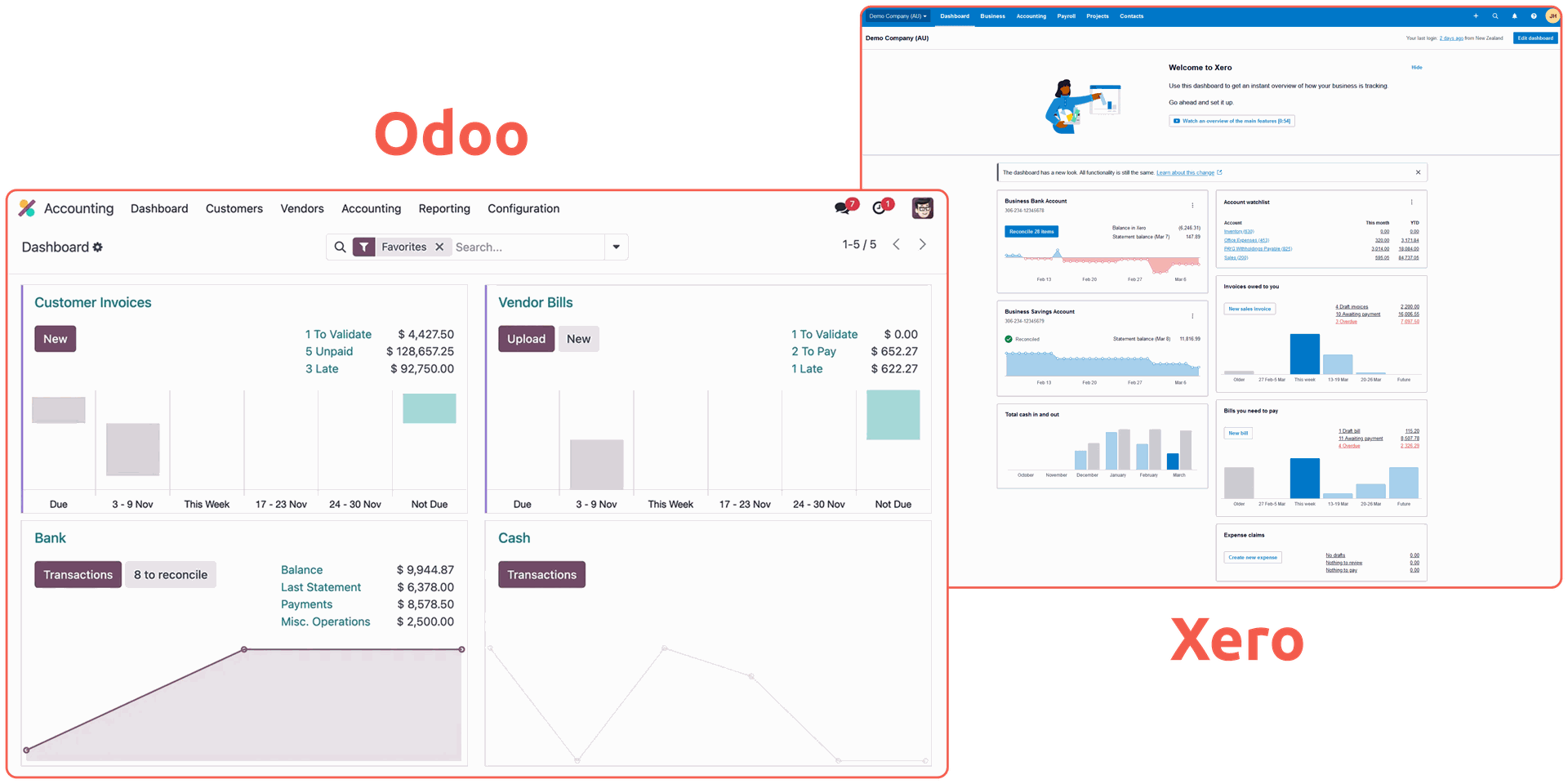

If you’re comparing accounting tools for a growing UK business, chances are you’ve looked at both Xero and Odoo.

Xero is known for its clean interface and fast onboarding. Odoo is an open-source ERP that includes a full accounting suite with built-in automation, compliance, and reporting logic all under one licence.

We compared the two side by side, not just on price, but on what each tool can do once accounting becomes central to your operations.

Table of contents

To compare accounting software effectively, you need a common benchmark

UK tax compliance starts with HMRC recognition and MTD

Odoo vs Xero - key accounting features

Customer invoicing & accounts receivable

Vendor bills, AP automation & SEPA support

Disclaimer: Pricing and feature availability are based on publicly available information as of July 2025. Actual costs may vary by region, billing terms, user count, and setup.

To compare accounting software effectively, you need a common benchmark

Vendors bundle features differently.

Some include core functions like SEPA or deferred revenue. Others split them into add-ons or leave them out entirely.

This comparison looks at the features UK businesses typically rely on once accounting becomes operationally critical. Here’s what that typically includes:

- Multi-currency support: Needed for working with international suppliers or clients.

- SEPA payment formats: Required for smooth cross-border EU payments.

- Deferred revenue handling: Critical for subscription or prepaid business models

- Automation: Reduces manual effort and error-prone data entry

- Field and screen-level access: Important for managing financial roles and security

- Multi-company consolidation: Needed to close books across multiple entities

- Custom reports and KPIs: Useful for investor reporting, board packs, and forecasts

- Smart reconciliation: Saves time with matching logic and AI rules

- UK/EU localisation: Ensures compliance with VAT, MTD, and audit standards

We compared:

- Odoo Enterprise: full accounting with automation, SEPA, and reporting tools

- Xero Standard: core accounting with invoicing and bank feeds

These reflect the plans most teams use once they’ve outgrown lightweight tools.

UK tax compliance starts with HMRC recognition and MTD

HMRC (His Majesty’s Revenue and Customs) is the UK government department responsible for collecting taxes and enforcing compliance.

Odoo is officially recognised by HMRC as compliant with the UK’s Making Tax Digital (MTD) requirements, the government’s initiative to digitalise VAT returns and accounting records.

That means UK businesses can use Odoo to:

- Submit digital VAT returns

- Maintain digital VAT records

- Stay MTD-compliant without third-party plugins

Xero has supported MTD since its introduction and also meets all HMRC-recognised requirements. Both tools meet the digital VAT compliance requirements for the UK. Odoo’s official recognition confirms it's a valid MTD alternative to more established players like Xero.

Odoo vs Xero - key accounting features

Before diving into specifics, here’s a high-level look at the accounting features UK businesses typically rely on, from consolidation and access rights to automation, reporting, and localisation.

Feature | Odoo | Xero |

Multi-company | ✅ | ❌ |

Multi-currency | ✅ | ✅ |

Consolidation | ✅ | ❌ |

Multiple journals | ✅ | ❌ |

SEPA Direct Debit | ✅ | With Batch2SEPA add-on (pricing per credit) |

OCR* bill recognition | ✅ | ❌ |

Recurring invoices | ✅ | ✅ |

Subscription KPIs (MRR**, churn) | ✅ | ❌ |

Follow-up reminders | ✅ | Limited |

Pivot table reporting | ✅ | ❌ |

Perpetual fiscal closing | ✅ | ❌ |

Multi-tax per line | ✅ | ❌ |

Bank feed support | ✅ | ✅ |

Reconciliation rules | ✅ | Limited |

Built-in AI flows | ✅ | ❌ |

Access rights (screen/field) | ✅ | ❌ |

Countries supported | 80+ | ~5 |

Languages | 85+ | 1 |

Mobile app | ✅ | ✅ |

*Optical character recognition

**Monthly recurring revenue

In a nutshell:

Xero handles the basics well with clean invoicing, solid UK compliance, and easy bank feeds.

While Xero may be ideal for SMEs, it cannot handle complex reporting and consolidation breakdown that are often needed in midsize to big corporations.

Odoo includes features growing teams often need, like SEPA support, multi-company structure, access controls, or automation logic. It also has built-in AI, deeper reporting, and full localisation for UK and EU entities out of the box.

Customer invoicing & accounts receivable

We looked at how both tools handle recurring invoices, subscription billing, SEPA, and customer communication.

Feature | Odoo | Xero |

Proforma invoices | ✅ | ❌ |

SEPA Direct Debit | ✅ | ❌ |

Multiple taxes per line | ✅ | ❌ |

Recurring invoices | ✅ | ✅ |

Subscription KPIs (MRR, churn) | ✅ | ❌ |

Email threads in invoices | ✅ | ❌ |

Follow-up reminders | ✅ | Limited |

In a nutshell:

Odoo is better for businesses with complex billing cycles or subscription models. Xero works well for standard recurring invoicing, but lacks deep automation or EU features.

Vendor bills, AP automation & SEPA support

This section compares how Odoo and Xero manage vendor payments, OCR, and approval workflows.

Feature | Odoo | Xero |

OCR for vendor bills | ✅ | ❌ |

SEPA & ACH payments | ✅ | ❌ |

Purchase agreements | ✅ | ❌ |

Purchase approvals | ✅ | ❌ |

Billing validation flows | ✅ | ❌ |

Mobile expenses app | ✅ | ✅ |

In a nutshell:

Odoo helps you automate vendor processing with OCR, approvals, and payment flows. Xero handles basic expenses and bank transfers but not SEPA or advanced AP logic.

Bank feeds & reconciliation

From bank formats to matching logic, here’s how both systems handle reconciliation at scale.

Feature | Odoo | Xero |

Bank feed support | ✅ | ✅ |

Reconciliation rules | ✅ | Limited |

Import formats (OFX, CODA, CAMT) | ✅ | OFX only |

Currency rate auto-update | ✅ | ✅ |

In a nutshell:

Xero makes reconciliation fast for standard feeds. Odoo supports more formats and adds matching logic, AI, and automation triggers.

Reporting & dashboards

We compared what reporting options are available out of the box and how customisable they are for growing finance teams.

Feature | Odoo | Xero |

P&L, Balance Sheet, Cashflow | ✅ | ✅ |

Pivot tables | ✅ | ❌ |

KPI customisation | ✅ | ❌ |

Fiscal year closing (perpetual) | ✅ | ❌ |

Annotated reports | ✅ | ✅ |

In a nutshell:

Xero covers the basics with clean visuals. Odoo offers multi-dimensional analysis, pivots, and deeper compliance tools for UK/EU audits.

Automation & AI

These features show what each tool can automate and how far built-in AI actually goes.

Feature | Odoo | Xero |

OCR invoice reading | ✅ | ❌ |

Automated deferred revenue | ✅ | ❌ |

AI follow-up logic | ✅ | ❌ |

AI tagging / COGS* entry | ✅ | ❌ |

*Cost of goods sold

In a nutshell:

Odoo leads on automation with native AI logic and document scanning. Xero is rule-based only, with no built-in AI features.

Platform scope, pricing & deployment options

Here’s what you get with each platform in terms of pricing, user limits, and deployment flexibility.

Platform | Pricing | Includes | User Cap | Deployment | Other business needs |

Odoo | ~£25–30/mo | Full accounting, AP/AR, AI, ERP apps | Unlimited | SaaS or self-hosted | Inventory, Manufacturing, CRM out of the box |

Xero | ~£30/mo | Core accounting, invoicing, bank feeds | 5 | SaaS only | Not available |

In a nutshell:

Odoo gives you a complete ERP-grade suite with AI and custom flows. Xero is leaner and ideal for single-entity, SaaS-only use cases.

When to choose Odoo and when to choose Xero

The bottom line is that the right tool depends on how far your accounting needs to go and how closely it should connect with the rest of your business.

Choose Odoo if…

You are a larger corporation in need of a centralised system for unified business operations

You want SEPA, subscription billing, or multi-company setup

You need pivot reporting or EU tax logic

You want AI-led automation

You plan to scale into inventory, HR, or CRM

Choose Xero if…

You’re an SME wanting to implement basic accounting quickly

You want to invoice quickly and reconcile bank feeds

You just need UK compliance & bank visibility

You prefer a low-friction setup

You’ll stick with accounting only

Want to upgrade your accounting setup with Odoo?

Odoo Accounting goes beyond the basics with automation, EU compliance, and real-time group reporting built in. It’s part of a full business suite that scales with you.

Reach out to our team of Odoo experts to tailor an accounting setup for your finance workflows.