ERP subsidies

All beginnings are difficult, and especially in the field of digitalisation and automation, SMEs and start-ups are not so much lacking in willpower, but much more often in the necessary financial resources. This is where it pays to take advantage of government programmes: In Germany, the federal and state governments offer various funding programmes and financing options that make it easier to take the step into a digital future. Here we collected an overview for you.

In Germany, there are 3 types of funding for ERP projects:

What are the criteria to be eligible for funding?

At first glance, the range of different funding programmes appears very diverse, but on closer inspection it quickly becomes clear that the same conditions and legal framework apply in most cases.

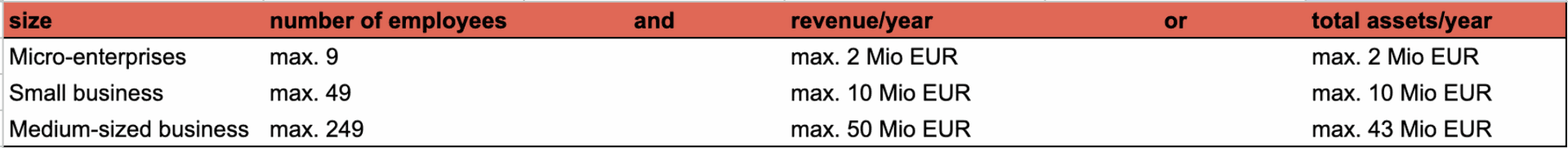

In most cases, SMEs are eligible for funding. But which companies actually fall under this term?

Most funding programmes are aimed at so-called SMEs, i.e. small and medium-sized enterprises. These include commercial and craft enterprises as well as freelancers with fewer than 250 employees. The exact calculation of the funding rate usually depends on the size of the company, based on the threshold values recommended by the EU:

The EU's de minimis regulation - what to bear in mind for most grants, loans, guarantees & participations:

The EU's de minimis regulation states that companies can receive up to €200,000 in state aid within a period of three fiscal years without it being considered unauthorised state aid. SMEs should ensure that they do not exceed this maximum limit when applying for state aid in order to avoid possible sanctions from the EU Commission.

1. nationwide, non-repayable grants

As the name suggests, these are government grants that do not have to be repaid. In principle, companies can receive a grant of 30-80% for their projects, depending on the programme. However, each programme is limited to a maximum amount. In addition, a personal contribution must be made in each case.

Go Digital

For who?

SMEs:

- with fewer than 100 employees,

- with an annual turnover or an annual balance sheet total of max. 20 million euros in the year before the contract is concluded.

- that are eligible for funding under the de minimis regulation.

- have a permanent facility or branch in Germany

Trade businesses that want to optimise business processes with the help of digital solutions

For what?

The programme is structured in 5 eligible modules:

Module 1: Digital business processes

- Introduction of e-business software solutions for overall or sub-processes of the company

- Consulting and implementation services, e.g. in the areas of shipping and returns management, logistics, warehousing, electronic payment processes

- Due to COVID-19, this also includes setting up home office workstations

Module 2: Digital market development

- Development of company-specific online marketing strategies

- Subordinate business processes of an online shop, e.g. ordering goods and payment procedures

- Development of a professional internet presence for marketing

Module 3: IT security

- Risk and security analysis (assessment of threats and potential vulnerabilities) of the existing or newly planned operational ICT infrastructure

- Measures for the initiation/optimization of operational IT security management systems

Module 4: Data management

- Collecting and generating data

- Data identification, evaluation and utilization

- Use of artificial intelligence in data processing

- Addressing legal and security aspects when handling data

- Goal: Active participation in the developing data economy and generation of new business areas

Module 5: Digital strategy

- Development of new digital business models or processes

- Digitization of existing business models or processes

- Goal: needs analysis, feasibility study and risk assessment for your own digitization project

How is funding provided?

- Consulting services: up to 50% with a maximum daily consultant rate of € 1,100

- Scope of funding: max. 30 days in a period of 6 months

- The maximum possible 30 consultant days can be spread over one or more modules

Limitations

- Restricted to authorized consulting companies

- Main module with at least 51% of the funding focus must be selected

BAFA - Funding for entrepreneurial know-how

For who?

- SMEs with up to 250 employees and an annual turnover of less than €50 million

- Start-ups / new businesses, existing businesses (older than two years) and businesses in difficulty.

For what?

Start-ups and established companies:

- General advice on economic, financial, personnel and organizational management issues

- This includes support services for projects in the course of digital transformation, e.g. for technical advice on the introduction of a new software system.

Companies in difficulty:

- Consultation on restoring performance and competitiveness

How is funding provided?

- Funding rate of 50 to 80 % depending on the federal state

- The maximum eligible consultancy costs are € 3,500. The amount of the subsidy depends on the location of the consultancy provider.

- In the new federal states, the subsidy amounts to 80% of the eligible costs, i.e. a maximum subsidy of € 2,800.

- In the old federal states, the subsidy rate is 50%, i.e. €1,750.

Please note:

The new funding guideline applies to all grant applications submitted from January 1, 2023.Within the period of validity of the funding guideline (until December 31, 2026), each eligible company can receive funding for a maximum of five stand-alone consultations, but no more than two per year. The decisive factor here is the time of application.

Please note that the proof of use for your funding applications can be submitted from February 2023 via the proof of use portal provided for this purpose.

Go Inno

For who?

SMEs with fewer than 100 employees and less than €20 million turnover per year.For what?

Innovation consulting in the form of 2 service levels:

Service level 1: Potential analysis

- Strengths and weaknesses profile of the company in connection with the innovation project,

- Preliminary examination of the marketability of the innovation project,

- Anticipated capacity requirements when drawing up a realization concept,

- Draw up a financing plan, include public funding programs,

- Assessment of the prospects of success.

Service level 2: Realization concept

- Technology evaluation on the basis of market assessments and market analyses,

- Identification of a suitable external technology provider,

- Development of the realization concept,

- Initiating cooperation between the company to be advised and, if applicable, the external technology provider,

- Inclusion of public funding programs to finance the innovation project,

- Supporting the company in necessary discussions, in particular with banks or venture capital companies.

- Creative workshop

- Enabling the advised company to set up or expand innovation management

How is funding provided?

- Grant of up to €20,000 with a funding rate of 50%

- Only services provided by authorized consulting companies are funded

- Funding is available for consulting services in three service levels:

- 1. Potential analysis for a maximum of 8+2 consultant days at a maximum of €5,500

- 2. Realization concept for a maximum of 20+5 consultant days at a maximum of €13,750

- 3. A maximum of €1,100 per consultant day is eligible for 50% funding

2. non-repayable grants from the federal states

Baden-Württemberg

Bavaria

Berlin

Brandenburg

Bremen

Hamburg

Hesse

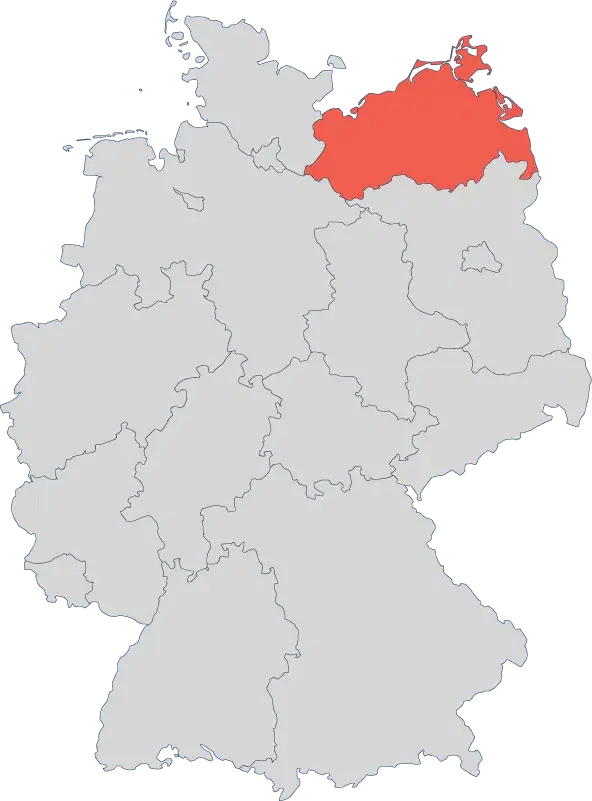

Mecklenburg–Western Pomerania

Lower Saxony

Nordrhine-Westphalia

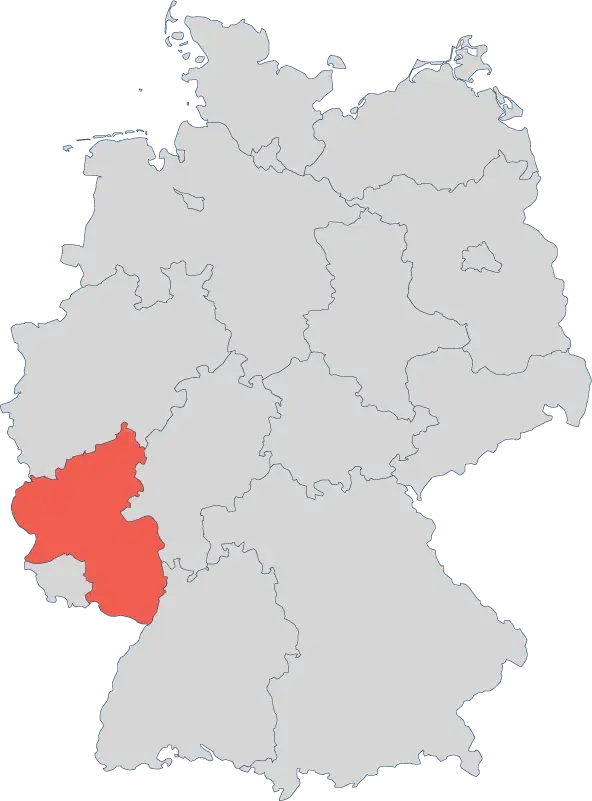

Rhineland-Palatinate

Saarland

Saxony

Saxony-Anhalt

Schleswig-Holstein

Thuringia

Baden-Württemberg

Innovation voucher Hightech Digital

For who?

- Companies with a maximum of 100 employees and a turnover or balance sheet total of €20 million

- If the planned project is implemented with a start-up as a research and development (R&D) service provider, companies with up to 250 employees and € 50 million turnover or € 43 million balance sheet total are also eligible to apply

For what?

- Solutions for the digital transformation of business models

- Development of solutions in connection with Industry 4.0

- Networked systems and processes

- Internet of Things

- Smart services

- Highly flexible automation

- Big data projects

- Simulation models

- Virtual and augmented reality

- Embedded systems

How?

- Up to €20,000, whereby a maximum of 50% of the expenditure is covered

- To receive the maximum funding amount, proof of at least € 40,000 (net) in eligible expenditure must be provided

- The approval period is 10 months

Note:

Can be combined with innovation voucher A.

Innovation financing 4.0

For who?

- Small and medium-sized companies

- Larger medium-sized companies (up to € 500 million annual turnover)

- Freelancers

For what?

- Innovative projects for the development of new or improved products or processes

- Development or introduction of a new, innovative business model

- Costs of digitalization projects

- Regardless of the specific project, innovative companies with capital requirements can also receive a loan

How?

- Subsidized loan via local bank with redeemable loan subsidy

- Loan amount: €10,000 to €5 million, up to €25 million for larger companies

- Loan term: 5, 7 or 10 years, with 0 to 2 years repayment-free

- Special repayment possible at any time from 01.07.2021 against prepayment penalty

- Debit interest reduction and commitment: same as loan term, max. 10 years

Additional benefit: Repayment subsidy for small and medium-sized enterprises

- 3.0% of the loan amount in the priority areas of innovative projects and digitalization projects

- 4.0% of the loan amount in the priority area of innovative business models

- 0.0% in the priority area of innovative companies

Note

The subsidy application is submitted to the bank, the house bank then disburses the subsidized loan.

Digitization Premium Plus - loan variant

For who?

- Medium-sized companies with up to 500 employees

- Excludes companies in which companies with more than 500 employees and public bodies hold a stake of 25% or more

For what?

- Digitalization in production, processes, products and services

- Costs for hardware and software and associated services and training

- Increase in ICT (information and communication technology) security

How?

- Subsidized loan via local bank with redeemable loan subsidy

- Loan amount: € 5,000 to € 100,000

- Loan term: 5, 7 or 10 years, with 0 to 2 years repayment-free

- Special repayment possible at any time from 01.07.2021 against prepayment penalty

Note

The subsidy application is submitted to the bank, the house bank then disburses the subsidized loan.

Digitization Premium Plus - subsidy variant

For who?

- Medium-sized companies with up to 500 employees and an annual turnover of up to €500 million

For what?

- Digitalization in production, processes, products and services

- Costs for hardware and software and associated services and training

- Increase in ICT (information and communication technology) security

How?

- The grant is proportionate to the amount of eligible expenses

- For eligible expenses of €5,000 up to and including €15,000, the grant is 30%, up to a maximum of €3,000

Note

The subsidy application is submitted to the bank, the house bank then disburses the subsidized loan.

Bavaria

Digitalbonus

For who?

- Small and medium-sized enterprises

For what?

- Improvement of existing products, processes and services when digital systems are used for the first time or the degree of digitalization is increased to the latest level

- Measures to improve IT security

- Measures to establish information security management

- Services from external providers including the implementation of necessary hardware and software

Digitalbonus standard

- Optimization of business processes e.g. through ERP, CRM, document management, merchandise management systems, etc.

Digitalbonus Plus

- Innovation content is a key requirement e.g. new and different business model, serving new markets, breaking new ground with a digital product/service

How?

Digitalbonus Standard:

- Grant of up to €10,000

- Subsidy rate is up to 50%

Digitalbonus Plus

- Up to €50,000

- Subsidy rate is up to 50%

Note:

- It is not possible to combine Standard and Plus

- The digital loan can be combined with the Digitalbonus Standard and Plus

Innovation financing 4.0

For who?

- Small and medium-sized companies

- Freelancers

- Newly founded companies

For what?

- Innovative projects and the acceleration of digitalization in the company

- Digitization projects

- Integration of CRM systems with manufacturing execution systems (MES)

- Comprehensive networking of ERP and production systems

- Integration of mobile operating devices in production control

- Company training measures in the area of digitalization

How?

- Up to 100% of the eligible costs

- Minimum loan amount: € 25,000

- Maximum amount: € 7.5 million

- Term: 3 to 10 years

Note

Is applied for via the house bank to the LfA Förderbank Bayern

Berlin

Transfer Bonus "Standard Option Digitization"

For who?

- Technology-oriented, small and medium-sized enterprises (SMEs)

- Non-technology-oriented SMEs whose project has a strong technological component

- Social economy enterprises

For what?

- Contracts awarded to scientific institutions in Berlin and Brandenburg in the field of technology and knowledge transfer

Entry-level variant

- Funding of expenses for external scientific activities in advance of the development of a new or modified product, a new or modified service or with regard to a process innovation, which arise in connection with the company's first specific cooperation with a scientific institution

- The duration of the project should not exceed 6 months

Standard variant

- Funding for expenses for external planning, development and implementation-oriented research and development activities that are geared towards advancing new or modified products, services and production processes to market or production maturity

- It can also be applied for if the entry-level variant has already been applied for a previous, independent project

- The duration of the project should not exceed 6 months

Standard variant digitization

- Funding of expenses for external planning, development and implementation-oriented research and development activities aimed at developing new or modified products, services and production processes in the field of digitization (providers) or implementing them in their own company (users)

- The duration of the project should not exceed 12 months

- After examining the basic eligibility for funding, a project meeting will be held at IBB Business Team GmbH.

How?

Entry-level variant

- 100% funding rate of the order volume, but max. €7,500

- This variant applies once and only to companies that have not yet implemented a project-related cooperation with scientific institutions, e.g. via “Pro FIT” (a program to promote research, innovation and technology) or another federal or state program.

Standard variant

- 70% funding rate of the contract volume, but max. €15,000

- The standard variant can be applied for a maximum of three times (including a digitization project) with projects that are clearly distinct from each other in a period of three consecutive calendar years

Standard variant digitization

- 70% funding rate of the contract volume, but max. €45,000

- The standard variant digitization can only be applied for once.

Brandenburg

In Brandenburg, there are currently no funding programs available that cover the area of digitization.

Bremen

Consulting funding program for digitization and work 4.0

For who?

- Small and medium-sized enterprises

For what?

- Topics of digitization, such as big data, IT security or cloud

- Concept development and application examples for industry 4.0 (e.g. networking of systems)

- Development of new digital business models

- Digital process consulting / process management, process 4.0 (change of workflows, qualifications, contribution of management)

- Organizational development / change and project management

- Cloud services and IT security concepts

How?

- Subsidy of up to 50% of external costs

- Max. €5,000 per project

- Eligible costs here are consultancy services for the development and introduction of strategies and prototypes Work up to prototypes, samples, strategy

- Combination of several service providers in the project possible

Hamburg

Hamburg Digital

For who?

- Small and medium-sized enterprises

- Freelancers

For what?

- Module I Hamburg Digital Check

- Expenses for consulting service providers that have received certification under the federal program “go-digital” are eligible for funding.

- Module II Hamburg Digital Invest

- Funding is available for investments to implement the developed strategies and concepts.

- Includes both expenses for ICT hardware and software and expenses for external service providers that are necessary to implement the measures.

How?

- “Module I – Hamburg Digital Check”: up to 50 percent of the eligible costs, but no more than €5,000

- “Module II – Hamburg Digital Invest”: up to 30 percent of the eligible costs, but no more than €17,000

- The eligible expenses must amount to at least €3,000 net per module.

Hesse

Distr@l funding program Strengthening Digitization – Transfer Life

For who?

- SMEs

- Partnered companies, universities and research institutions as well as transfer companies

For what?

Funded area 1: Feasibility studies

- Activities to evaluate and analyse the potential of a project to prepare innovation projects or to independently analyse facts related to digitization..

- Structuring and improving project planning and the chances of success of complex projects.

Funded area 2

- Module A: Digital product innovation

- Testing or creation of a new product, a new process or a service in the field of digitalization that shows the potential to advance the state of the art.

- Implementation of a digital application – development of prototypes, systems or processes.

- Module B: Digital process innovation

- Planned projects for the application of a new or significantly improved method for the production or optimization of a value chain or digital processes.

- Significant changes in techniques, equipment or software.

- Module C: Digital pioneers

- Implementation of innovation projects by digital pioneers.

- Research topics in the context of digitization, which are addressed on the basis of specific social, economic and scientific problems.

- Transfer of current scientific findings to industry.

Funded area 3: Knowledge and transfer project

- Knowledge and transfer projects from research at universities in the field of digitization in application centers for industry to make visible and usable.

Funded area 4

- Module A: Validation / Spin-off

- The aim is to implement entrepreneurial ideas more strongly in universities, particularly with regard to the special dynamics of digitalization.

- Interesting research results with a digital connection can be validated with this module in order to examine the economic potential – preferably in an interdisciplinary university team as part of a university project.

- Module B: Growth

- Implementation of an innovative business idea with high growth potential

How?

Funded area 1: Feasibility studies

- Duration: 3 to 12 months with a maximum contribution of €100,000 and a maximum subsidy rate of 50%.

Funded area 2

- Module A: Digital product innovation

- Duration 12 to 36 months with a maximum contribution of €500,000 and a maximum funding rate of 50% for SMEs and 90% for universities and research institutions

- Module B: Digital process innovation

- Duration 12 to 36 months with a maximum contribution of €500,000 and a maximum funding rate of 50% for SMEs and a maximum of 100% for universities and research institutions

- Module C: Digital Pioneers

- Duration 12 to 36 months with a maximum contribution of €200,000 and a maximum funding rate of 100%

Funded area 3: Knowledge and transfer project

- Duration: 12 to 36 months with a maximum contribution of €1,000,000 and a maximum subsidy rate of 100%.

Funded area 4

- Module A: Validation / Spin-off

- Duration 12 to 24 months with a maximum contribution of €1,000,000 and a maximum funding rate of 100%

- Module B: Growth

- Duration 12 to 24 months with a maximum contribution of €160,000 and a maximum funding rate of 100% in the first year and 60% in the second year

Mecklenburg–Western Pomerania

In Mecklenburg-Vorpommern, , there are currently no funding programs available that cover the area of digitization.

Lower Saxony

Low-threshold innovation funding for SMEs and trade

For who?

- SMEs and trade businesses

For what?

- Improved or new products, production processes, services, and new operational and organizational structures

How?

- Maximum funding amount is 35% of the eligible expenses

- In the transition region for small companies, a maximum of 45% of the eligible expenses, but not more than €100,000

Note

The simultaneous use of financial assistance from other public funds from federal, state or municipal programs is excluded.

North Rhine-Westphalia

NRW.BANK.Digitalization and Innovation

For who?

- SMEs

- Freelancer

For what?

- Digital production and processes, such as the integration of digital customer interfaces, comprehensive networking of resource planning and production systems, and the expansion of in-house broadband networks

- Digital products

- Development and improvement of digital platforms

- Development of predictive maintenance applications and product-related and/or user control software

- Development of digital standards and norms

- Digital strategy and organization, such as:

- Development of a comprehensive digitization strategy

- Initial costs for the use of cloud technologies

- Development and implementation of an IT, data security and/or social media communication concept

- CRM and ERP systems are eligible for funding

How?

- If the €10 million mark is exceeded, the particular eligibility of the project for funding in NRW must be explained

- Installment loan: 3 years without redemption year or 5, 7 and 10 years with optional redemption year

Rhineland-Palatinate

In Rheinland-Pfalz, there are currently no funding programs available that cover the area of digitization.

Saarland

In Saarland, there are currently no funding programs available that cover the area of digitization.

Saxony

In Saxony, there are currently no funding programs available that cover the area of digitization.

Saxony-Anhalt

IB-Digitization loan

For who?

- SMEs

- Freelancer

For what?

- Tangible and intangible assets

- Personnel costs

- Project expenses

- Third-party services

How?

- Subsidized loan for up to the full amount of the financing requirement.

- Min. €10,000, max. €1.5 million

- Term: max. 10 years, of which max. two years are redemption-free.

- Covers up to 100% of the financing requirement.

- Fixed interest rate: 0.95%

Note

- A viable concept must be submitted.

- Existing liabilities cannot be settled.

- No pre-financing of VAT that is subject to reimbursement.

- The total financing must be secured.

Schleswig-Holstein

Funding for business innovation (BIF)

For who?

- SMEs

For what?

Module 1 – Process and organizational innovations

- Costs for instruments and equipment as well as rent, leasing or usage fees for hardware, software, software as a service and interfaces

- Costs for services, such as contract research and innovation consultancy services

- Personnel costs (flat rate of 20% of eligible costs for instruments, equipment and services)

Modules 2 and 3 – Research and development projects

- Personnel costs for researchers, technicians and other staff in connection with the project

- Costs for instruments and equipment

- Costs for contract research, consultancy and equivalent services

- Operating costs incurred directly as a result of the project

How?

- Minimum project volume of €60,000

- Funding rate for projects focusing on process and organizational innovation: 50%

- Funding rate for projects focusing on development projects: 35 to 45%

- Funding rate for projects with complex research and development projects: 45 to 70%

Note

The project must contribute to climate protection, for example in the form of improved resource efficiency, and ensure an economic improvement of the company after the end of the project, for example by creating new jobs.

Digitization measures in small companies (DKU)

For who?

- Small businesses in the commercial sector

For what?

Consulting module

- Projects that aim to comprehensively analyze existing operational procedures and processes for innovation potential through digitization and to develop suitable individual solutions and recommendations for action.

- Improving IT security

- Improving digital business models

- Digitization of processes

- Digitization of products and processes

Implementation module

- Projects that aim to implement the individual solutions found in the company and to provide the necessary training for employees

- Hardware, e.g. servers, PCs, storage and peripheral devices

- Software, e.g. BI tools, CRM, DMS, ECM, ERP

- One-time purchase of a user license for a maximum period of up to 36 months

- “Software as a Service” (SaaS) Costs for twelve full calendar months

- Rental of cloud storage solutions for up to six full calendar months

- Services related to the purchase of hardware or software

- Installation of hardware

- Installation and customization of software

- Data migration

- Monthly hosting and service costs

- Costs of creating and obtaining digital accessibility

- Qualification measures, such as training for your own employees

How?

Consulting module

- Licensed advice from a federal go-digital consultant

- Calculated consultancy costs amount to at least €2,500

- Maximum eligible expenses is €20,000

- Non-repayable grant for a maximum of 40% of eligible expenditure

- The funded measure should be completed within eight months

Implementation module

- Implementation is based on a previously prepared consulting report from the consulting module or the go-digital consulting

- Calculated costs for investments in hardware and software as well as for the associated services for the digitization project amount to at least €10,000.

- Eligible expenses of up to €200,000.

- Non-repayable grant of up to 40% of the eligible expenses.

- The funded measure should be completed within 18 months.

Thuringia

Digital bonus

For who?

- SMEs

- Freelancer

For what?

- Digitization of business processes

- Digitization of products and services

- Introduction or improvement of information and data security solutions

How?

- Funding covers up to 50% of the eligible costs, but no more than €15,000.

- The eligible costs must be at least €5,000 and must not, in principle, exceed €150,000.

- License, usage and system service fees incurred during the approval period are eligible for a maximum period of 12 months.

FTI-Thuringia TECHNOLOGY

For who?

- SMEs

- Large companies and scientific institutions in association with SMEs

For what?

- Industrial production and systems

- Sustainable and intelligent mobility and logistics.

- Healthy living and health economy

- Sustainable energy and resource utilization

- Information and communication technologies, innovative and production-related services

How?

- The specific funding rates depend on the individual applicant and the specific funding project.

- Personnel expenses and residual costs amounting to 40% of personnel expenses for research and development projects.

- External service contracts as part of the innovation voucher.

3. Subsidized loans

290

The KfW loan for growth

360

ERP Mezzanine for Innovation

365-366

ERP subsidised loan for SMEs

375-376

KfW loan for medium-sized companies

380

The ERP Digitization & Innovation Loan

The KfW loan for growth

For who?

- Domestic and foreign companies that

- are majority-owned by private persons

- have a group turnover of max. 2 billion euros

- Companies that provide (energy) services to a third party under a contracting agreement

- Foreign projects of German companies and their subsidiaries based abroad;

- Projects of foreign companies in Germany

For what?

- Expenses or projects to develop new markets or customer groups

- Innovation expenses, i.e. all investments for the development/introduction of product and process innovations

- Expenses for significantly increasing the digitalization of the company

- Projects and measures to renew or improve the IT structure and use of digital applications and measures to expand company-specific knowledge regarding digital applications

- Digitalization projects

How?

- KfW participates in debt financing just like any other bank

- KfW risk share of €7.5 million – €100 million

- Financing provided directly as a consortium partner/indirectly through risk sub-participation

- Up to 70% of project financing

- KfW must not be the largest risk carrier

- Participating banks

- The total volume of risk assumption plus refinancing funds is a maximum of €100 million.

Please note

Cannot be combined with ERP Mezzanine and ERP Digitization Loan.

ERP Mezzanine for Innovation

For who?

- Private companies and freelancers with at least 2 years of business experience and

- registered office in Germany

- Registered office abroad for subsidiaries, branches, operating facilities or offices in Germany

- Max. 500 million euros group turnover

For what?

- Projects to develop new markets and customer groups

- Innovation spending, i.e. all investments for the development and introduction of product and process innovations

- Expenses for significantly increasing the digitalization of the company

- Measures to renew/improve IT structures and use digital applications

- Measures to expand company-specific knowledge regarding digital applications

How?

Loan structure

Financing consists of two tranches:

- Classic loan (debt capital)

- Loan with equity character (subordinated capital)

Shares of the tranches:

Turnover | Finance package | Speciality | |

| 60% subordinated capital 40% debt capital | high share of subordinated capital | |

over 50 Mio. € | 50% subordinated capital 50% debt capital |

Advantages of subordinated capital:

- The bank is not liable for 100% of the subordinated tranche, which facilitates financing.

- No collateral required.

- The subordinated tranche improves the company's balance sheet structure and credit rating.

- Collateral remains available for further loans.

- Long maturities and redemption-free initial years conserve liquidity.

- KfW's termination rights are restricted.

Loan amount, interest rates and term

- Fixed interest rate for the entire term

- Interest rates dependent on economic situation and quality of the collateral

- Term generally 10 years

- No commitment commission

- Up to €5 million per project, minimum €25,000

- Up to 100% of your eligible costs

- 100% disbursement according to the progress of the project

Please note

Cannot be combined with other liability-exempt KfW loans and with research grants under the Research Grants Act (FZuIG).

ERP subsidised loan for SMEs

For who?

- Companies with up to 250 employees, a maximum annual turnover of EUR 50 million or a balance sheet total of EUR 43 million

- Including sole traders, freelancers, founders and successors in sideline businesses

- If companies can provide 2 annual financial statements, they can apply for the ERP SME development loan (366)

- Larger SMEs can apply for the KfW promotional loan for large SMEs.

For what?

Everything you need for your business activities:

- Acquisitions (investments)

- Equipment and machinery

- Land and buildings

- Construction costs

- Furnishings

- Company vehicles

- Operating and office equipment

- Intangible investments (licenses and patents)

- Software

- Running costs (operating resources)

- Liquid funds

- Personnel costs

- Rents

- Marketing costs

- Consulting costs

- Storage of materials and goods

- Company formation, succession and participation

How?

Loan amount and payout

- Without risk assumption (365): Loan amount up to €25 million, 100% payout, total or partial amounts, payout period up to 36 months, commitment commission from the 7th month

- With risk assumption (366): Loan amount up to €25 million for investments, acquisitions and participations and up to €7.5 million for working capital, 100% payout, total or partial amounts, payout period up to 12 months, commitment commission from the 7th month.

Interest rates and terms

- The bank calculates the individual interest rate based on the economic circumstances and the quality of the collateral.

- Information on terms and interest rates can be found in the overview of conditions.

- Companies with a term of up to five years and projects in regional development areas receive a particularly favorable interest rate.

Please note

In general, the subsidy can be combined with other forms of financial assistance (loans, allowances and grants).

KfW loan for medium-sized companies

For who?

- Large medium-sized companies with

- at least 250 employees

- and an annual turnover of up to €500 million, including successors

For what?

Everything you need for your business activities:

- Acquisitions (investments)

- Equipment and machinery

- Land and buildings

- Construction costs

- Furnishings

- Company vehicles

- Operating and office equipment

- Intangible investments (licenses and patents)

- Software

- Running costs (operating resources)

- Liquid funds

- Personnel costs

- Rents

- Marketing costs

- Consulting costs

- Storage of materials and goods

- Company formation, succession and participation

How?

Loan amount and payout

- Without risk assumption (375): Loan amount up to €25 million, 100% payout, total or partial amounts, payout period up to 36 months, commitment commission from the 7th month

- With risk assumption (376): Loan amount up to €25 million for investments, acquisitions and participations and up to €7.5 million for working capital, 100% payout, total or partial amounts, payout period up to 12 months, commitment commission from the 7th month.

Interest rates and terms

- The bank calculates the individual interest rate based on the economic circumstances and the quality of the collateral.

- Information on terms and interest rates can be found in the overview of conditions.

Please note

It is not possible to combine this loan with other KfW loans that are exempt from liability and with research grants under the Research Grants Act (FZuIG).

The ERP Digitization & Innovation Loan

For who?

- Medium-sized companies, freelancers and young companies in the process of being established

- based in Germany

- based abroad for subsidiaries, branches, operating facilities or offices in Germany

For what?

Financing of digitization and innovation projects:

- Investments, operating resources and overall financing needs of innovative companies

- Examples of digitization projects: networking of ERP and production systems, IT and data security concepts, digital platforms and distribution channels, additive manufacturing processes, expansion of broadband networks

Innovative project and company:

- An innovative project involves the development of new or improved products, processes or services.

- An innovative company is characterized by above-average growth, high investments in research and development or innovation funding already received.

How?

Loan amount and payout

- Minimum loan amount: €25,000

- Up to €25 million per innovation and digitalization project

- Up to €7.5 million per financing requirement of innovative companies

- Up to 100% of eligible investment costs and operating resources

- 100% disbursement of the loan amount

Interest rates and terms

- The bank calculates the individual interest rate based on the economic circumstances and the quality of the collateral.

- Information on terms and interest rates can be found in the overview of conditions.

- The minimum term is generally 2 years.

- Companies and projects in regional development areas receive a particularly favorable interest rate.

Please note

Combination with other funding programs is generally possible, provided that there is no over-funding.

News & current topics