When it comes to automized invoicing with Odoo, there are many different options available. From fixed-price invoicing to invoicing based on timesheets or milestones, each method has its advantages and can be customized to suit your business needs. In this article, we’ll take a closer look at the different invoicing types available in Odoo and explore their different use cases

Tailor your invoicing methods to your business needs with Odoo’s customizable invoicing policies

Invoicing policies in Odoo refer to the various methods and rules that businesses can use to generate and send invoices to their customers automatically. These policies can be customized to suit different business needs and requirements, such as invoicing based on fixed price, project completion, time and material, and many others.

Fixed Price Invoicing: simple and straightforward

Fixed price invoicing is a popular invoicing method for businesses that offer products or services at a fixed price. With Odoo, you can automatically create invoices based on fixed prices by setting up invoicing policies for your products or services. You can define the fixed price per unit or per hour and specify whether the price includes taxes or not. This method is useful for businesses that deal with a large volume of customers and products or services, as it streamlines the invoicing process and helps ensure that payments are received on time.

This invoicing method might be typically used in:

- E-commerce: An online clothing store that sells t-shirts and hoodies e.g. can use the Invoice on Fixed Price method to generate invoices for each item sold. For example, a t-shirt may have a fixed price of $20 and a hoodie may have a fixed price of $40. The online store can use the “Invoice on Fixed Price” feature in Odoo to easily create invoices for each sale, with the fixed price per item calculated automatically.

- Wholesale: A wholesale supplier of office equipment e.g. can use the Invoice on Fixed Price method to generate invoices for each bulk purchase made by their customers. For example, a customer may purchase 50 chairs at a fixed price of $100 each. The wholesale supplier can use the “Invoice on Fixed Price” feature in Odoo to create an invoice for this purchase, with the fixed price based on the quantity sold.

- Services: A graphic design agency e.g. can use the Invoice on fixed price feature in Odoo to charge clients a fixed price for each design project, such as creating a logo, designing a website, or creating marketing materials. This helps the agency to ensure that it is paid a fair amount for its work, and clients can easily understand the costs associated with each project.

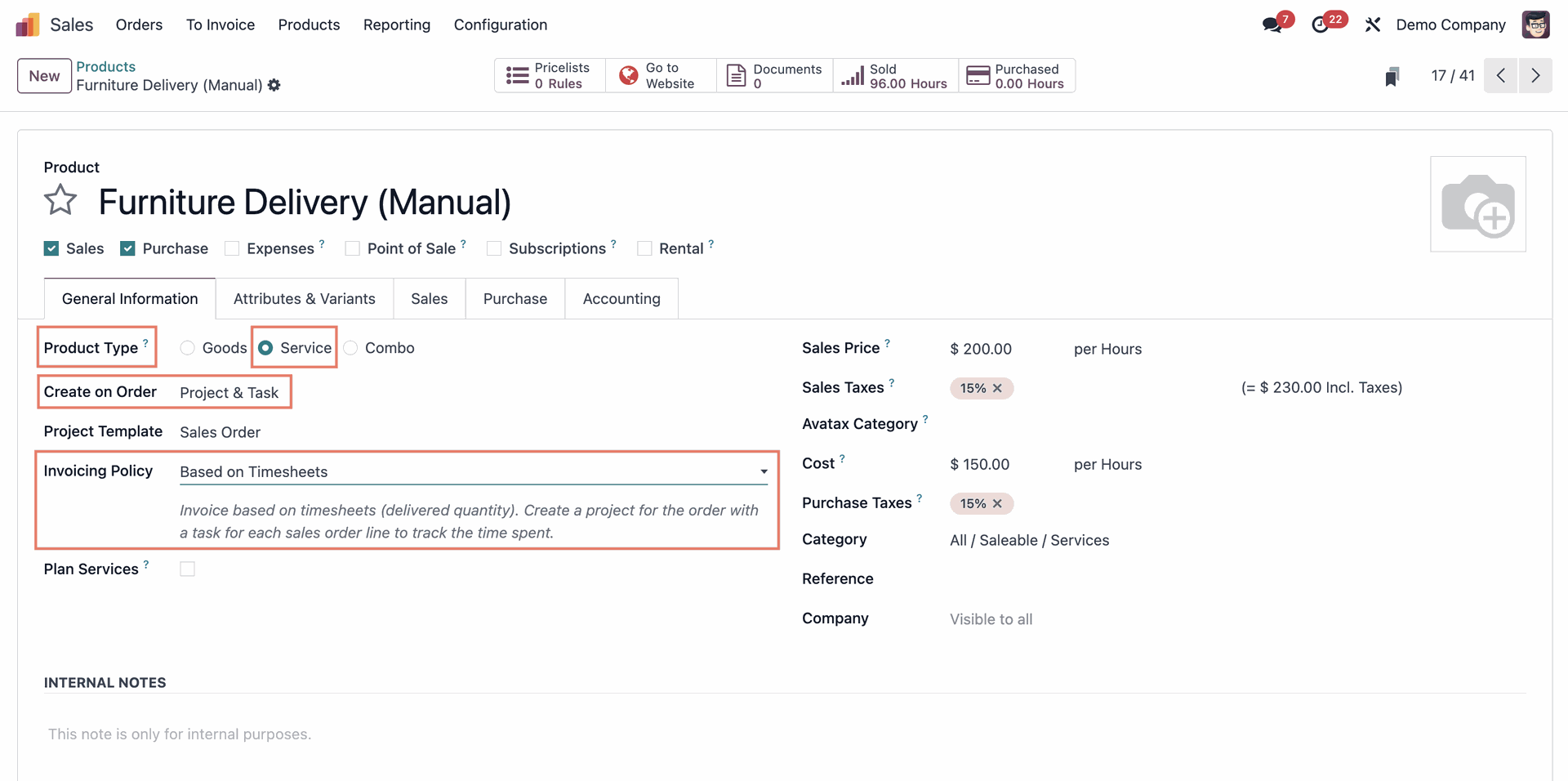

Invoicing Based on Timesheets: Accurate Billing for Hourly Work

With the invoice based on timesheets feature in Odoo, businesses can easily create invoices based on the time spent by employees on a particular project. This is particularly useful for service-based companies or businesses that charge clients on an hourly basis. Employees can log their hours worked on a project, and those hours can be used to create an invoice for the client. This feature allows businesses to accurately bill clients for the hours spent on a project and streamline their billing and invoicing process. Timesheets can be created for individual employees or entire teams, and include a description of the task or project.

This invoicing method might be typically used in:

- Consulting Firms: Consulting firms can use the Invoice based on timesheets feature to track the work hours of their consultants and generate accurate invoices for each project. For example, if a consulting firm is working with a client on a marketing strategy, they can log the hours spent by each consultant on research, planning, and meetings, and use those hours to create an invoice that accurately reflects the time spent on the project.

- Law Firms: Law firms can use the Invoice based on timesheets feature to track the time spent by their lawyers on various legal activities and generate accurate invoices for each client. For example, if a law firm is representing a client in a lawsuit, they can log the hours spent by each lawyer on research, document preparation, court appearances, and client meetings, and use those hours to create an invoice that accurately reflects the time spent on the case.

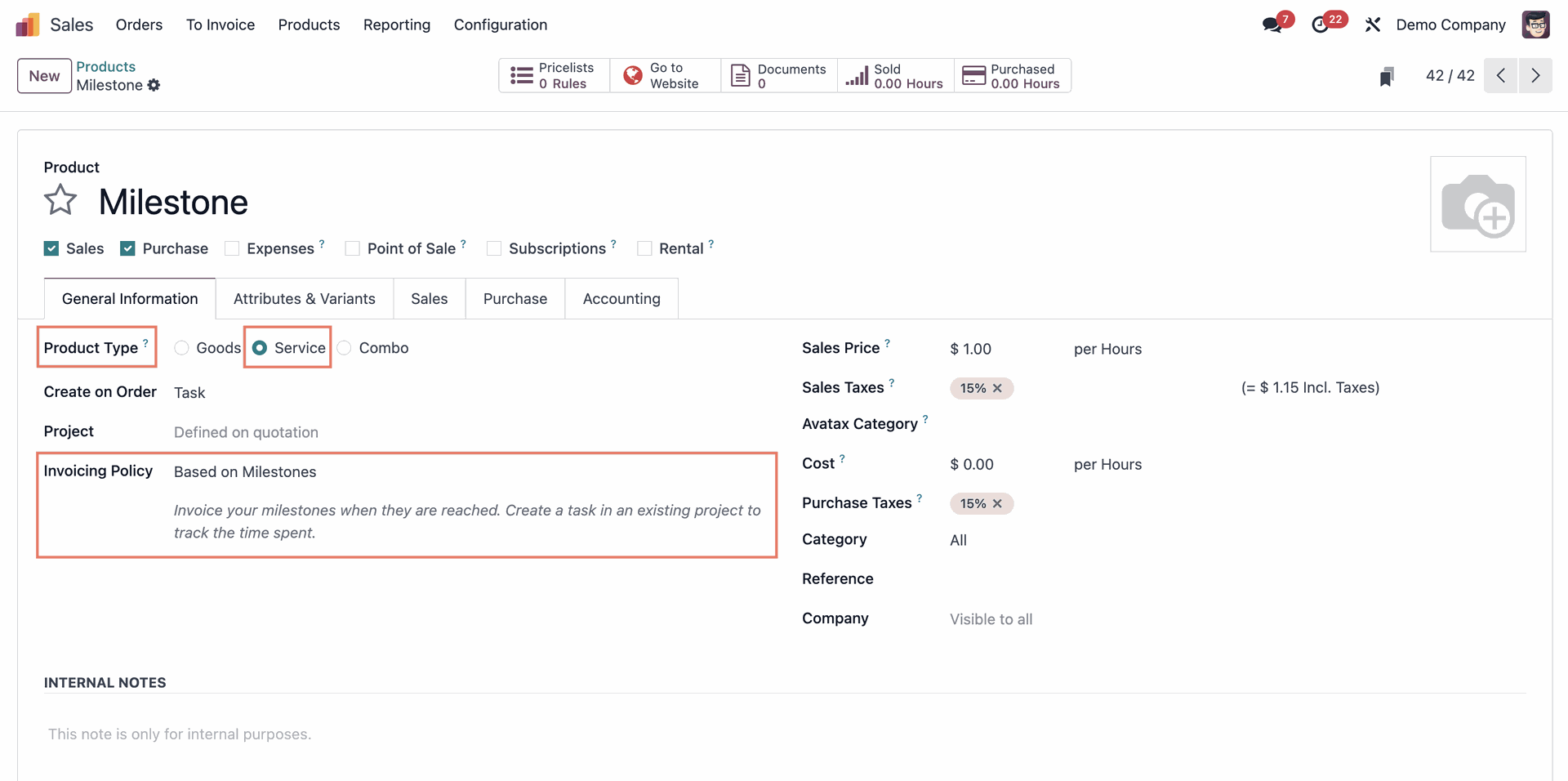

Invoicing Based on Milestones: Timely Payments for Long-Term Projects

The Invoice based on Milestones feature in Odoo allows businesses to create invoices based on the completion of project milestones. This is particularly useful for long-term projects or services that span multiple stages, as it allows for timely payment and avoids the need to wait until the project is fully completed. Users can set up the milestones, assign deadlines for each, and track progress. Once a milestone is completed, invoices can be generated automatically or manually and be send to the customer. This method of invoicing helps to ensure that your business is paid in a structured manner and gives your clients insight into project progress and costs.

This invoicing method might be typically used in:

- Software development: In the software development industry, it is common to invoice based on milestones, as the completion of specific tasks, features or stages are critical for the overall success of a project. For example, a software company may invoice a client once a new module or feature has been successfully developed and tested.

- Marketing: Marketing agencies might use the Milestones feature to invoice clients for different stages of a marketing campaign, such as the completion of research, planning, creative work, media buying, and reporting.

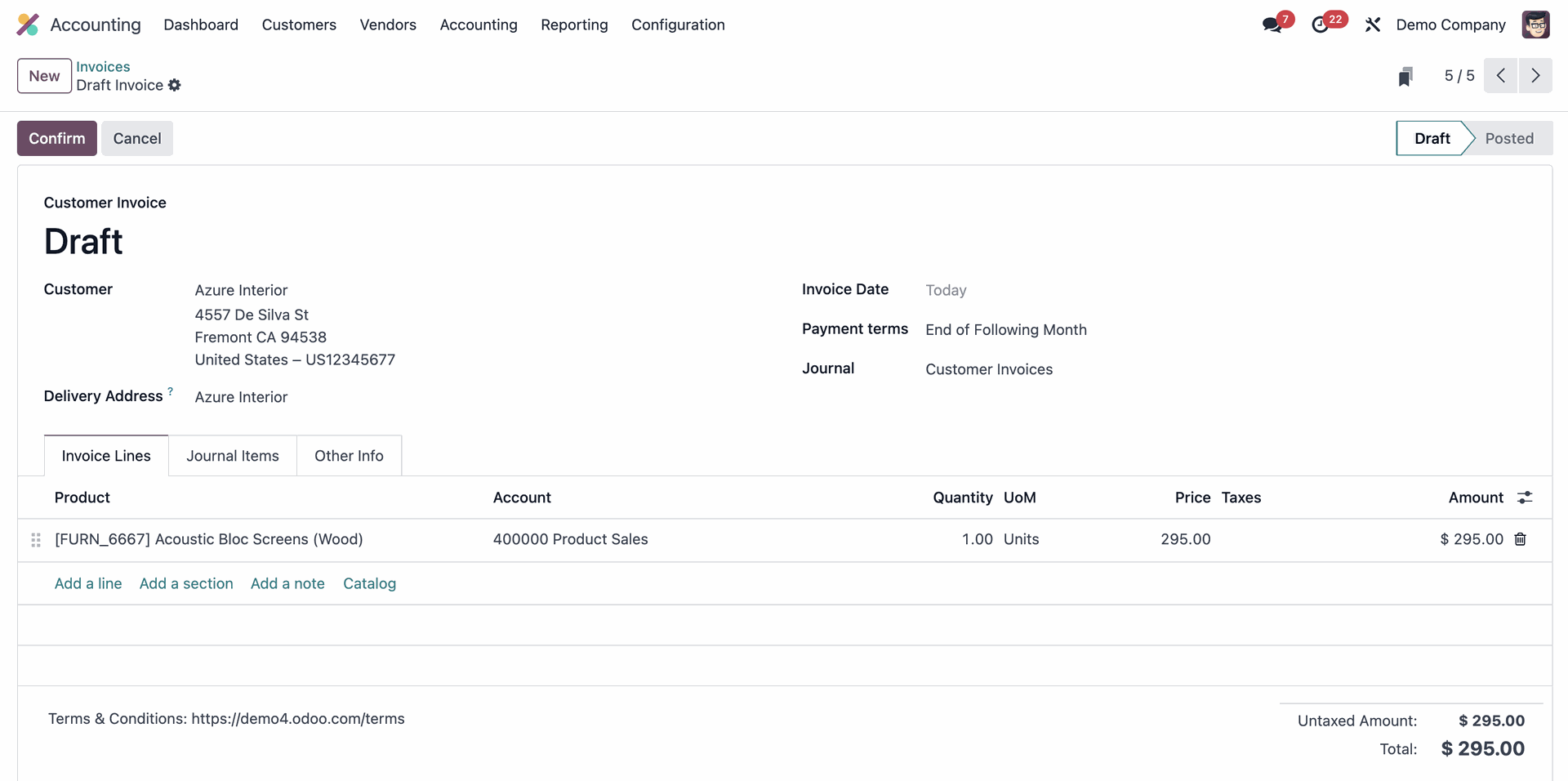

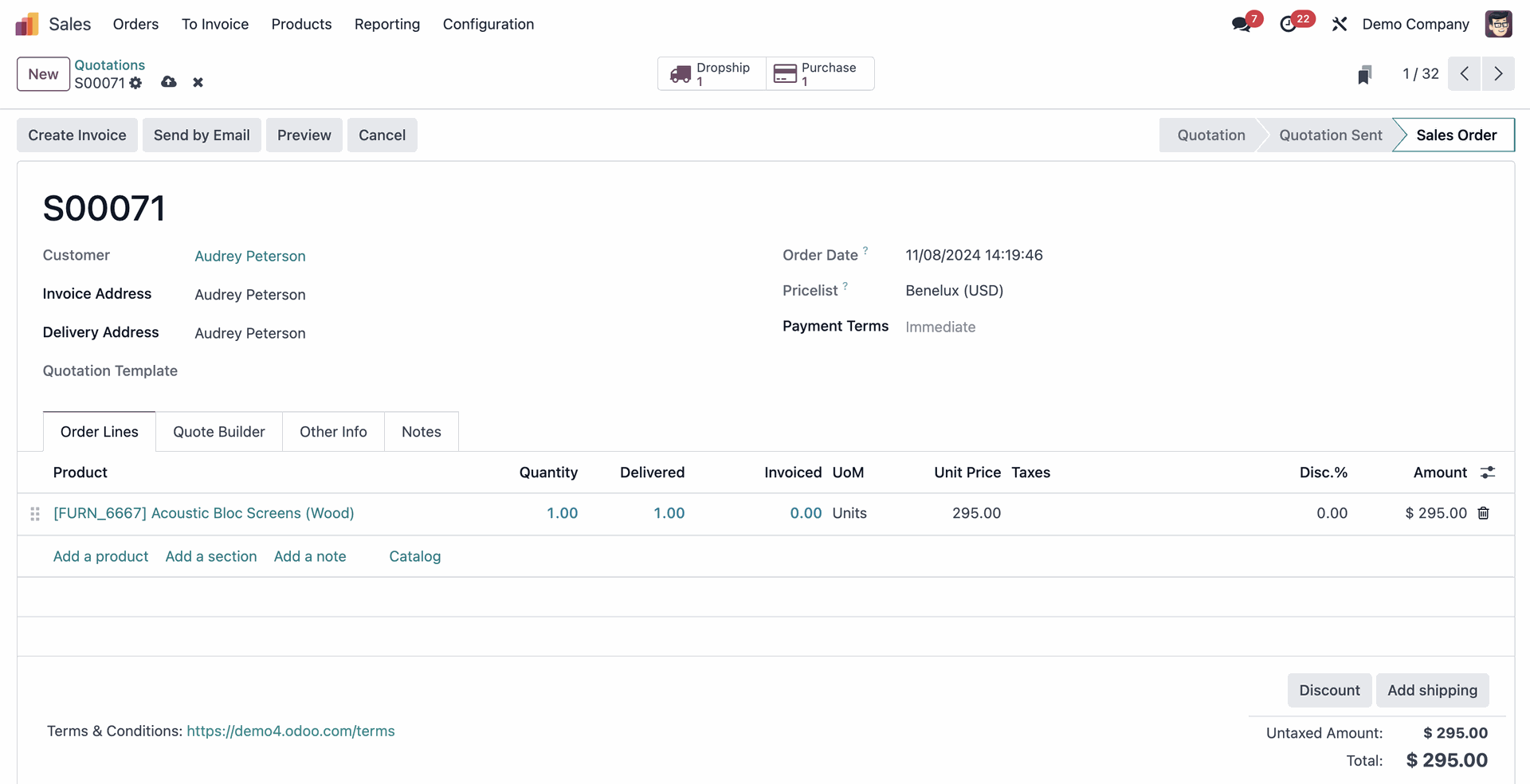

Invoice Based on Delivered Quantity (Manual): Accurate Invoicing for Partial Deliveries

For businesses that need to create an invoice for a partial delivery, a product sample, or a service that has been provided outside of the standard delivery schedule, invoicing based on delivered quantity (manual) can be a good option. With this method, businesses can create invoices based on the actual quantity of goods delivered, rather than on the initially ordered amount. This feature can be useful in scenarios where the actual quantity delivered may be less or more than the initially ordered quantity.

This invoicing method might be typically used for:

- Custom Order Requests: If a customer requests a custom order with unique specifications, the seller can use this feature to manually track the quantity of goods delivered and invoice accordingly.

- Partial Deliveries: This feature can also be used to invoice based on partial deliveries, where a business delivers a portion of the order and invoices accordingly, then delivers the rest of the order at a later date and invoices again based on the delivered quantity.

Invoicing Based on Subscriptions: Automated Billing for Recurring Services

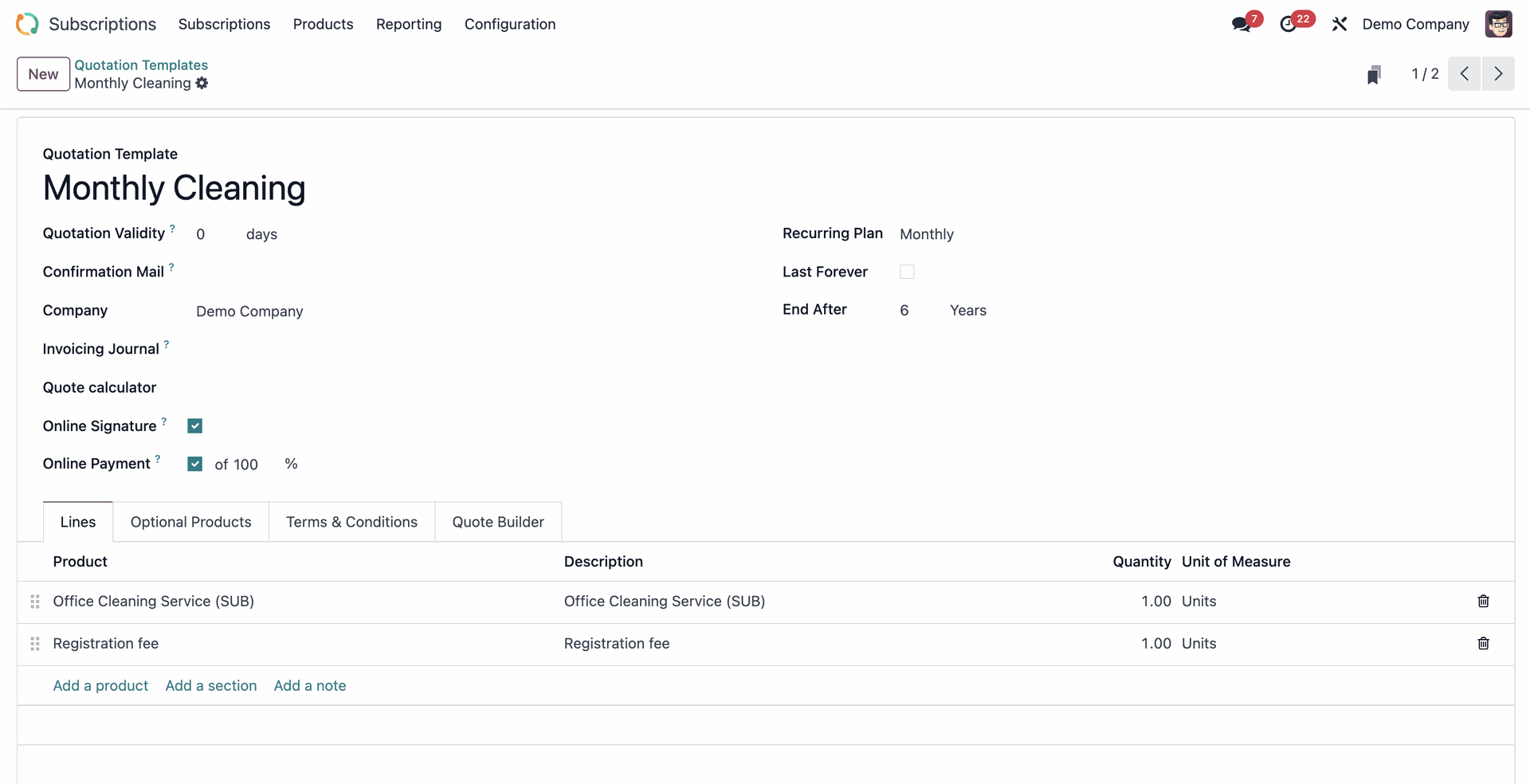

The subscription feature in Odoo enables businesses to automate the creation of recurring invoices for products or services sold on a subscription basis. This feature is ideal for businesses that offer regular services or products, such as software licenses, website hosting, or gym memberships. With Odoo’s Subscription feature, businesses can set up automatic billing for their customers on a recurring basis, reducing the need for manual invoicing. This feature provides businesses with customizable invoicing templates, flexible billing cycles, and automatic payment reminders to ensure timely payment. It is an effective way to streamline subscription management, invoicing, and payment collection.

This invoicing method might be typically used for:

- Magazine Subscriptions: A publisher can use the subscription feature in Odoo to bill customers for their magazine subscription. The subscription can be set up as a recurring invoice, with the billing frequency matching the magazine’s publication frequency.

- Membership Fees: An organization that charges membership fees can use the subscription feature to bill members on a regular basis. The membership fee can be set up as a subscription, and invoices will be automatically generated on a recurring basis.

- Maintenance Contracts: Companies that offer maintenance contracts can use the subscription feature in Odoo to create invoices based on the length of the contract. The customer is billed monthly or annually for the duration of the contract, and invoices are generated automatically based on the subscription set up in Odoo.

Make your Invoicing a no-brainer with Odoo – Talk to our Experts!

Invoicing can be a headache, but with Odoo, it doesn’t have to be. With a range of invoicing methods available, you can choose the one that’s right for your business. From fixed-price invoicing to invoicing based on timesheets, milestones, and subscriptions, Odoo has you covered. Plus, with the ability to customize invoicing policies and templates, you can create invoices that are tailored to your business needs. Want to know more about how Odoo can help streamline your invoicing process? Contact our Odoo experts today for a personal consultation and discover the possibilities for your business!