Growing a business from within isn’t easy.

Organic growth takes time, discipline, and often a level of market predictability that’s hard to maintain. While it offers long-term stability, it rarely delivers the kind of acceleration investors look for.

That’s why private equity often takes a different route. Buy-and-build is one of the most widely used strategies to scale fast.

You start with a platform company, then add a series of smaller players. The logic is clear: grow by acquiring, then integrate to extract value.

However, this is where most strategies lose momentum.

Each acquisition brings new systems, new processes, and new reporting challenges. The value is there, but only if the operations can keep up.

That’s where Odoo comes in. It offers a modular ERP system that matches the rhythm of acquisition and is made to scale.

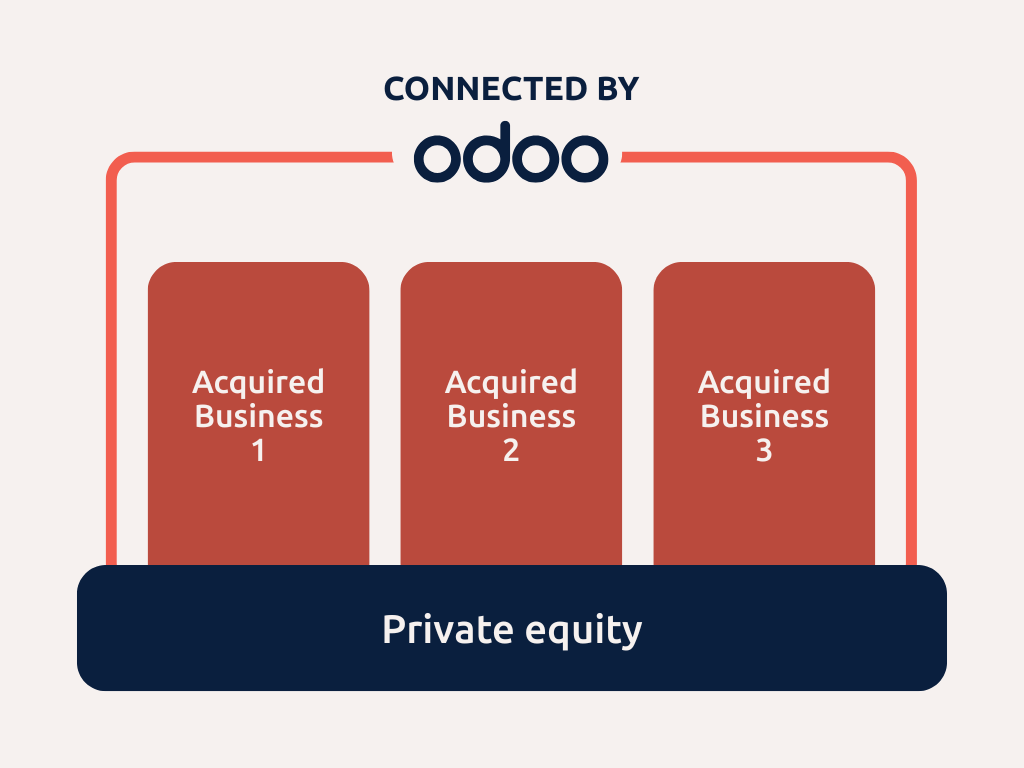

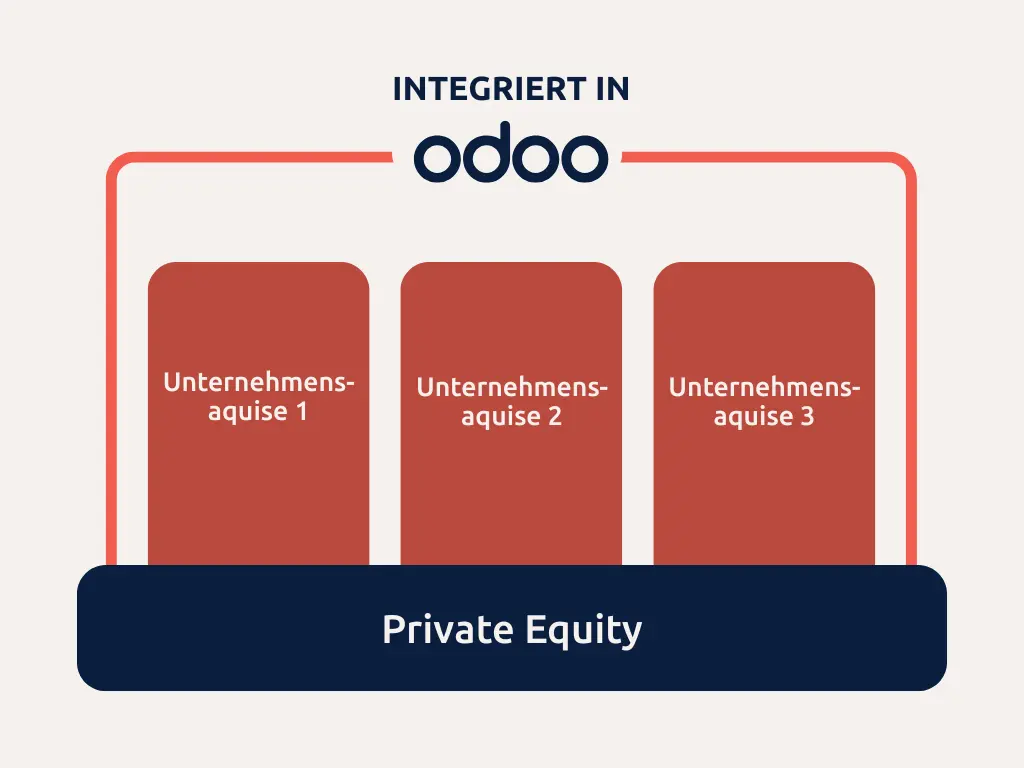

Odoo supports buy-and-build strategies by unifying multiple acquisitions into one main system

Buy-and-build needs a flexible system like Odoo

The idea behind buy-and-build is simple in theory: acquire, add, and consolidate.

Every acquisition adds systems, processes, and complexity. The challenge is to connect it all fast, without freezing the business or inflating costs.

That’s where Odoo fits.

It’s a modular ERP system that supports growth from day one.

You can roll out core apps early, connect companies gradually, and define exactly what each user sees and does. Standard processes, custom workflows, and cross-entity reporting all work side by side.

6 reasons why Odoo is made for buy-and-build

Here are six ways Odoo fits the realities of acquisition-led growth across different teams, tools, and timelines.

1. Odoo avoids digital complexity & tool zoos

Acquisition goes hand in hand with tool zoos.

One company uses Excel. Another runs an ageing on-premise system. A third patched together cloud apps with no integration.

Each company is used to working in isolation until it joins a portfolio.

Odoo adapts to that reality. It supports separate or shared databases. Multi-company flows work out of the box across entities. Teams can use the same set of apps or entirely different ones, all within the same system.

Odoo covers all key areas with standard apps, such as:

- Accounting

- CRM & Sales

- Inventory

- Purchasing

- Subscriptions

- HR Management

- Expenses.

You don’t need to separate or clean everything up before you start. The system handles variation and complexity from the outset.

2. Odoo goes live fast, customisations can be phased in later

With Odoo, fast rollout doesn’t require deep integration or custom development.

You can quickly launch core Odoo apps like Accounting, CRM, Sales or Inventory using only Odoo’s standard features. That gives each company a working setup from day one.

More advanced needs like custom workflows, integrations, or secondary apps can follow in later phases.

This phased approach means that companies can start working in Odoo early, while leaving room to adapt the system later.

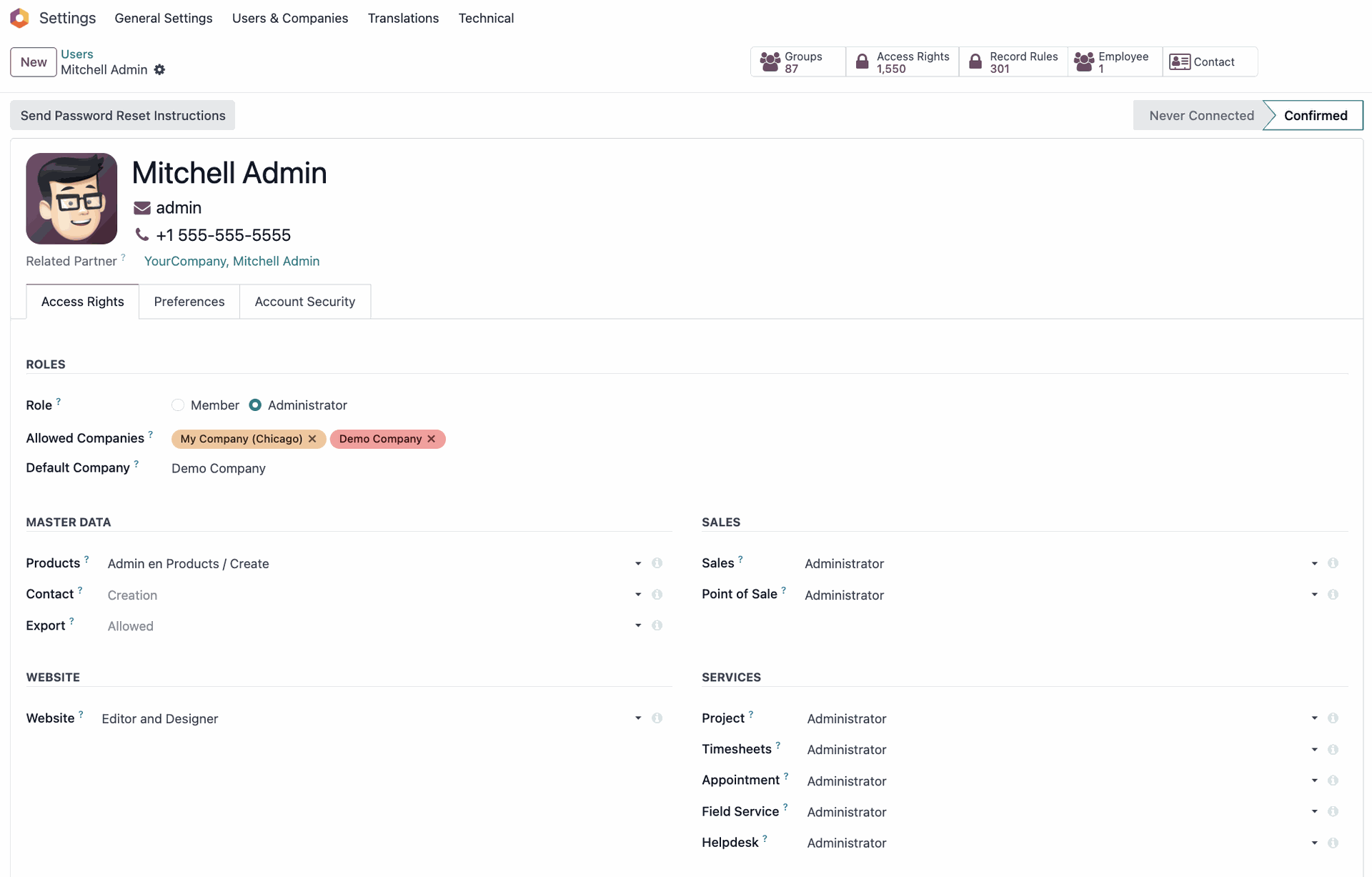

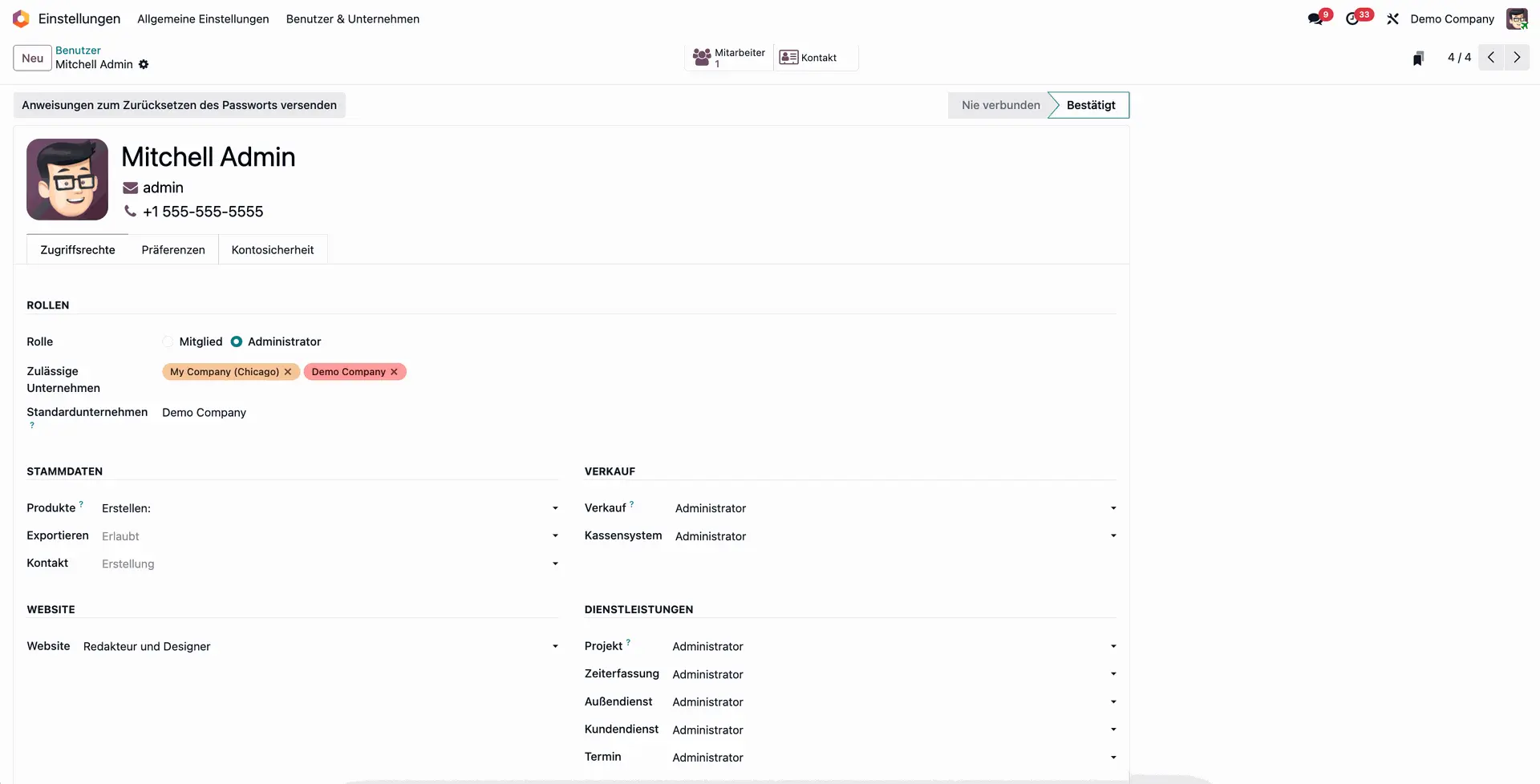

3. Odoo gives users access to their own company, apps & tasks

In buy-and-build strategies, not every employee is allowed to work across the whole group.

Roles and needed features vary, and permissions to access these need to follow suit.

Odoo lets you define exactly what each user can see and do based on their company, department, and responsibility.

This means that users can only access the apps they need. They only see the data from the company they work in. And they only execute the processes they’re responsible for.

Here are some examples on how Odoo functions for different users across a multi-entity setup:

- Sales teams in acquired companies only see their own leads and customers

- Finance staff in the group HQ manage Accounting across all companies

- HR managers see employees, timesheets, and leaves, but only in their own entity

- Warehouse staff have access to Inventory and Purchasing and nothing else.

Managing user accesses in a multi-company Odoo, from an Administrator view.

4. Odoo reporting gives you group-wide visibility from day one

Standardising processes takes time, but getting visibility over acquired companies shouldn’t.

Odoo gives portfolio managers and finance leads access to consistent reporting structures, even when companies use different apps.

You can track:

- Group revenue and margin by entity

- Operating costs across countries or verticals

- Inter-company flows

- Accounts Payable and Accounts Receivable in one dashboard.

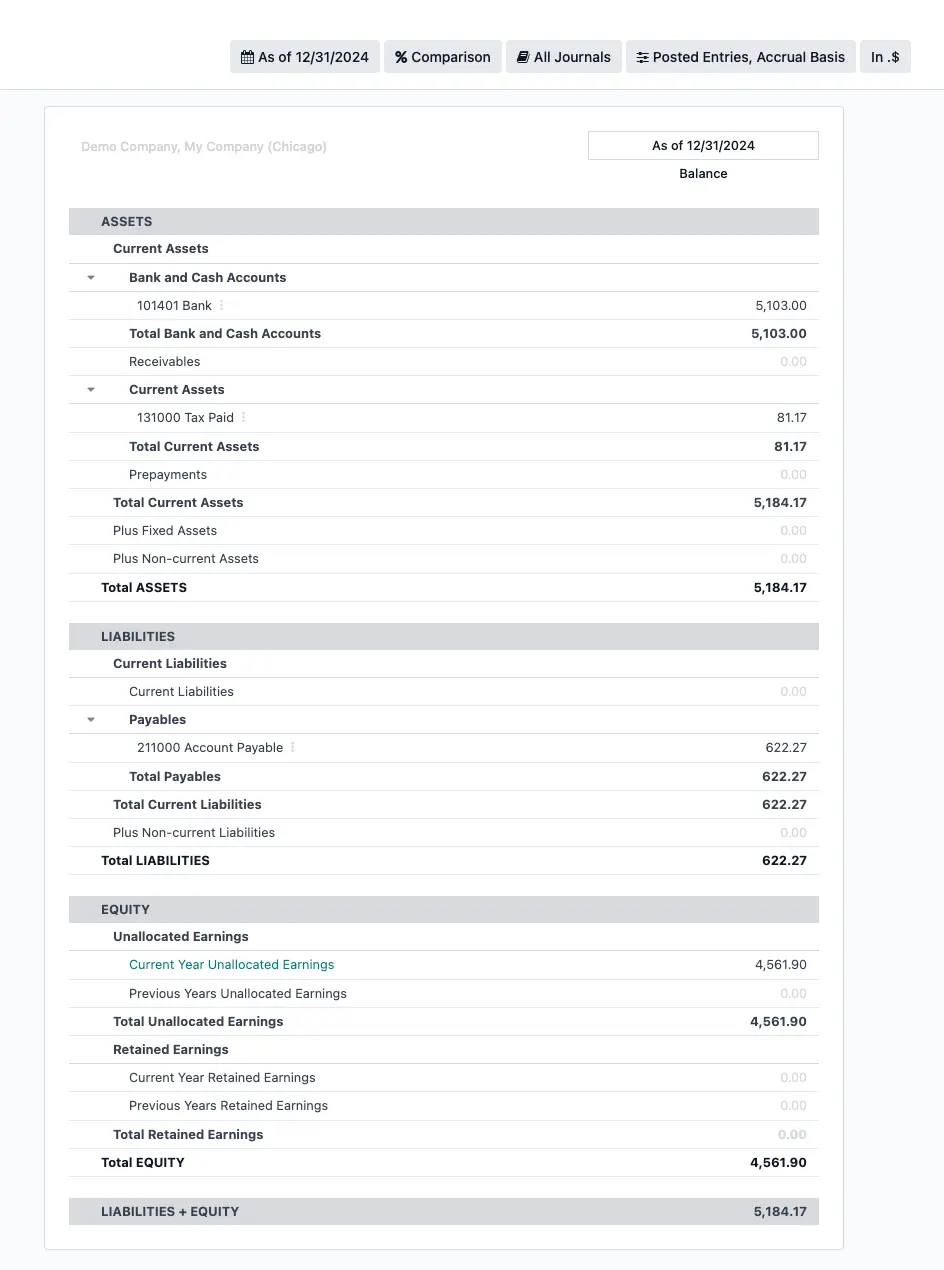

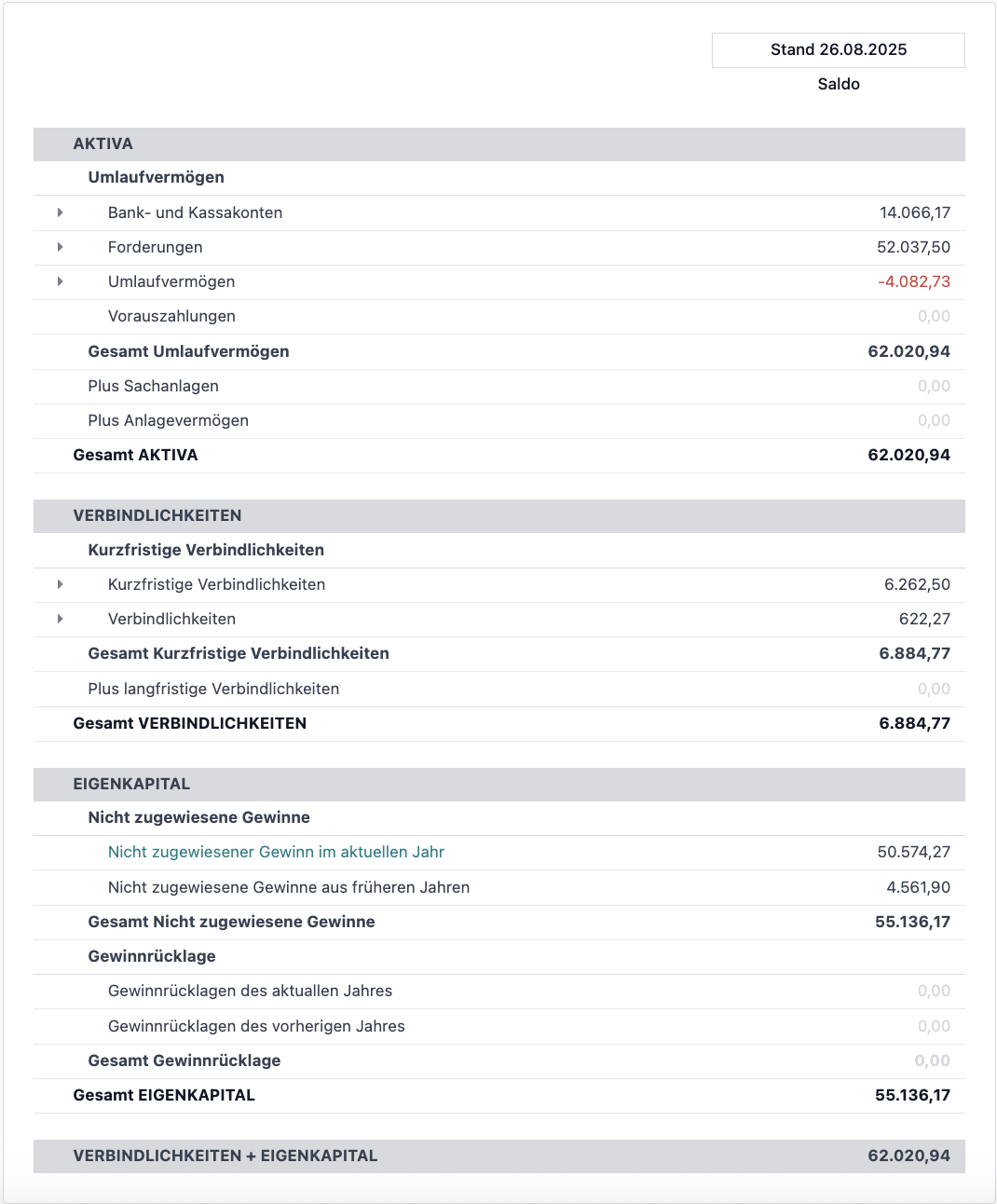

On top of that, consolidated reports are available out of the box. Group P&Ls and balance sheets pull data from all company instances.

You can filter results by entity, compare across subsidiaries, or drill down into specific business units, all within the same report.

Reports can be seen within each Odoo app, custom-built in Odoo Dashboards, or exported to external BI tools. All without having to wait for full organisational consolidation.

Consolidated Balance Sheet report from a multi-company Odoo Accounting setup.

5. Odoo facilitates compliance with EU law

Buy-and-build strategies often involve a carve-out or sale.

Under EU merger regulations, companies typically have six months to complete divestments (e.g. carve-out) during the initial phase, with an optional additional three‑month trustee period if needed.

This makes it critical that companies have clear data separation, as buyers expect operational transparency when walking into a deal.

Odoo is open-source, which means the full database can be exported at any time. You retain full control over your data and workflows, without being tied to a proprietary system.

Depending on your setup, custom developments can be fully owned and documented, so no features or processes get lost during a handover.

There’s no rigid licensing model and no artificial limits on companies, users, or apps.

This keeps the system flexible right through to the exit:

- Full data export is available at all times

- No proprietary architecture or black-box components

- Ownership of custom code (but beware of some partner conditions, as they may used locked files)

- Easy rebranding, spin-offs, and carve-outs.

With Odoo, your ERP doesn’t become a blocker during exit planning. It adds value by keeping everything transparent and easy to transfer.

6. Odoo keeps your operational costs low as you scale

Buy-and-build projects span over years, and so do ERP costs.

With Odoo, you avoid increased licensing fees that come with scaling and integration costs that come with legacy systems.

New entities don’t add new price tiers. There’s no per-app vendor markup. And because the platform is modular, you only pay for what you use.

Over 10 years, Odoo keeps the total cost of ownership low:

- No extra costs for new subsidiaries or users

- One provider across finance, sales, and operations

- Fewer tools to license and connect

- Minimal maintenance and upgrade costs.

That translates into a clear ROI: lower operational spend, fewer hidden costs, and more value added across the lifecycle of your buy-and-build strategy

With Odoo, private equities with a buy-and-build strategy don’t just get faster rollout and better inter-company alignment. They get better margins, too.

Odoo supports common growth strategies for private equity

Private equity deals move fast, and ERP setups often decide how quickly value can be created post-deal.

In Buy & Build cases, new portfolio companies need to be integrated without disrupting day-to-day business, while carve-outs demand standalone systems that can go live in just a few months.

Odoo’s modular structure makes both possible: core apps can be rolled out in weeks, group-wide reporting is available from day one, and each company instance adapts to local rules without slowing down consolidation.

This combination of speed and flexibility is why Odoo fits the realities of private equity better than traditional ERP systems.

Need Odoo for your private equity buy-and-build strategy?

We’re an Odoo Gold Partner with experience in implementing modular ERP setups across investment portfolios, including fund structures, consolidation, and cross-entity operations.

If you're planning your next acquisition or need a clearer ERP system setup, our Odoo experts are here to help.