Most ERP systems provide basic legal reporting, but Odoo gives you the tools to build reporting that’s flexible, detailed, and business-relevant.

With analytic accounting, you can track project costs, allocate budgets, and measure performance without relying on spreadsheet workarounds.

Here’s how Odoo analytic accounting works, what it can do for your finance team, and what to keep in mind when setting it up.

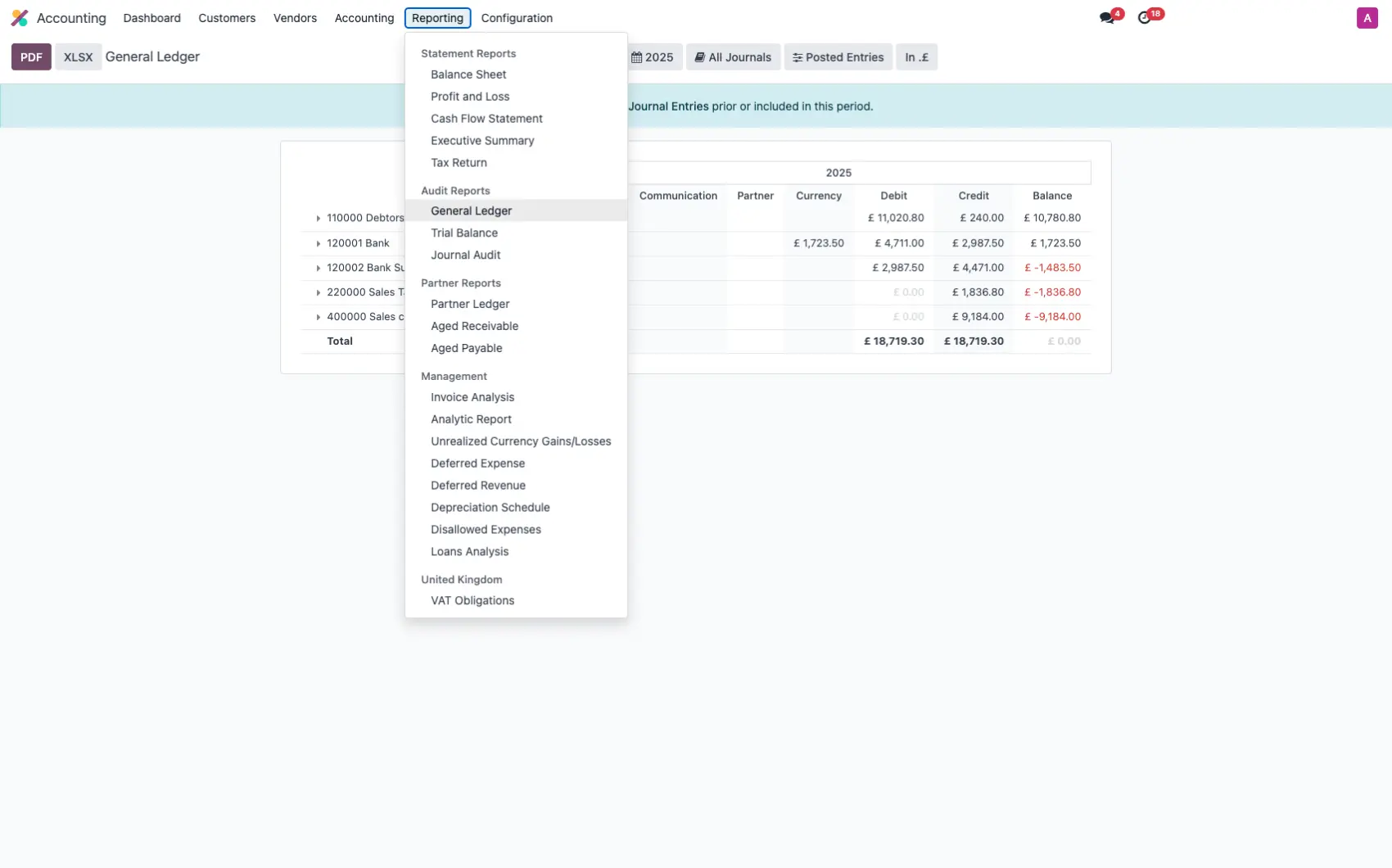

Odoo offers advanced accounting reporting out of the box

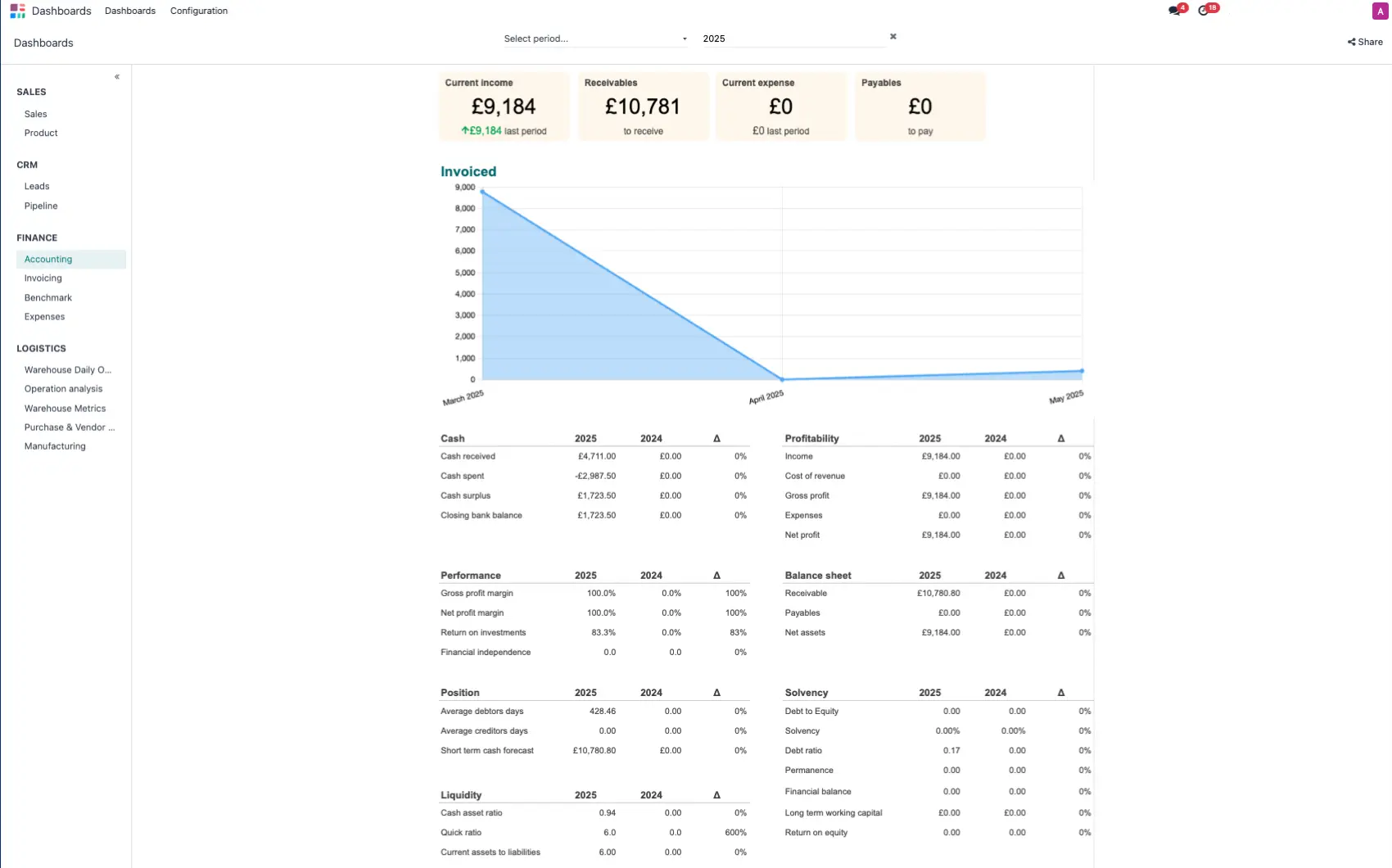

In Odoo, reporting goes beyond balance sheets and profit-and-loss statements.

It gives you tools to break down your financial data in more flexible, actionable ways across projects, teams, departments, or cost centres.

In Odoo, the layer for reporting sits on top of your general ledger.

It’s fully customisable and allows you to track financial performance the way your business operates, not just the way your tax authority requires.

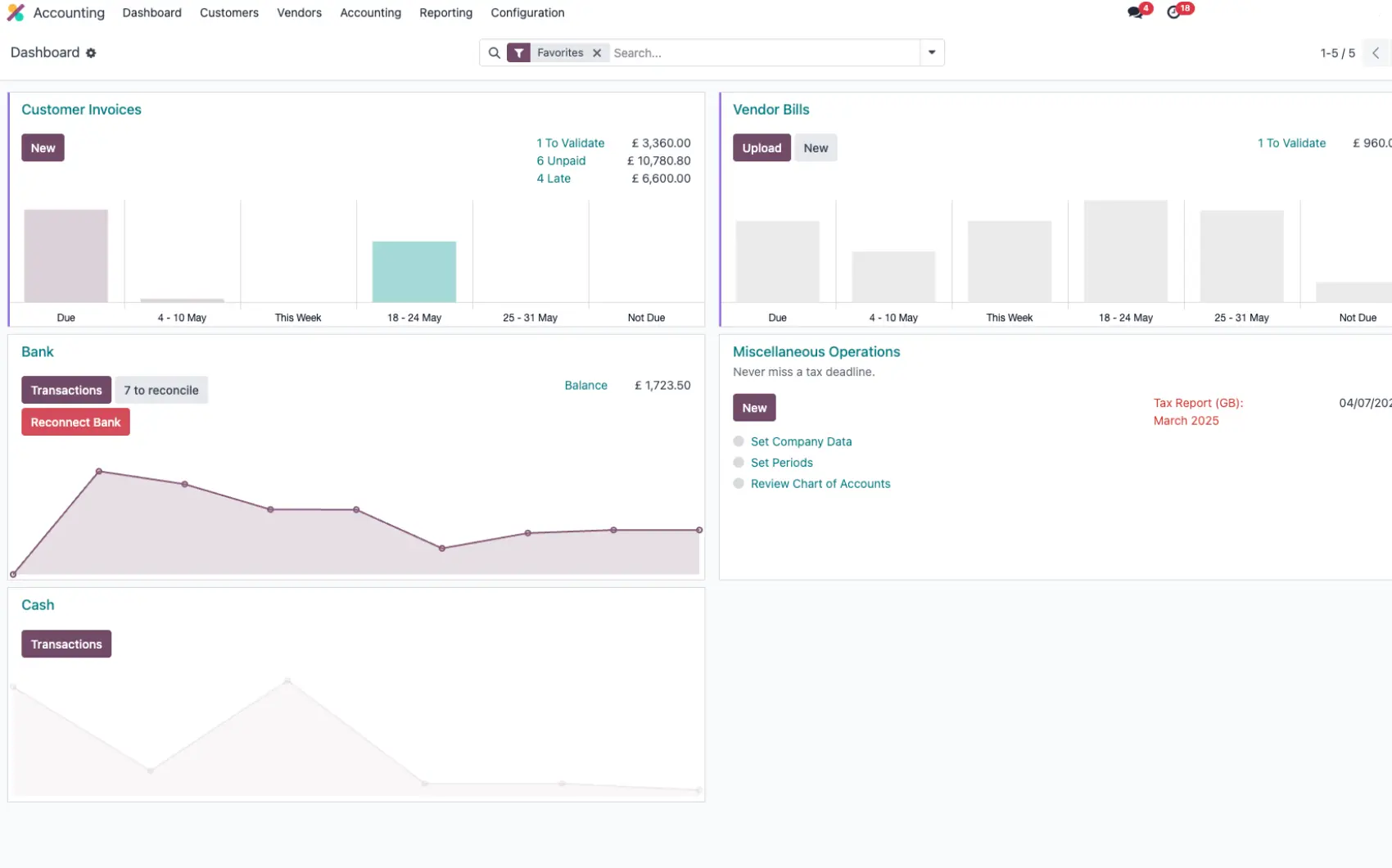

Dashboards and reports in Odoo can be filtered by analytic accounts or tags, helping managers and controllers understand profitability, cost allocation, and project performance in real time.

As the app is fully integrated with the rest of Odoo (Sales, Projects, Timesheets, etc.), the data is always up to date.

On top, Odoo supports management accounting workflows

Management accounting is all about helping decision-makers steer the company.

Odoo supports this through features designed specifically for internal visibility and control.

Analytic accounts and tags

Odoo accounting analytics lets you break down financials by project, client, department, or any custom dimension.

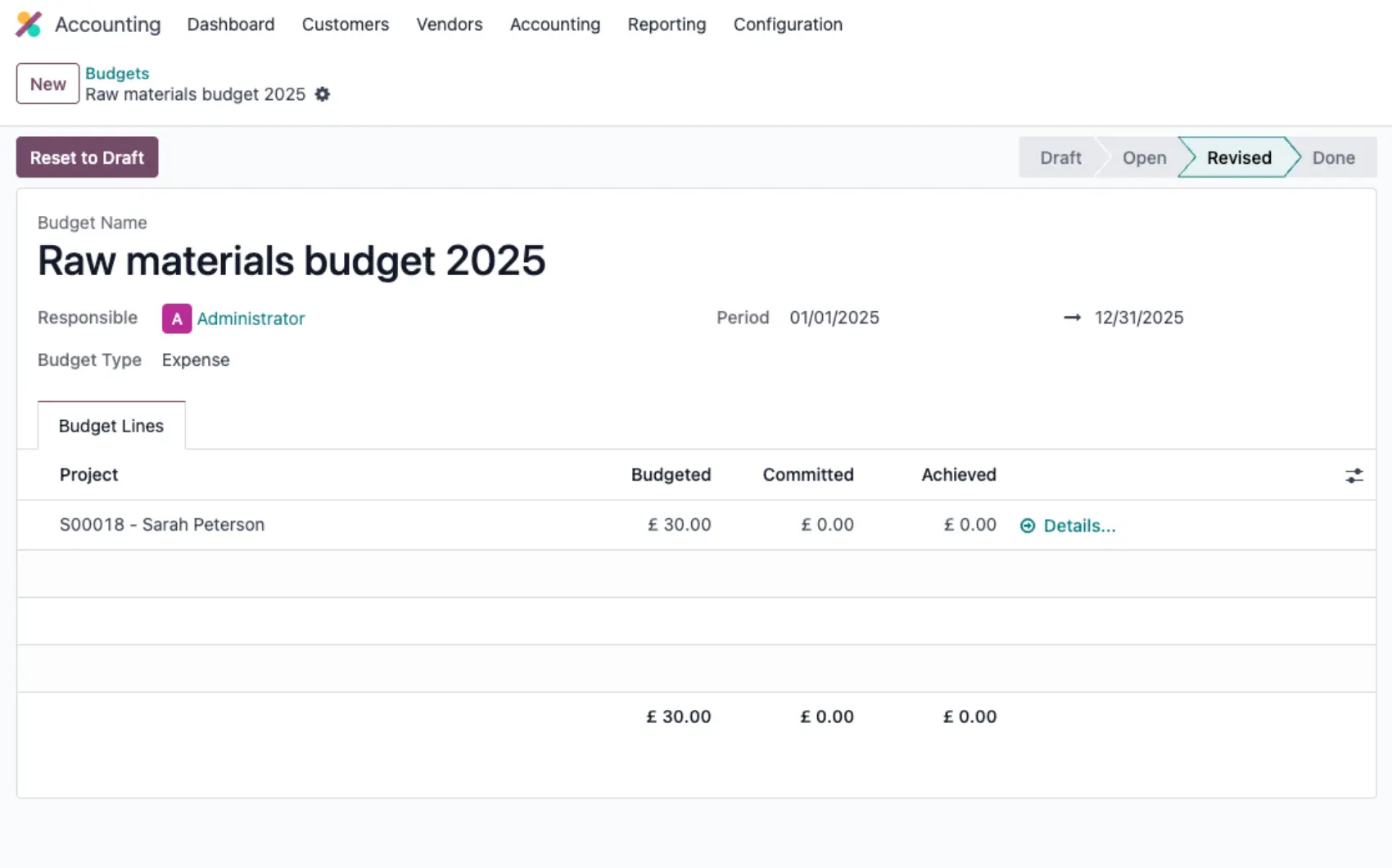

Budgets and targets

You can plan spending across analytic accounts and compare real-time actuals vs. planned.

Cost allocation tools

Distribute overheads, salaries, or shared expenses across multiple departments or projects.

Integrated reporting

See performance data across modules e.g., how much a specific campaign or product line actually costs when you include overhead, salaries, and indirect expenses.

In other words, Odoo gives you the building blocks to structure internal accounting the way you need it without being locked into statutory formats.

How analytic accounting works in Odoo

Analytic accounting in Odoo is like a parallel ledger that follows your internal logic instead of legal accounting rules. Here’s how it works:

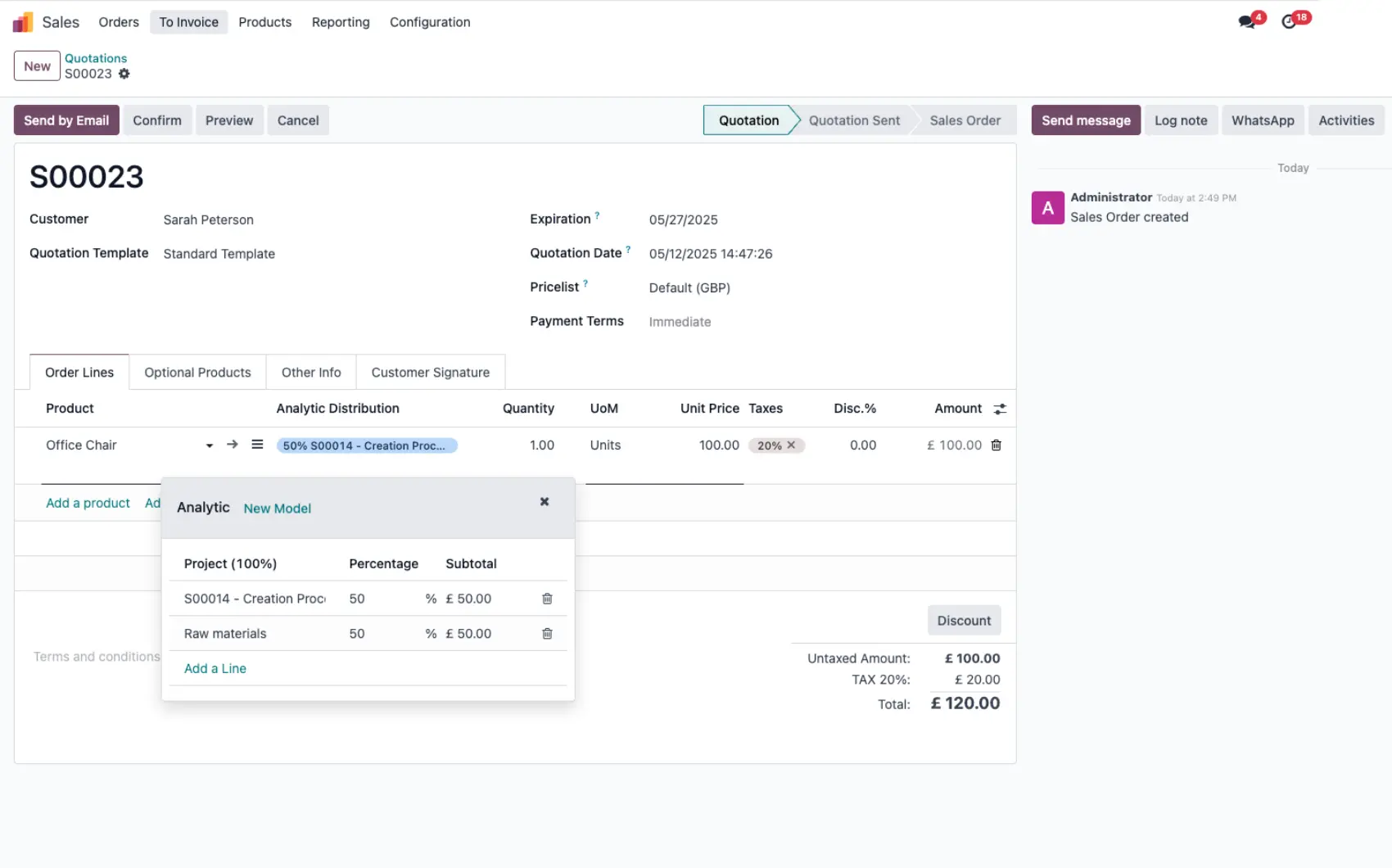

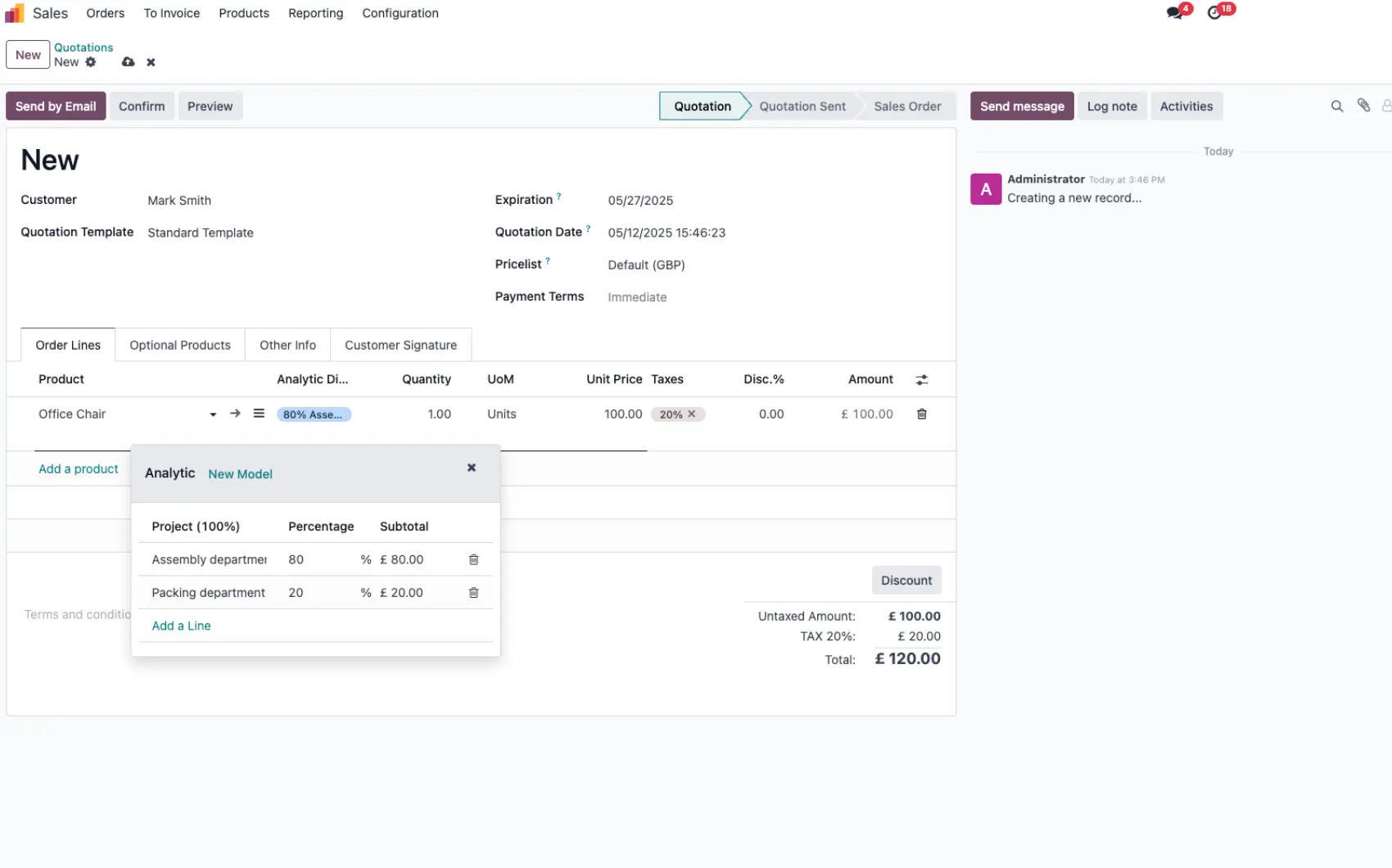

- Analytic accounts are assigned to transactions like invoices, bills, timesheets, or expenses. They can reflect projects, departments, campaigns, or any other category you want to track.

- Analytic tags offer a second, more flexible layer. For example, if a transaction belongs to multiple projects or dimensions, tags allow you to split and categorise them further.

- Automated assignment rules can link analytic accounts based on products, accounts or users, reducing manual work.

- Reports are available natively within the accounting dashboard or as customised pivot tables, giving you full visibility over cost drivers and profitability.

This flexibility makes it easy to answer internal questions like “How much did our marketing campaign actually cost?” or “Which client projects are the most profitable?"

Odoo analytic accounting covers multiple use cases

Here’s how teams actually use analytic accounting in Odoo to support smarter decision-making:

- Project-based businesses (e.g. consulting, IT services) use analytic accounts to track time and expenses per client or project.

- Marketing departments assign analytic accounts to campaigns and use tags to compare performance by channel or target audience.

- Manufacturing companies allocate machine costs and overhead to different product lines using analytic distribution.

- Multi-entity or international groups use analytic tags to compare performance across regions or business units, even when legal entities are consolidated.

Odoo analytic accounting gives you the flexibility to dig into the numbers that are most relevant for your business operation, be it profitability, cost control or ROI.

5 tips for setting up Odoo analytic accounting

To get the most out of Odoo analytic accounting, a little planning goes a long way:

- Define your structure up front: Decide what you want to track (e.g. projects, departments, cost centres) and keep the hierarchy simple.

- Use tags for flexibility: Don’t try to do everything with analytic accounts - tags give you added granularity without overcomplicating the setup.

- Automate where possible: Set up product-based or user-based assignment rules to avoid manual entry.

- Involve the business team: Make sure controllers, project managers, and department leads are aligned on how analytic tracking works.

- Test with real data: Before going live, simulate a few use cases in your staging environment to make sure reporting delivers the insights you need.

Done right, Odoo analytic accounting can help your finance team move from number crunching to real business control.

We can help you set up Odoo analytic accounting

If you’re struggling to understand what’s really driving your numbers, it might be time to rethink your setup. Odoo’s analytic accounting features can give you the clarity you need across projects, departments, campaigns, and more.

Our experts will walk you through how to structure your analytic accounts, automate tracking, and build the reports your finance team actually needs.