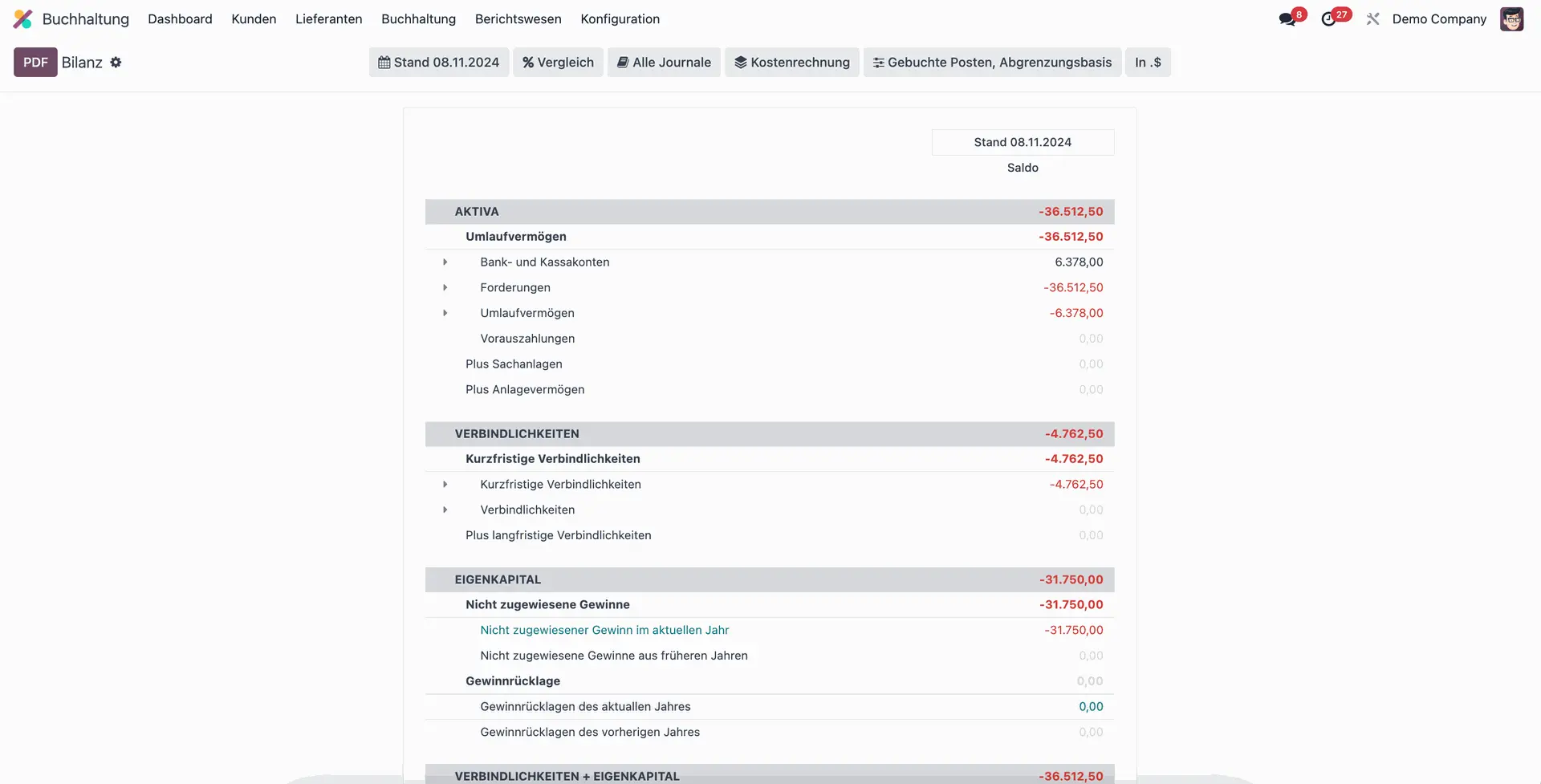

Reporting, Reporting, Reporting

With a range of customizable reports, including balance sheets, profit and loss statements, overdue invoice reports, and sales tax reports, you’ll have all the data you need to make informed decisions and drive growth. Plus, with powerful analysis tools like cost center analysis, you can get a detailed view of your expenses and revenue streams. And if you’re operating in Germany, you’ll love the easy integration with the DATEV , making the communication with your tax consultant seamless.

A closer look: Reporting in Odoo Accounting includes

- Balance sheet report

- Profit and Loss Account

- Sales tax report

- Cash flow report

- Fixed assets

Conclusion

Odoo Accounting is a true all-arounder that provides a comprehensive and user-friendly solution for managing your business finances. Its robust set of features ensures you have everything you need to streamline your accounting processes, maintain compliance, and improve efficiency.

Need help setting up Odoo Accounting? Talk to our experts!

If you’re interested in learning more about how Odoo Accounting can help you with your unique business use cases, don’t hesitate to get in touch with our Odoo experts. They’re ready and eager to guide you through the capabilities of this powerful platform and help you unlock its full potential. Reach out to us today and take the first step towards transforming your business accounting with Odoo!

Customizable Chart of Accounts

The customizable chart of accounts feature in Odoo Accounting allows businesses to tailor their financial reporting to their specific needs, categorize transactions, and generate custom reports, using individual charts of accounts or creating individual accounts afterward. This feature offers several benefits for businesses, including:

- Accurate and relevant financial reporting

- Improved financial analysis and decision-making

- Better financial management and tracking

- Informed decision-making regarding budgeting, investments, and cash flow

- Flexibility to adapt to changes in the business environment without extensive reconfiguration of the accounting system

- Standard reports and chart of accounts for over 80 countries, supporting businesses worldwide.

Easy localization for accounting compliance across the Globe

Whether you’re operating in the US, Europe, or Asia, Odoo Accounting has you covered with comprehensive localization features tailored to each country’s accounting standards and regulations. This includes automatic tax calculation, support for multiple currencies, and the ability to generate financial statements according to local standards. Additionally, Odoo Accounting supports multiple languages, making it easy to use for businesses operating in multilingual environments. Odoo Accounting can help streamline your accounting processes and ensure compliance with local regulations, no matter where you do business.

For example – Features for localization in Germany include:

- Support for DATEV interface, which is widely used by tax consultants and accountants in Germany, with an export module

- Compliance with the GoBD principles for proper accounting and record-keeping in electronic form

- Includes a chart of accounts based on SKR03 and SKR04, which are commonly used standards in Germany

- Ability to generate financial statements according to German accounting standards

- Multiple currency support for businesses that operate in international markets

Automated incoming/outgoing invoice management & dunning process

One of the standout features of Odoo Accounting is its automated incoming/outgoing invoice management and dunning process. With this, you can automatically create invoices for incoming payments and register outgoing invoices for payments due, making it easy to track your cash flow. Additionally, the dunning process automates the reminder process for overdue payments, ensuring that you receive payments on time and minimize any cash flow disruptions. Overall, this feature can save you time and reduce the risk of errors in your accounting processes, helping you to maintain financial stability for your business.

A closer look: incoming invoices in Odoo

Incoming invoices, which are automatically recognized, are pre-assigned and linked to the original document.

- Create invoices manually or upload them as PDF.

- Automatic document capture via OCR and artificial intelligence

- Detect and connect invoices to purchase orders automatically

- Posting suggestions and manual processing

- Validate invoices and mark as due

- Export/pay invoices in one payment run

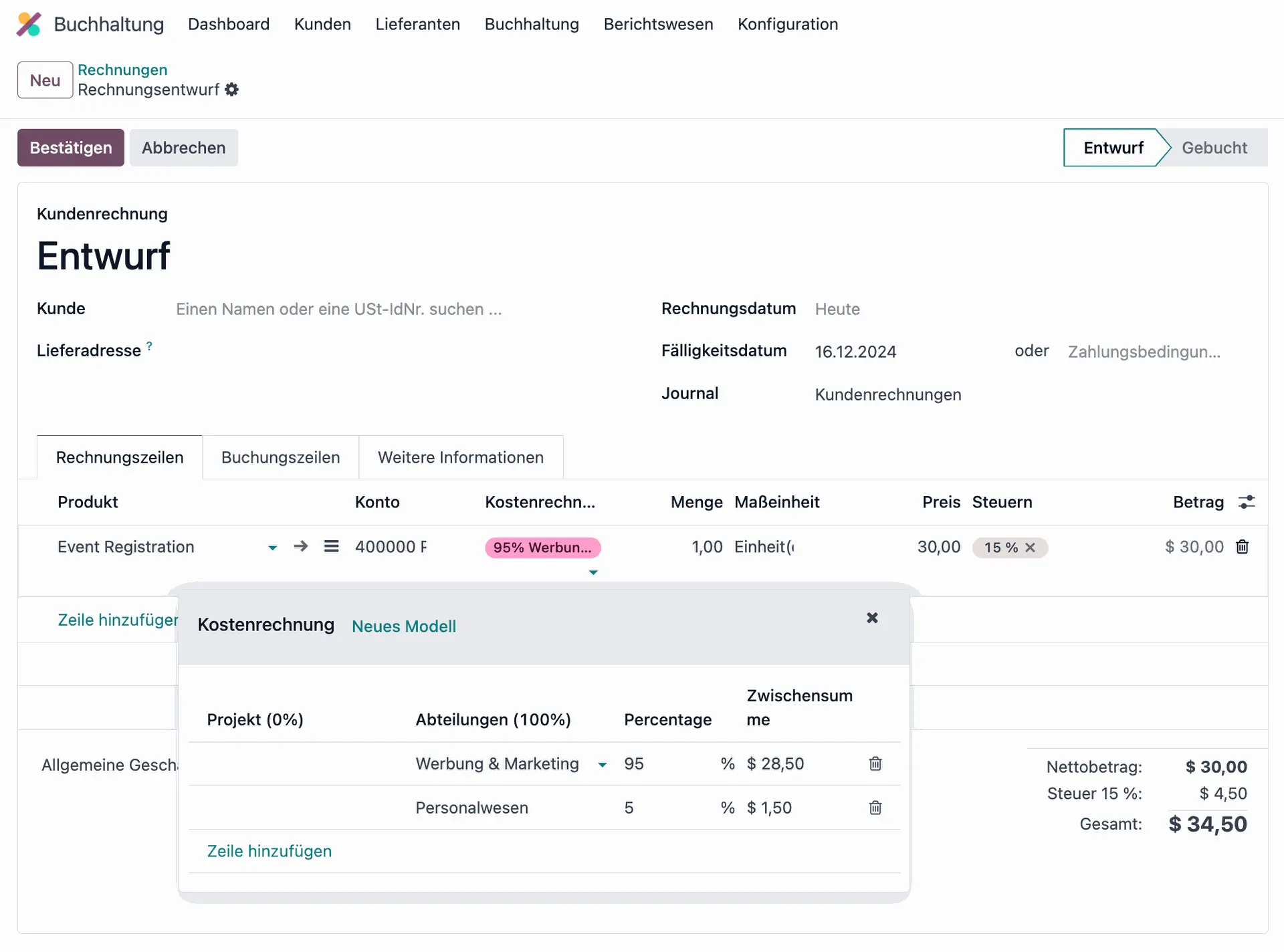

A closer look: outgoing invoices in Odoo

Thanks to customizable invoice templates, you can personalize your invoices to reflect your company’s unique branding. Moreover, with automated posting suggestions for accounts, you’ll save much time on manual data entry. Plus, sending invoices directly to your customers has never been easier! Keep track of paid and outstanding invoices with ease via the partner books feature. All of this goes hand in hand with an automated dunning process at various levels.

- Automatically & easily create invoices from sales orders

- Customizable, individual invoice design & layout

- Directly set payment target, invoice date, postings

- Post invoices directly

- Send invoices to the customer automatically

- Overview of overdue invoices

- Automated dunning running on different levels

Note: Apart from vendor invoices and customer invoices, you can of course also generate classic accounting records, e.g. as part of the monthly or annual financial closing.

A closer look: Manual posting in Odoo Accounting includes

- Postings for monthly and year-end closing

- Accrual postings

- Fixed asset accounting incl. depreciation run

Automated depreciation

Delimit costs or sales and streamline your asset accounting with an automated depreciation run. Plus, with the ability to assign bookings to individual cost centers, you’ll get detailed insights into your expenses and revenue streams.

A closer look: cost centers in Odoo Accounting includes

- Easy creation cost centers

- Creation cost center groups

- Evaluation at cost center level

Automated bank synchronization

In Odoo Accounting you can easily link your bank accounts and automatically synchronize bank movements at regular intervals. This means you’ll always have up-to-date information on your balances, transactions, and more. Plus, with the ability to assign and settle supplier and customer invoices via bank details, you can streamline your payment processes and avoid manual data entry errors. And when it comes time to make payments, Odoo Accounting has you covered with the ability to create payment files for online banking and corresponding banks.

Reporting, Reporting, Reporting

With a range of customizable reports, including balance sheets, profit and loss statements, overdue invoice reports, and sales tax reports, you’ll have all the data you need to make informed decisions and drive growth. Plus, with powerful analysis tools like cost center analysis, you can get a detailed view of your expenses and revenue streams. And if you’re operating in Germany, you’ll love the easy integration with the DATEV , making the communication with your tax consultant seamless.

A closer look: Reporting in Odoo Accounting includes

- Balance sheet report

- Profit and Loss Account

- Sales tax report

- Cash flow report

- Fixed assets

Conclusion

Odoo Accounting is a true all-arounder that provides a comprehensive and user-friendly solution for managing your business finances. Its robust set of features ensures you have everything you need to streamline your accounting processes, maintain compliance, and improve efficiency.

Need help setting up Odoo Accounting? Talk to our experts!

If you’re interested in learning more about how Odoo Accounting can help you with your unique business use cases, don’t hesitate to get in touch with our Odoo experts. They’re ready and eager to guide you through the capabilities of this powerful platform and help you unlock its full potential. Reach out to us today and take the first step towards transforming your business accounting with Odoo!