Wer in Großbritannien wachsende Unternehmen bei der Wahl einer Buchhaltungssoftware berät, stößt schnell auf die beiden Kandidaten Xero und Odoo.

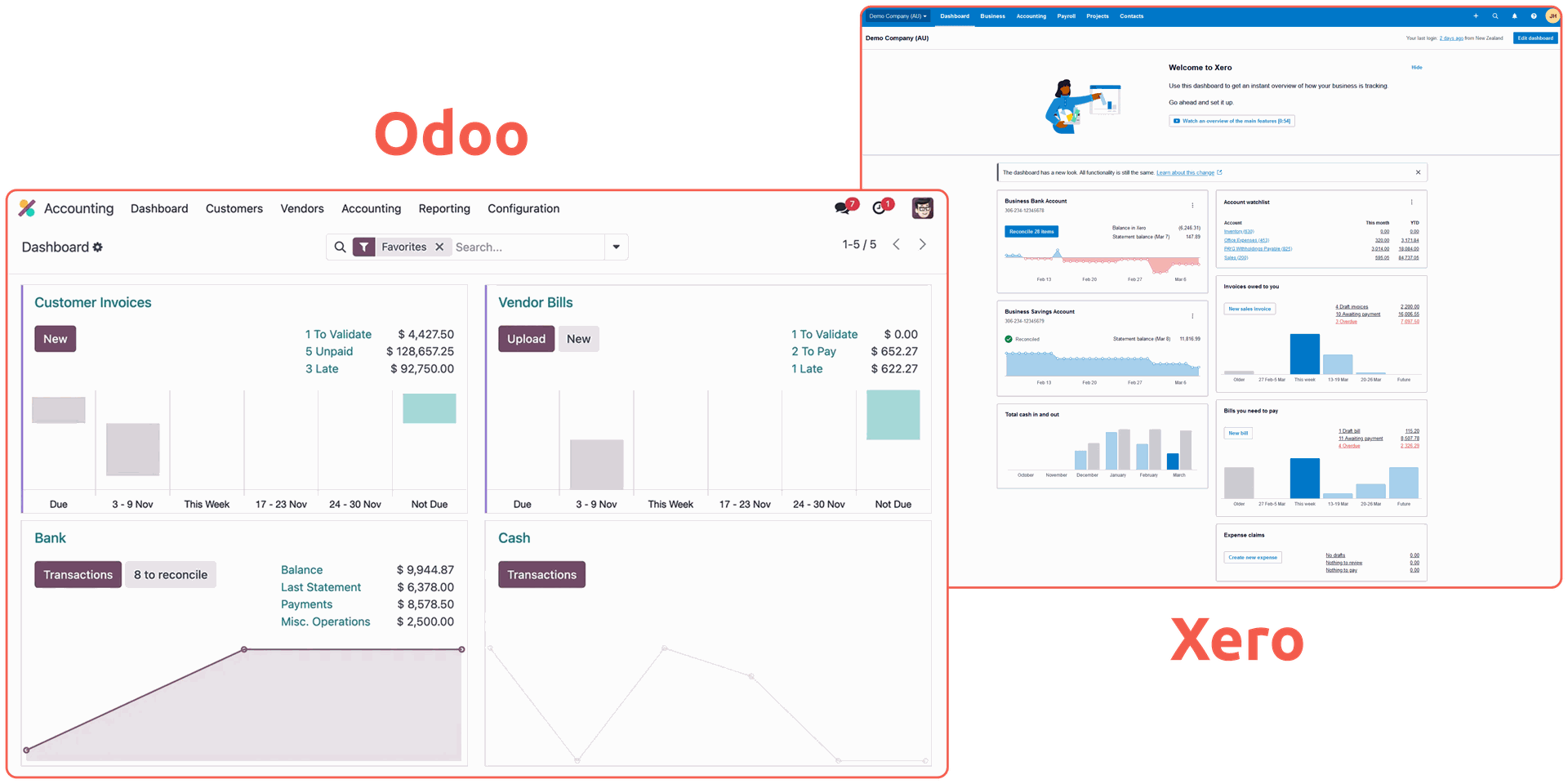

Xero ist bekannt für seine aufgeräumte Oberfläche und schnelle Einarbeitung. Odoo hingegen ist ein Open-Source-ERP, das eine vollständige Finanz-Suite inklusive integrierter Automatisierung, Compliance und Reporting-Logik unter einer einzigen Lizenz bündelt.

Wir vergleichen die beiden Systeme direkt, nicht nur beim Preis, sondern vor allem hinsichtlich des Funktionsumfangs, den Unternehmen benötigen, sobald die Buchhaltung zum zentralen operativen Element wird.

Inhaltsübersicht

Der allgemeine Maßstab für Buchhaltungssoftware

Die HMRC-Anerkennung erfüllt die MTD-Steuerpflicht

Odoo vs Xero: Die wichtigsten Funktionen im Vergleich

Kundenrechnungen und Debitorenmanagement

Lieferantenrechnungen, AP-Automatisierung und SEPA

Bank-Feeds und Abstimmung (Reconciliation)

Hinweis: Preisangaben und Funktionsverfügbarkeit basieren auf öffentlich zugänglichen Informationen vom Juli 2025. Die tatsächlichen Kosten können je nach Region, Abrechnungsbedingungen, Nutzerzahl und Setup variieren.

Der allgemeine Maßstab für Buchhaltungssoftware

Anbieter bündeln Funktionen sehr unterschiedlich.

Manche integrieren Kernfunktionen wie SEPA oder abgegrenzte Einnahmen standardmäßig, andere bieten diese nur als Add-ons oder lassen sie ganz weg.

Dieser Vergleich betrachtet die Funktionen, auf die UK-Unternehmen angewiesen sind, sobald die Buchhaltung operativ kritisch wird. Dazu gehören in der Regel:

- Multi-Währungs-Support: Notwendig für die Arbeit mit internationalen Lieferanten oder Kunden.

- SEPA-Zahlungsformate: Erforderlich für reibungslose EU-Zahlungen über Grenzen hinweg.

- Behandlung abgegrenzter Einnahmen (Deferred Revenue): Kritisch für Abonnement- oder Prepaid-Geschäftsmodelle.

- Automatisierung: Reduziert manuelle Arbeit und fehleranfällige Dateneingaben.

- Zugriffsrechte auf Feld- und Bildschirmebene: Wichtig für die Verwaltung von Finanzrollen und die Sicherheit.

- Konsolidierung mehrerer Gesellschaften (Multi-Company): Notwendig für den Periodenabschluss mehrerer juristischer Einheiten.

- Benutzerdefinierte Berichte und KPIs: Hilfreich für Investoren-Reporting, Board-Unterlagen und Prognosen.

- Intelligente Abstimmung (Reconciliation): Spart Zeit durch Abgleichlogik und KI-Regeln.

s

- UK/EU-Lokalisierung: Gewährleistet die Compliance mit VAT, MTD und Audit-Standards.

Wir haben verglichen:

- Odoo Enterprise: Volle Buchhaltung mit Automatisierung, SEPA und Reporting-Tools.

- Xero Standard: Kernbuchhaltung mit Rechnungsstellung und Bank-Feeds.

Diese Pläne beinhalten die Funktionen, die die meisten Teams brauchen, sobald sie aus reinen Lightweight-Tools herausgewachsen sind.

Die HMRC-Anerkennung erfüllt die MTD-Steuerpflicht

HMRC (His Majesty’s Revenue and Customs) ist die britische Regierungsbehörde, die für das Eintreiben von Steuern und die Durchsetzung der Vorschriften verantwortlich ist.

Odoo ist offiziell von der HMRC anerkannt und erfüllt die Anforderungen der britischen Making Tax Digital (MTD)-Initiative zur Digitalisierung der Umsatzsteuererklärungen und Buchhaltungsunterlagen.

Das bedeutet, britische Unternehmen können Odoo nutzen, um:

- Digitale Umsatzsteuererklärungen einzureichen.

- Digitale VAT-Aufzeichnungen zu führen.

- MTD-konform ohne Drittanbieter-Plugins zu bleiben.

Xero unterstützt MTD seit seiner Einführung und erfüllt ebenfalls alle HMRC-anerkannten Anforderungen. Beide Tools sind somit für die digitale VAT-Einhaltung in Großbritannien geeignet. Die offizielle Anerkennung von Odoo bestätigt es als valide MTD-Alternative zu etablierten Playern wie Xero.

Odoo vs Xero: Die wichtigsten Funktionen im Vergleich

Bevor wir ins Detail gehen, hier ein Überblick über die Buchhaltungsfunktionen, die wachsende UK-Unternehmen typischerweise benötigen – von Konsolidierung und Zugriffsrechten bis hin zu Automatisierung, Reporting und Lokalisierung.

Funktion | Odoo | Xero |

Mehrmandatfähigkeit(Multi-Company) | ✅ | ❌ |

Mehrwährung (Multi-Currency) | ✅ | ✅ |

Konsolidierung | ✅ | ❌ |

Mehrere Journale | ✅ | ❌ |

SEPA-Lastschrift | ✅ | Mit Batch2SEPA Add-on (Preis pro Gutschrift) |

OCR-Rechnungserkennung* | ✅ | ❌ |

Wiederkehrende Rechnungen | ✅ | ✅ |

Abonnement-KPIs (MRR**, Churn) | ✅ | ❌ |

Mahnwesen (Follow-up Reminders) | ✅ | Begrenzt |

Pivot-Tabellen-Reporting | ✅ | ❌ |

Permanenter Jahresabschluss (Perpetual Fiscal Closing) | ✅ | ❌ |

Mehrere Steuersätze pro Posten | ✅ | ❌ |

Bank Feed-Support | ✅ | ✅ |

Abstimmregeln (Reconciliation Rules) | ✅ | Begrenzt |

Eingebaute KI-Flows | ✅ | ❌ |

Zugriffsrechte (Screen/Field Level) | ✅ | ❌ |

Unterstützte Länder | 80+ | ~5 |

Unterstützte Sprachen | 85+ | 1 |

Mobile App | ✅ | ✅ |

*Optische Zeichenerkennung

**Monatlich wiederkehrender Umsatz

Kurz gesagt:

Xero deckt die Grundlagen gut ab: saubere Rechnungsstellung, solide UK-Einhaltung der Vorschriften und einfache Bank-Feeds.

Es ist ideal für KMU, kann aber komplexe Reporting- und Konsolidierungsanforderungen, die in mittelständischen oder größeren Unternehmen benötigt werden, nicht abbilden.

Odoo enthält Funktionen, die wachsende Teams häufig benötigen, wie SEPA-Support, Multi-Company-Strukturen, Zugriffskontrollen oder Automatisierungslogik. Es verfügt zudem über eingebaute KI, tieferes Reporting und eine vollständige Lokalisierung für UK- und EU-Gesellschaften ab Werk..

Kundenrechnungen und Debitorenmanagement

Wir haben untersucht, wie die Tools wiederkehrende Rechnungen, Abonnement-Abrechnungen, SEPA und die Kundenkommunikation behandeln.

Funktion | Odoo | Xero |

Proforma-Rechnungen | ✅ | ❌ |

SEPA-Lastschrift | ✅ | ❌ |

Mehrere Steuern pro Zeile e | ✅ | ❌ |

Wiederkehrende Rechnungen | ✅ | ✅ |

Abonnement-KPIs (MRR, Churn) | ✅ | ❌ |

E-Mail-Verlauf in Rechnungen | ✅ | ❌ |

Mahnwesen (Follow-up Reminders) | ✅ | Begrenzt |

Kurz gesagt:

Odoo eignet sich besser für Unternehmen mit komplexen Abrechnungszyklen oder Abonnement-Modellen. Xero funktioniert gut für die Standard-Rechnungsstellung, lässt aber tiefgreifende Automatisierung oder EU-Funktionen vermissen.

Lieferantenrechnungen, AP-Automatisierung und SEPA

Dieser Abschnitt vergleicht, wie Odoo und Xero die Zahlungen an Lieferanten, OCR und Genehmigungs-Prozesse verwalten.

Funktion | Odoo | Xero |

OCR für Lieferantenrechnungen | ✅ | ❌ |

SEPA- & ACH-Zahlungen | ✅ | ❌ |

Einkaufsvereinbarungen | ✅ | ❌ |

Einkaufs-Genehmigungen | ✅ | ❌ |

Rechnungs-Validierungs-Prozesse | ✅ | ❌ |

Mobile Spesen-App | ✅ | ✅ |

Kurz gesagt:

Odoo unterstützt die Automatisierung der Lieferantenbearbeitung mit OCR, Genehmigungen und Zahlungs-Flows. Xero deckt grundlegende Spesen und Banküberweisungen ab, jedoch kein SEPA oder erweiterte AP-Logik (Accounts Payable).

Bank-Feeds und Abstimmung (Reconciliation)

Von Bankformaten bis zur Abgleichlogik: So behandeln beide Systeme die Abstimmung bei großem Volumen.

Funktion | Odoo | Xero |

Bank Feed-Support | ✅ | ✅ |

Abstimmregeln (Reconciliation Rules) | ✅ | Begrenzt |

Importformate (OFX, CODA, CAMT) | ✅ | Nur OFX |

Automatisches Update der Wechselkurse | ✅ | ✅ |

Kurz gesagt:

Xero beschleunigt die Abstimmung für Standard-Feeds. Odoo unterstützt mehr Formate und bietet zusätzliche Abgleichlogik, KI und Automatisierungs-Trigger.

Reporting und Dashboards

Wir haben verglichen, welche Reporting-Optionen standardmäßig verfügbar sind und wie anpassbar sie für wachsende Finanzteams sind.

Funktion | Odoo | Xero |

GuV, Bilanz, Cashflow | ✅ | ✅ |

Pivot-Tabellen | ✅ | ❌ |

KPI-Anpassung | ✅ | ❌ |

Permanenter Jahresabschluss | ✅ | ❌ |

Annotierte Berichte | ✅ | ✅ |

Kurz gesagt:

Xero deckt die Grundlagen mit sauberer Visualisierung ab. Odoo bietet multi-dimensionale Analysen, Pivot-Tabellen und tiefere Einhaltung der Vorschriften-Tools für UK-/EU-Prüfungen.

Automatisierung und KI

Diese Funktionen zeigen, was jedes Tool automatisieren kann und wie weit die eingebaute KI tatsächlich reicht.

Funktion | Odoo | Xero |

OCR-Rechnungserkennung | ✅ | ❌ |

Automatisierte abgegrenzte Einnahmen | ✅ | ❌ |

KI-gestützte Mahnlogik | ✅ | ❌ |

KI-Tagging / COGS*-Einträge | ✅ | ❌ |

*Cost of Goods Sold (Herstellungskosten)

Kurz gesagt:

Odoo führt bei der Automatisierung mit nativer KI-Logik und Dokumentenscanning. Xero ist rein regelbasiert und bietet keine eingebauten KI-Funktionen.

Plattform-Umfang, Preisgestaltung und Deployment-Optionen

Was Sie jeweils in Bezug auf Preis, Nutzerlimits und Deployment-Flexibilität erhalten.

Plattform | Preis | Beinhaltet | Nutzerlimit | Deployment | Weitere Geschäftsbereiche |

Odoo | ~£25–30/Monat | Vollständige Buchhaltung, AP/AR, KI, ERP-Apps | Unbegrenzt | SaaS oder Selbst-gehostet | Lager, Fertigung, CRM standardmäßig integriert |

Xero | ~£30/Monat | Kernbuchhaltung, Rechnungsstellung, Bank-Feeds. | 5 | Nur SaaS | Nicht verfügbar |

Kurz gesagt:

Odoo bietet eine komplette ERP-Suite inklusive KI und benutzerdefinierten Flows. Xero ist schlanker und ideal für Ein-Gesellschafts-Setups, die nur SaaS nutzen möchten.

Wann Odoo wählen und wann Xero?

Das Fazit: Die Wahl des richtigen Systems hängt davon ab, wie tief Ihre Buchhaltungsanforderungen gehen und wie eng sie mit dem Rest Ihres Geschäfts verbunden sein müssen.

Wählen Sie Odoo, wenn...

Sie ein größeres Unternehmen sind, das ein zentrales System für vereinheitlichte Geschäftsabläufe benötigt.

Sie SEPA, Abonnement-Abrechnungen oder ein Multi-Company-Setup benötigen.

Sie Pivot-Reporting oder EU-Steuerlogik benötigen.

Sie KI-gestützte Automatisierung wünschen.

Sie planen, in Bereichen wie Lager, Personalwesen oder CRM zu skalieren.

Wählen Sie Xero, wenn...

Sie ein KMU sind, das die grundlegende Buchhaltung schnell implementieren möchte.

Sie schnell Rechnungen erstellen und Bank-Feeds abstimmen möchten.

Sie nur UK-Regelkonformität und Banktransparenz benötigen.

Sie eine reibungsarme Einrichtung bevorzugen.

Sie ausschließlich ein System für die Buchhaltung suchen.

Möchten Sie Ihr Buchhaltungs-Setup mit Odoo erweitern?

Odoo Buchhaltung bietet eingebauter Automatisierung, EU-Einhaltung der Vorschriften und Echtzeit-Konzernreporting. Es ist Teil einer vollständigen Business-Suite, die mit Ihnen skaliert.

Kontaktieren Sie unser Odoo-Expertenteam, um ein Buchhaltungs-Setup maßzuschneidern, das zu Ihren Finanz-Workflows passt.