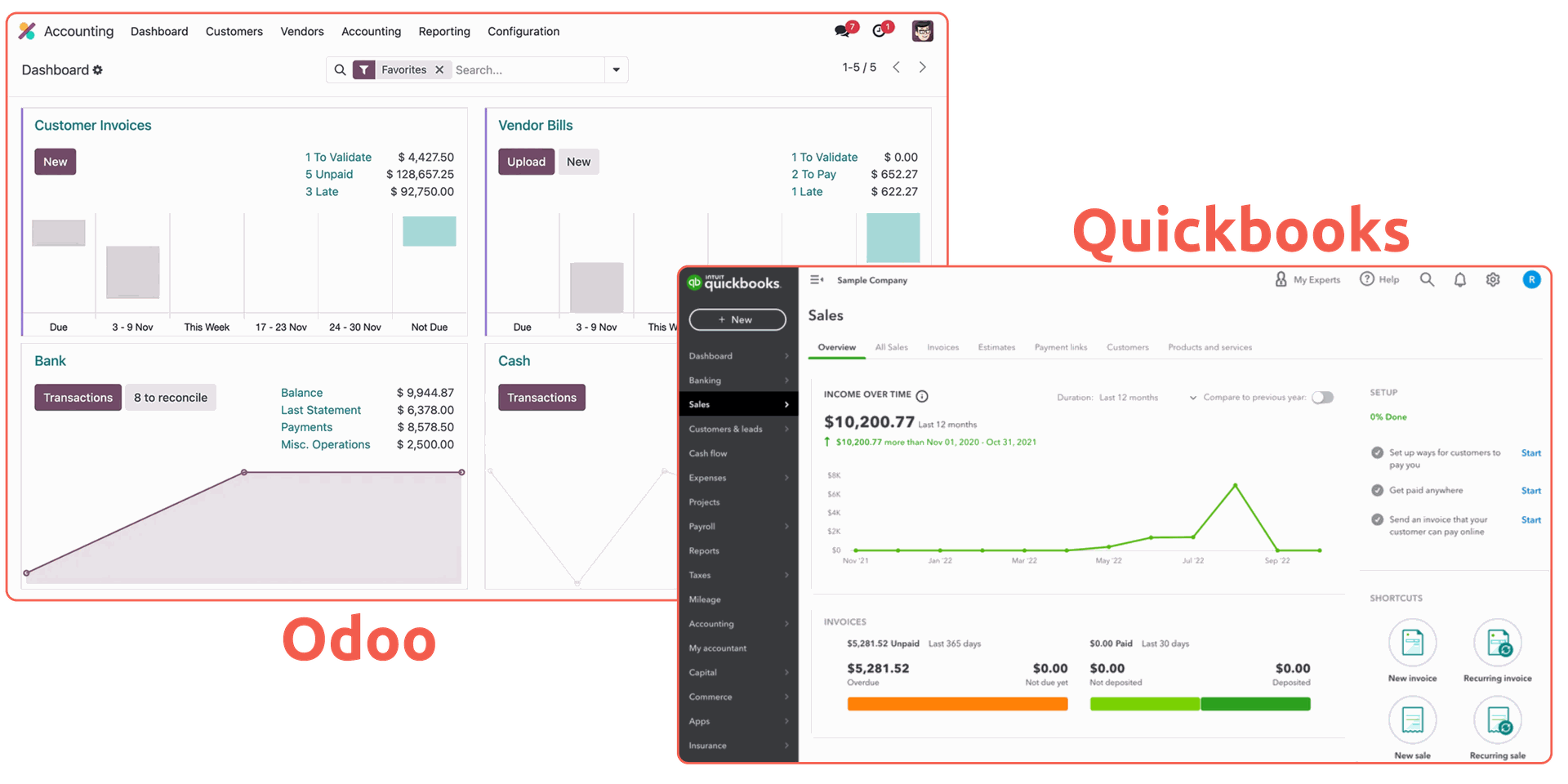

If you're comparing accounting tools for a growing UK business, chances are you’ve looked at both QuickBooks and Odoo.

QuickBooks is widely used for its fast setup and accessible interface, especially among small businesses.

Odoo is an open-source ERP that includes a full accounting suite with native automation, multi-company logic, and compliance-ready reporting all under one licence.

We compared the two side by side, not just on price, but on what each system can actually do once accounting becomes central to your operations.

Table of contents

Benchmarks to compare Odoo Accounting and QuickBooks

UK tax compliance: MTD, VAT and audit readiness

Odoo vs QuickBooks key accounting features

Customer invoicing & accounts receivable

Vendor bills, accounts payable automation & SEPA support

much. Consulting launched an AI app for Automated Actions in Odoo

Disclaimer: Pricing and feature availability are based on publicly available information as of July 2025. Actual costs may vary by region, billing terms, user count, and setup.

Benchmarks to compare Odoo Accounting and QuickBooks

Vendors bundle features differently. Some include essentials like SEPA, multi-company support, or deferred revenue automation. Others keep those features behind paywalls or leave them out entirely.

We focused on the features UK finance teams typically rely on once accounting becomes operationally critical:

- Multi-company accounting & consolidation.

- SEPA payment formats (for EU transactions).

- Deferred revenue, multi-step payment terms.

- AI or rule-based automation.

- UK VAT and MTD compliance.

- Access control down to field/screen level.

- Subscription metrics (MRR, churn, etc.).

- Pivot reporting & KPI customisation.

We based this comparison on two specific editions from each software provider:

- Odoo Enterprise: full accounting suite with built-in automation and multi-app integration.

- QuickBooks Online Essentials: core accounting, used by many SMEs for fast invoicing and reporting.

UK tax compliance: MTD, VAT and audit readiness

Odoo is officially recognised by HMRC for Making Tax Digital (MTD), the UK government’s initiative to digitalise VAT returns and accounting records.

That means UK businesses can use Odoo to:

- Submit digital VAT returns.

- Maintain digital VAT records.

- Stay compliant without external plugins.

QuickBooks is also MTD-compliant and supports digital submissions. Both platforms meet the baseline for VAT compliance in the UK.

The difference lies in how deeply integrated these tools are into the rest of your finance workflows.

Odoo vs QuickBooks key accounting features

Before diving into each module, here’s a high-level overview of the core accounting capabilities UK businesses may need:

Feature | Odoo | QuickBooks Online |

Multi-company | ✅ | ❌ |

Consolidation | ✅ | ❌ |

Multi-currency | ✅ | ✅ |

Deferred revenue automation | ✅ | ❌ |

SEPA Direct Debit | ✅ | ❌ |

Subscription KPIs (MRR*, churn) | ✅ | ❌ |

Pivot table reporting | ✅ | ✅ (limited) |

Perpetual fiscal year closing | ✅ | ❌ |

Access rights (field/screen) | ✅ | ✅ |

OCR** for vendor bills | ✅ | ✅ (basic) |

*Monthly recurring revenue

**AI-powered optical character recognition

In a nutshell:

Odoo includes a wider set of accounting features out of the box, especially for subscription billing, EU compliance, and multi-entity setups.

QuickBooks covers the core workflows but lacks depth for larger finance operations.

Customer invoicing & accounts receivable

Customer invoicing setups vary significantly between Odoo and QuickBooks, especially when subscriptions or SEPA are involved:

Feature | Odoo | QuickBooks |

Proforma invoices | ✅ | ✅ |

Multiple taxes per line | ✅ | ❌ |

Email threads in invoices | ✅ | ❌ |

Follow-up automation | ✅ | ✅ (limited) |

Subscription KPIs | ✅ | ❌ |

Batch send invoices by email | ✅ | ❌ |

In a nutshell:

QuickBooks handles recurring invoices and UK-standard invoicing well.

However, it lacks deeper automation, tax handling and performance tracking features found in Odoo, especially for SaaS or B2B billing setups.

Vendor bills, accounts payable automation & SEPA support

Accounts payable workflows differ in depth and automation across both platforms:

Feature | Odoo | QuickBooks |

OCR for vendor bills | ✅ | ✅ |

SEPA & ACH transfers | ✅ | ❌ |

Purchase approvals | ✅ | ❌ |

Multi-step payment terms | ✅ | ❌ |

Peppol / UBL* support | ✅ | ❌ |

*Universal business language

In a nutshell:

Odoo enables full accounts payable automation to cover SEPA, validation flows, and structured document formats.

QuickBooks is limited to bill uploads and basic approvals, with no native EU payment logic.

Bank feeds & reconciliation

Bank connectivity and reconciliation support depend on features like bank format coverage, automation rules, and matching logic that each software has:

Feature | Odoo | QuickBooks |

Bank feeds | ✅ | ✅ |

Reconciliation rules | ✅ | ✅ (limited) |

Import formats (OFX, CAMT, CODA)* | ✅ | OFX only |

Automated currency updates | ✅ | ✅ |

*OFX (Open Financial Exchange), CAMT (Cash Management), CODA (Common Data)

In a nutshell:

QuickBooks makes reconciliation fast for standard UK feeds.

Odoo supports more formats, enables smarter matching, and triggers that save time at scale.

Reporting & dashboards

This is how Odoo and QuickBooks are contrasted based on their reporting flexibility and audit readiness:

Feature | Odoo | QuickBooks |

P&L / Balance Sheet / Cashflow | ✅ | ✅ |

Pivot tables & custom dashboards | ✅ | ✅ (limited) |

Annotated reports | ✅ | ❌ |

Customisable KPIs | ✅ | ❌ |

Fiscal year closing (perpetual) | ✅ | ❌ |

In a nutshell:

QuickBooks covers core reports well.

Odoo goes further with pivot views, KPI tracking, fiscal tools, and multi-entity visibility, which is useful for larger finance teams or regulated audits.

Automation & AI

Built-in automation varies widely across both softwares, especially for deferred revenue, AI tagging, and follow-up logic:

Feature | Odoo | QuickBooks |

OCR invoice reading | ✅ | ✅ (basic) |

Automated deferred revenue | ✅ | ❌ |

AI follow-up logic | ✅ | ❌ |

AI tagging / COGS entry | ✅ | ❌ |

In a nutshell:

Odoo leads on automation with native AI flows and increasing capabilities that are introduced in each new version.

QuickBooks relies on manual rules and lacks logic for features such as deferred revenue or automatic tagging.

As Odoo is an open-source software, third-party integrations are readily available and easy to connect via API, including various AI modules.

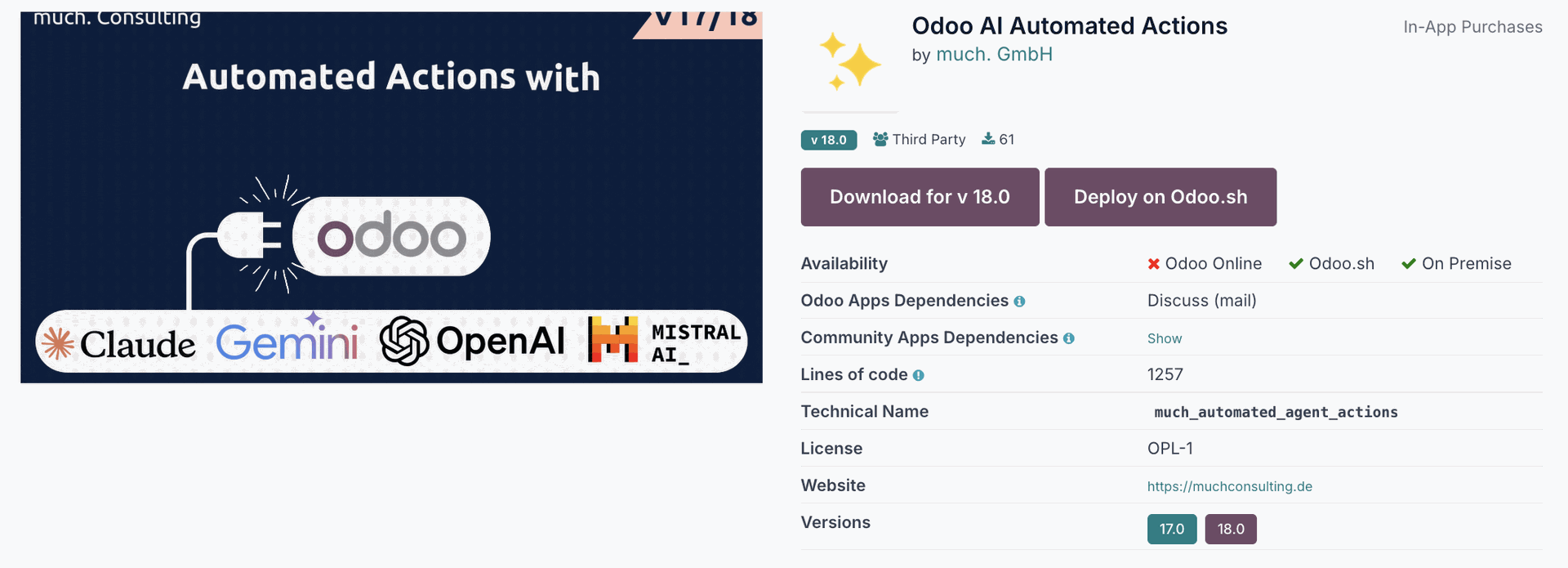

much. Consulting launched an AI app for Automated Actions in Odoo

Odoo AI Automated Actions builds on Odoo’s native AI features by automating real tasks using your data and chatter.

It supports Odoo 17 and 18 and connects with OpenAI, Gemini, Claude, and Mistral. Use it to validate invoices, enrich leads, screen CVs, draft replies, and summarise projects

Pricing & hosting options

Here’s how both tools compare in terms of pricing, user limits, hosting, and scope beyond accounting.

Platform | Pricing | User Cap | Hosting | Scope beyond accounting |

Odoo | ~£25–30/mo | Unlimited | SaaS or self-hosted | Inventory, Manufacturing, CRM, HR, etc. out of the box |

QuickBooks Online Essentials | £33/mo (£16.50/mo for the first 6 months) | 3 | SaaS only | Expenses, Payroll (add-on) |

In a nutshell:

Odoo includes more apps in the same licence, giving you an ERP-grade setup from day one.

QuickBooks focuses solely on accounting and requires extra tools and integrations to extend or connect with operational workflows.

When to choose Odoo and when to choose QuickBooks

The best tool depends on how far your accounting needs to go and how closely it connects to the rest of your business.

Choose Odoo if…

You run multiple entities or need EU-wide VAT support.

You want built-in automation (deferred revenue, OCR, KPIs).

You plan to scale into inventory, HR, CRM or subscriptions.

You want to consolidate finance with the rest of your business.

Choose QuickBooks if…

You’re an SME with standard UK compliance needs.

You want a low-friction, out-of-the-box accounting tool.

You don’t need deep customisation or AP/AR automation.

You prefer to keep accounting separate from operations.

Reach out & upgrade your accounting setup with Odoo

Odoo Accounting goes beyond the basics.

It provides built-in automation, full UK/EU compliance, and real-time group reporting on a platform that scales with your business.