Ein Unternehmen organisch zu entwickeln, erfordert Zeit, Disziplin und stabile Marktbedingungen.

Diese Form des Wachstums sorgt zwar für langfristige Sicherheit, bietet jedoch selten die Geschwindigkeit, die Investoren erwarten.

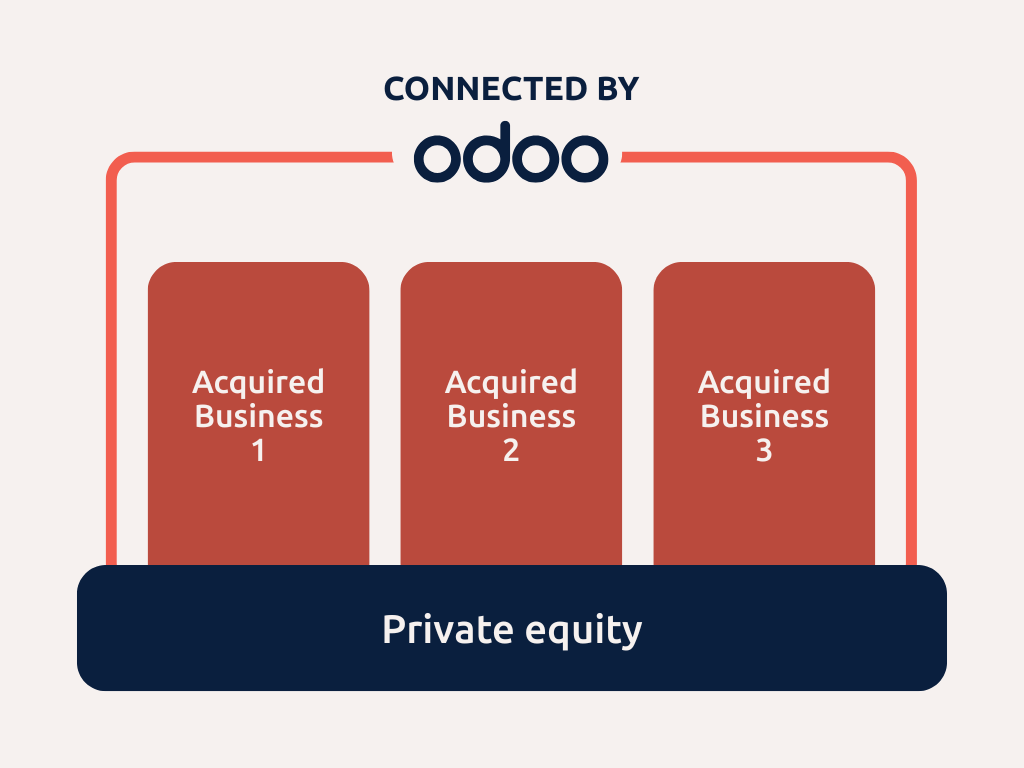

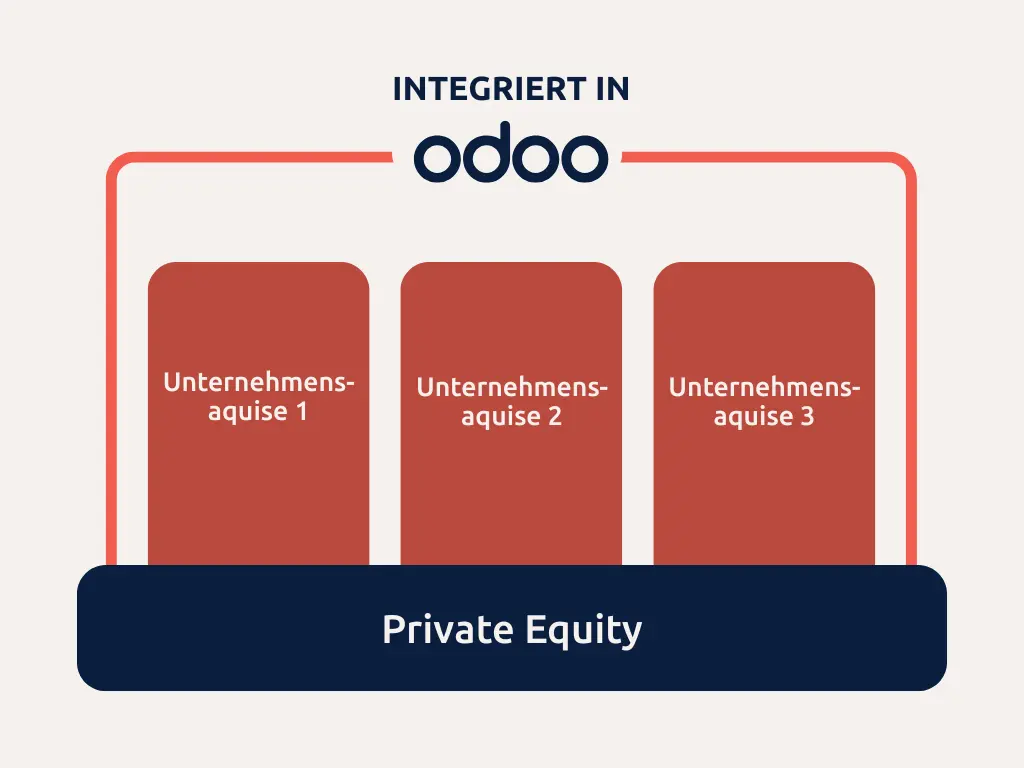

Private-Equity-Investoren setzen deshalb häufig auf einen anderen Ansatz: Buy-and-Build. Dabei startet man mit einem Plattform-Unternehmen und ergänzt es Schritt für Schritt durch Zukäufe. Das Prinzip: kaufen, integrieren, Wert steigern.

In der Praxis stößt dieses Modell jedoch schnell an Grenzen.

Jede Übernahme bringt eigene Systeme, Prozesse und Reporting-Anforderungen mit. Der Mehrwert entsteht nur, wenn es gelingt, alles effizient zusammenzuführen.

Genau hier kommt Odoo ins Spiel.

Das modulare ERP wächst mit jeder Übernahme mit und passt sich flexibel an. Zukäufe werden in einem zentralen System vereint, ohne Tempoverlust.

Odoo unterstützt Buy-and-Build-Strategien, indem es zugekaufte Unternehmen in einem zentralen System vereint.

Inhalt

Erfolgsfaktor Systemflexibilität

6 Arten, wie Odoo Buy-and-Build unterstützt

1. Odoo verhindert digitalen Wildwuchs

2. Odoo ermöglicht schnellen Go-live

3. Odoo erlaubt präzise Steuerung von Zugriffsrechten

4. Odoo liefert konsolidiertes Reporting

5. Odoo erleichtert die Erfüllung von EU-Vorgaben

6. Odoo hält operative Kosten niedrig

Odoo unterstützt gängige Wachstumsstrategien im Private Equity

Erfolgsfaktor Systemflexibilität

Die Idee hinter Buy-and-Build ist einfach: kaufen, hinzufügen, konsolidieren.

Die Realität sieht anders aus: Jede Übernahme bringt neue Systeme, Prozesse und Komplexität.

Die Herausforderung liegt darin, alles schnell zu verbinden, ohne das Tagesgeschäft auszubremsen oder Kosten ausufern zu lassen.

Odoo begegnet dieser Herausforderung von Anfang an.

Kern-Apps können sofort genutzt werden, weitere Funktionen lassen sich später ergänzen. Gleichzeitig bleibt klar definiert, welche Nutzer welche Daten sehen dürfen.

6 Arten, wie Odoo Buy-and-Build unterstützt

Hier sind sechs Gründe, warum Odoo optimal für akquisitionsgetriebene Wachstum-Strategien ist:

1. Odoo verhindert digitalen Wildwuchs

Jede Akquisition bringt unterschiedliche Systeme mit sich:

Excel-Tabellen hier, ein altes On-Premise-System dort, dazu eine zusammengewürfelte Sammlung von Cloud-Apps. Schnell entsteht ein Flickenteppich, der Prozesse bremst und Kosten erhöht.

Odoo passt sich dieser Realität an.

Mehrere Datenbanken können separat oder gemeinsam laufen, Multi-Company-Prozesse sind standardmäßig integriert. Teams arbeiten in einem System – mit denselben oder unterschiedlichen Apps.

Standard-Apps decken Kernbereiche ab wie:

- Buchhaltung

- CRM & Vertrieb

- Lager

- Einkauf

- Abonnements

- Personalverwaltung

- Spesen.

So wird Vielfalt handhabbar, ohne dass alles zuerst „aufgeräumt“ werden muss.

2. Odoo ermöglicht einen schnellen Go-live

Buy-and-Build erfordert Geschwindigkeit.

Statt monatelanger Vorbereitungen können Unternehmen mit Odoo sofort starten.

Kern-Apps wie Buchhaltung, CRM, Vertrieb oder Lager stehen direkt einsatzbereit zur Verfügung.

Erweiterte Integrationen, individuelle Entwicklungen oder zusätzliche Apps lassen sich schrittweise nachziehen. So erhält jede Gesellschaft ab Tag eins ein funktionierendes Setup.

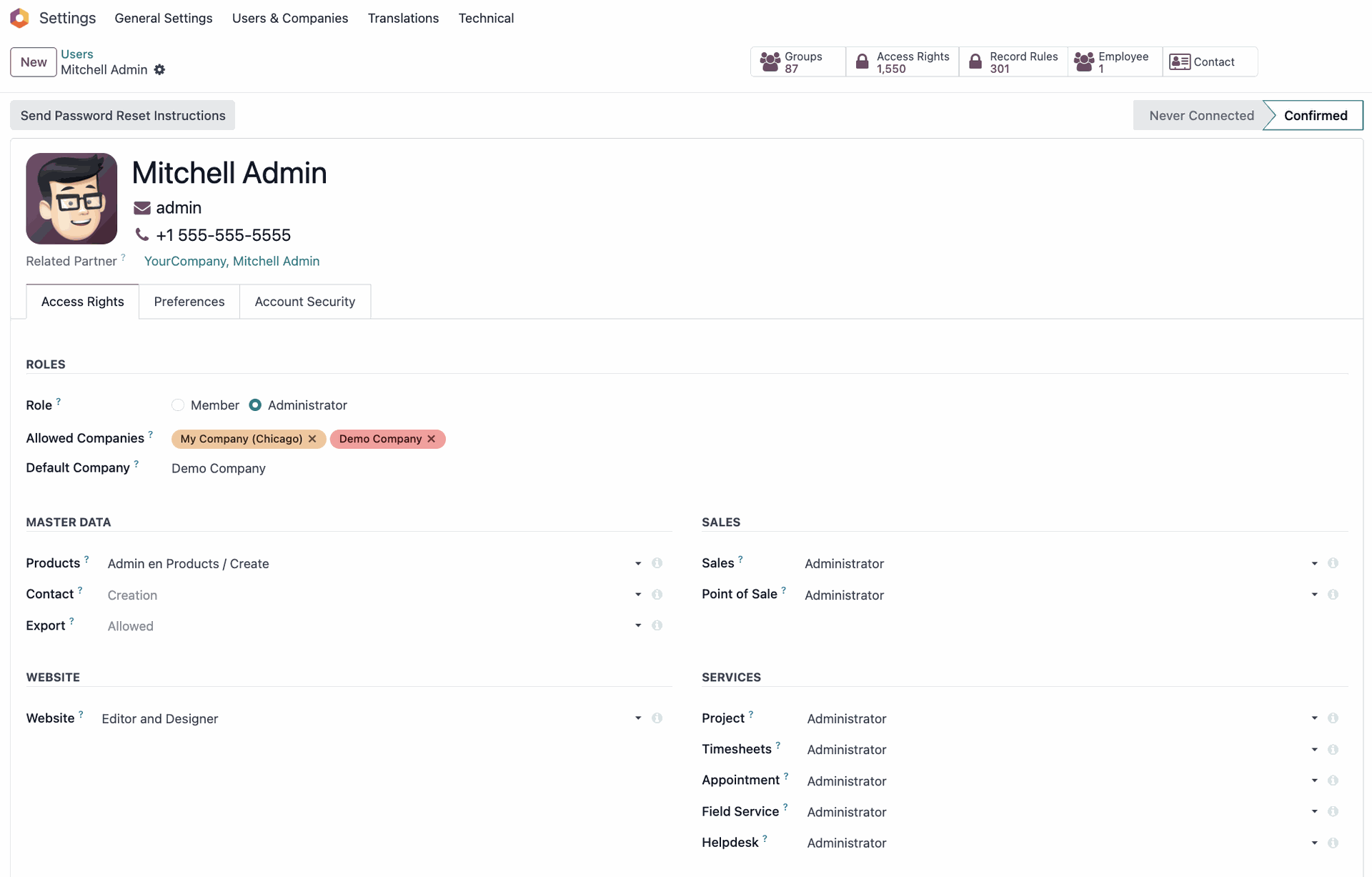

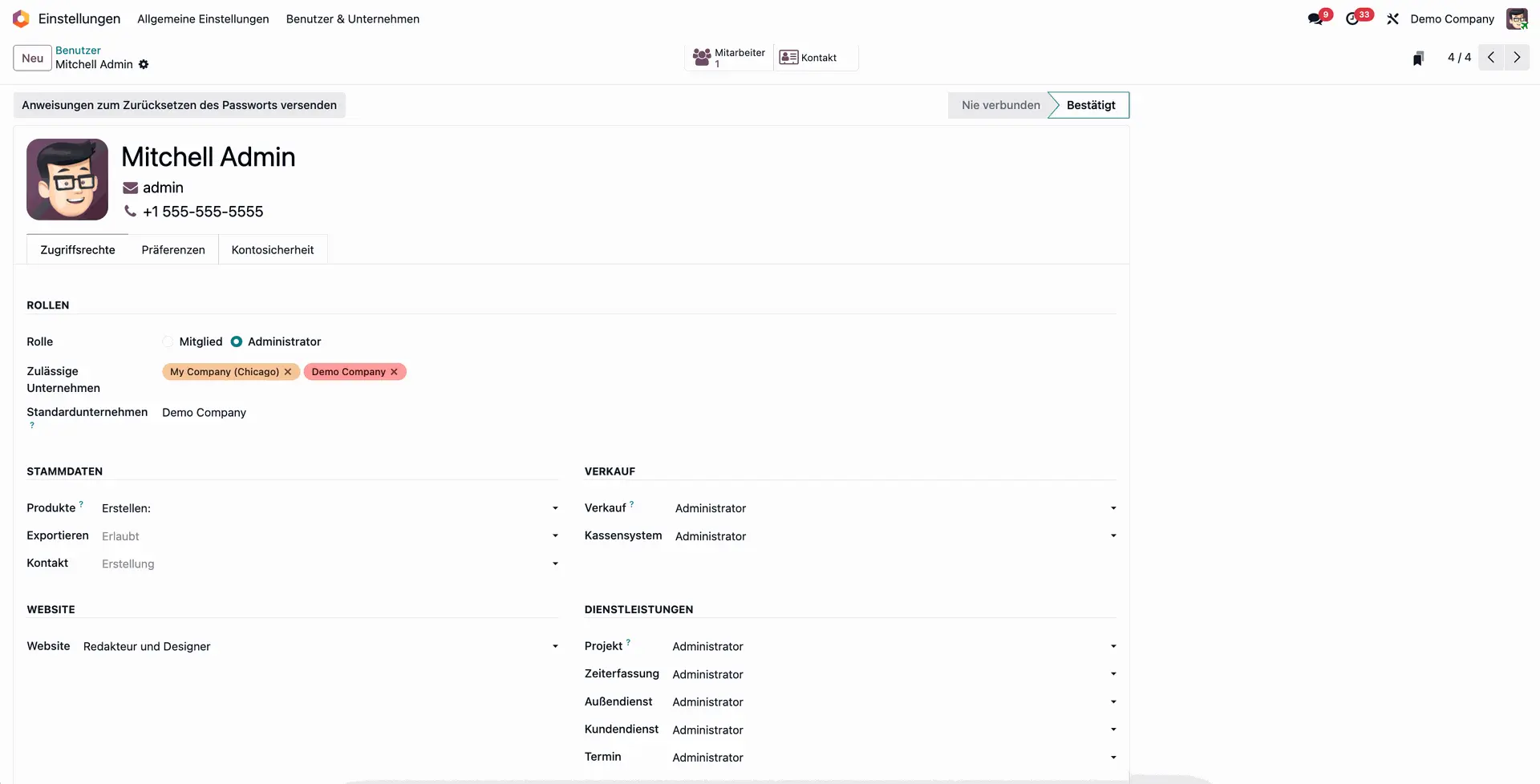

3. Odoo erlaubt präzise Steuerung von Zugriffsrechten

In Buy-and-Build-Strategien darf üblicherweise nicht jeder Mitarbeiter im gesamten Konzern arbeiten.

Rollen und benötigte Funktionen unterscheiden sich, und die Zugriffsrechte müssen entsprechend angepasst werden.

Mit Odoo lässt sich genau festlegen, was jeder Nutzer sehen und tun darf, abhängig von Gesellschaft, Abteilung und Verantwortung..

Das bedeutet: Nutzer greifen nur auf die Apps zu, die sie tatsächlich brauchen. Sie sehen ausschließlich die Daten der Gesellschaft, in der sie arbeiten. Und sie führen nur die Prozesse aus, für die sie zuständig sind.

Beispiele:

- Die Vertriebsteams sollen nur die jeweils eigenen Leads und Kunden sehen.

- Finanzmitarbeiter in der Konzernzentrale brauchen Zugriff zur Buchhaltung aller Gesellschaften für den Jahresabschluss.

- Die jeweilige Personalabteilung soll nur die Mitarbeiter der eigenen Einheit sehen.

- Die Lagerteams sollen nur Zugriff auf Lager- & Einkauf-Daten erhalten.

Verwaltung von Benutzerzugriffen in einem Odoo-System mit mehreren Unternehmen aus Sicht eines Administrators.

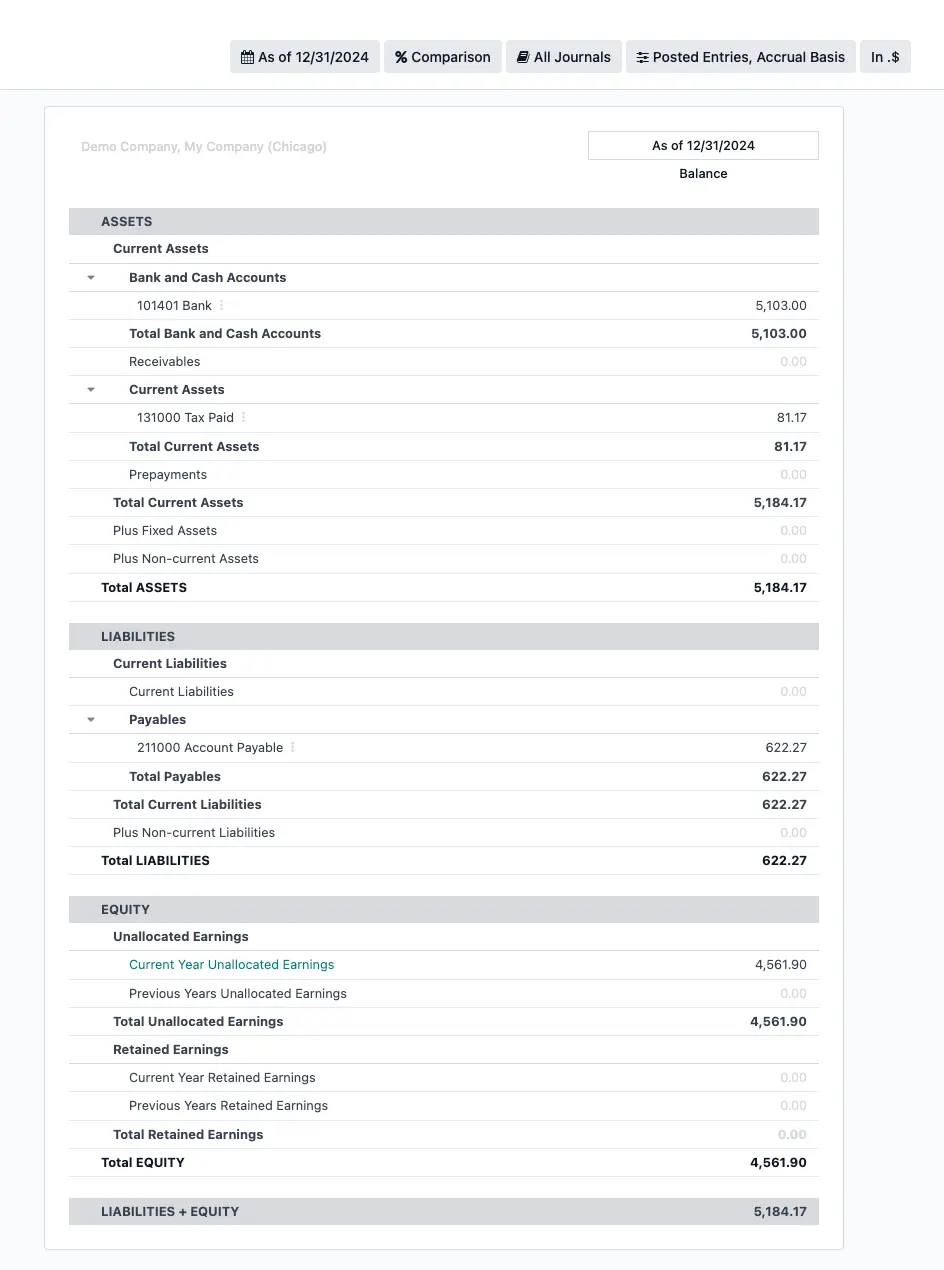

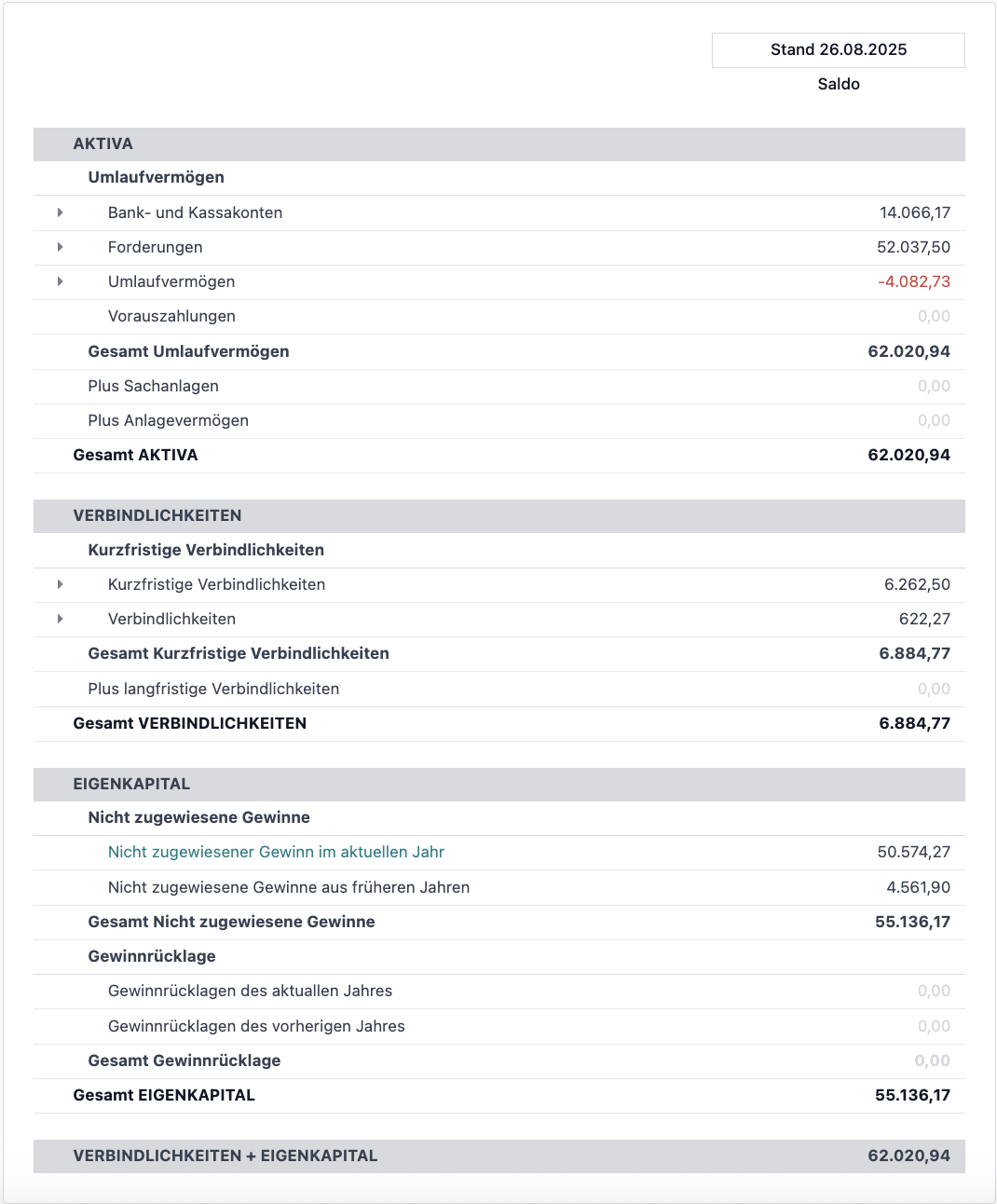

4. Odoo liefert konsolidiertes Reporting

Standardisierung braucht Zeit, doch Reporting darf nicht warten.

Odoo liefert sofort konsistente Bericht-Strukturen, auch wenn unterschiedliche Apps in den Einzelunternehmen verwendet werden.

Wichtige Kennzahlen wie:

- Umsatz und Marge der jeweiligen Gesellschaft,

- Betriebskosten nach Ländern oder Sparten,

- Intercompany-Prozesse,

- Kreditoren und Debitoren in einem Dashboard

lassen sich zentral verfolgen.

Konsolidierte Bilanzen und GuV-Berichte stehen standardmäßig bereit.

Berichte können in jeder Odoo-App angezeigt, in Odoo-Dashboards individuell angepasst oder in externe BI-Tools exportiert werden. Alles ohne auf die vollständige Konsolidierung der Organisation warten zu müssen.

Konsolidierter Bilanzbericht aus einem Multi-Company-Odoo- Buchhaltungssetup.

5. Odoo erleichtert die Erfüllung von EU-Vorgaben

Zu Buy-and-Build-Strategien gehören oft auch Carve-outs oder Firmenverkäufe.

Nach EU-Fusionsrechtmüssen diese in der Regel innerhalb von sechs Monaten abgeschlossen sein.

Das setzt eine saubere Trennung der Daten voraus.

Odoo ist Open Source. Das bedeutet, die gesamte Datenbank kann jederzeit exportiert werden. Unternehmen behalten die volle Kontrolle über ihre Daten und Workflows, ohne an ein proprietäres System gebunden zu sein.

Je nach Setup können individuelle Entwicklungen vollständig im Besitz des Unternehmens bleiben und sauber dokumentiert werden. So gehen bei einer Übergabe keine Funktionen oder Prozesse verloren.

Es gibt kein starres Lizenzmodell und keine künstlichen Limits für Gesellschaften, Nutzer oder Apps.

Damit bleibt Odoo auch im Exit flexibel:

- Ein vollständiger Datenexport ist jederzeit möglich

- Keine proprietäre Architektur und keine Black-Box-Komponenten

- Eigenentwicklungen können im Besitz des Unternehmens bleiben (Achtung: manche Partner verwenden geschützte Dateien)

- Rebranding, Spin-offs oder Carve-outs lassen sich einfach umsetzen.

Mit Odoo wird das ERP nicht zum Hindernis bei der Exit-Planung. Im Gegenteil: Es schafft Mehrwert, weil alles transparent und leicht übertragbar bleibt.

6. Odoo hält operative Kosten niedrig

Buy-and-Build-Stragien laufen über Jahre und ERP-Kosten ebenso.

Mit Odoo entfallen steigende Lizenzgebühren und Integrationskosten.

Für neue Unternehmen fallen keine zusätzlichen Kosten an. Es gibt keinen Aufschlag pro App. Und da die Plattform modular aufgebaut ist, zahlen Sie nur für das, was Sie tatsächlich nutzen.

So bleiben die Gesamtbetriebskosten für Odoo über eine Laufzeit von 10 Jahren niedrig:

- Keine Zusatzkosten für neue Firmen oder Nutzer.

- Ein Preis für Finanzen-, Vertrieb- und Betriebs-Systeme.

- Weniger Tools, die lizenziert und integriert werden müssen.

- Geringe Wartungs- und Upgrade-Kosten.

Daraus ergibt sich ein klarer ROI: geringere Betriebsausgaben, weniger versteckte Kosten und mehr Wertschöpfung über den gesamten Lebenszyklus Ihrer Buy-and-Build-Strategie hinweg.

Mit Odoo profitieren Private-Equity-Unternehmen mit einer Buy-and-Build-Strategie nicht nur von einer schnelleren Einführung und einer besseren Abstimmung zwischen den Unternehmen. Sie erzielen auch bessere Margen.

Odoo unterstützt gängige Wachstumsstrategien im Private Equity

Private-Equity-Deals verlaufen schnell, und oft entscheidet das ERP-System darüber, wie rasch nach einem Abschluss Wert geschaffen werden kann.

Im Buy-and-Build-Ansatz müssen neue Portfoliounternehmen integriert werden, ohne das Tagesgeschäft zu stören. Carve-outs erfordern dagegen eigenständige Systeme, die innerhalb weniger Monate live gehen können.

Die modulare Struktur von Odoo ermöglicht beides. Kern-Apps lassen sich innerhalb weniger Wochen ausrollen, gruppenweite Reports stehen ab dem ersten Tag bereit, und jede Gesellschaftsinstanz berücksichtigt lokale Anforderungen, ohne die Konsolidierung auszubremsen.

Diese Kombination aus Geschwindigkeit und Flexibilität macht Odoo für Private Equity zur besseren Lösung als traditionelle ERP-Systeme.

Noch Fragen? Sprechen Sie mit uns!

Wir sind ein Odoo Gold Partner mit Erfahrung in der Implementierung modularer Odoo-Setups für Investmentportfolios, einschließlich Fondsstrukturen, Konsolidierung und unternehmensübergreifenden Operationen.

Wenn Sie Ihre nächste Akquisition planen oder ein übersichtlicheres ERP-System benötigen, stehen Ihnen unsere Odoo-Experten gerne zur Verfügung.