Odoo makes it easy for companies, customers, and employees to pay and get paid.

Many payment methods are integrated into the system across all applications, like Accounting, POS, Expenses, Sales, and more.

We break down how Odoo connects payments to all apps, what the main methods and provider options are, and how they enable purchase flows.

Odoo lets you pay with various methods across different apps

Odoo supports a wide range of payment methods, depending on the app and configuration you may need:

In Sales & Website (eCommerce, Subscriptions, etc.), you can…

- Do online card payments through providers (Adyen, Authorize.Net, Razorpay, Stripe, Xendit, etc.)

- Set up wallets / one-click payments with Apple Pay and Google Pay (Stripe, Worldline, Flutterwave)

- Set up recurring payments using tokenisation for saved methods

- Establish manual capture for authorise-now, capture-later flows (where supported)

- Set up online down payments in Odoo 19.

In Accounting & Invoicing, you can…

- Conduct bank transfers such as wire transfer and SEPA Direct Debit

- Process online payments for invoices via integrated providers

- Invoice online payments directly via Pay Now in the Customer Portal

- Issue full or partial refunds where supported

- Manage reimbursements and payouts via configured payment journals.

In Point of Sale (POS), you can…

- Set up cash payments via a Cash journal

- Set up card payments via a Bank journal and connected payment terminal

- Connect terminal integrations with Adyen, Ingenico, Mercado Pago, QFPay, Razorpay, SIX, Stripe, Tyro, Viva.com, Worldline, etc.

- Set up customer restrictions, where you allow a certain payment method only for identified customers.

In Expenses, you can…

- Record and reimburse cash expenses through Accounting

- Register and import card expenses

- Set up Odoo Expenses cards for your employees to enable real-time expense capture.

In Purchase, you can…

- Pay supplier bills from Accounting using the company’s bank/transfer methods aligned with the localisation and bank journals

- Define where payment methods are allowed, i.e. online payment providers are designed for customer payments; POS terminals are for in-person sales.

What are all the methods you can pay with & expense in Odoo?

Out of the box, Odoo connects with various payment methods that can cover both internal and external flows.

eCommerce payment methods

Odoo includes a wide range of built-in payment providers to support online sales, invoices, and subscriptions.

These connectors make it possible to accept local and international payments directly in your eCommerce checkout or customer portal.

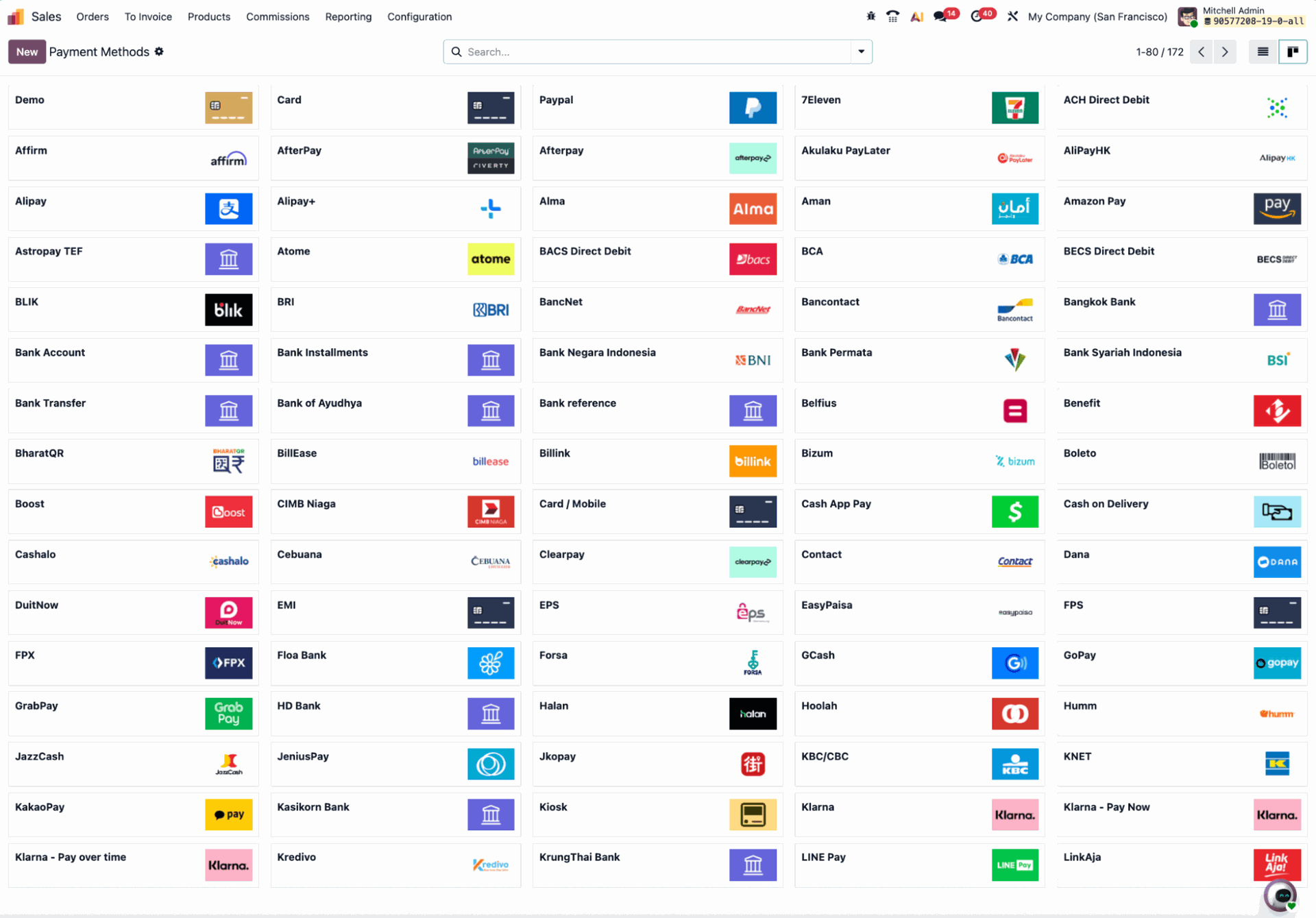

Some of the payment methods available in Odoo 19.

Odoo offers a wide range of payment connectors out of the box (170+ in total), and generally, you can find the payment method you need.

However, if you choose to use a payment method that isn’t available, Odoo’s open-source nature lets you easily connect to whichever method you may want via API.

Banks

Odoo connects directly to your bank accounts through bank synchronisation, allowing you to automatically import and reconcile transactions.

Using connectors like Plaid, Yodlee, and Enable Banking, Odoo supports thousands of financial institutions worldwide.

Once a bank is connected, statements are fetched automatically into Odoo.

This keeps balances up-to-date and reconciliation accurate across all journals without the need for manual imports. Odoo lets you choose from different reconciliation models, including different matching fields.

Bank synchronisation can be configured from the Accounting dashboard, where each bank account is represented by its own journal.

For regions or institutions that don’t support live feeds, Odoo also supports manual uploads via CSV, OFX, or CAMT files, maintaining flexibility for all banking environments.

Bank transfers (SEPA, BACS, Wire Transfer)

Odoo supports SEPA, BACS, and Wire Transfers for both outgoing and incoming payments.

These methods are configured within Accounting as payment methods linked to a Bank journal, meaning that companies can manage electronic transfers in line with local banking standards:

- SEPA (EU) allows exporting XML payment files for direct upload to your bank, simplifying euro-denominated transfers and recurring debits

- BACS (UK) supports batch payments for suppliers in the British banking network

- Wire Transfers act as universal manual payments and are available globally as part of Odoo’s default payment provider list.

For incoming transfers, Odoo automatically matches bank statement lines to open invoices or bills using reconciliation rules.

For outgoing payments, batch files can be generated directly from the Payments dashboard for upload to your banking portal.

Checks

While less common in digital-first businesses, Odoo still supports check payments as a manual payment method. This is especially relevant in markets like the US, where checks are still used to pay vendor bills.

Checks can be recorded directly from an invoice or bill, moving the payment amount from an Outstanding Receipts or Outstanding Payments account into the appropriate Bank journal once cleared.

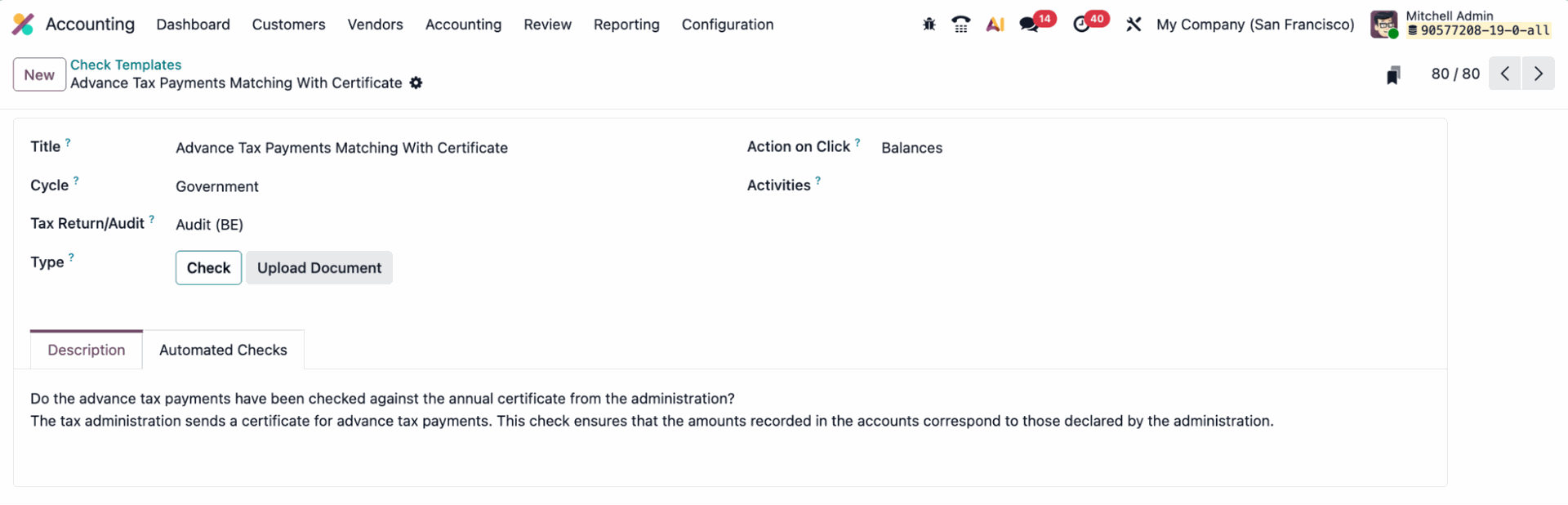

Check template in Odoo 19.

The system tracks each check’s status (received, deposited, or cleared), which guarantees full traceability within Accounting.

You can also bypass reconciliation steps if your company’s process marks the payment as cleared immediately upon deposit.

This flexibility makes Odoo suitable for organisations operating in mixed payment environments, where digital and manual methods coexist.

Cash

Cash remains a flexible payment method in Odoo, supporting both customer-facing and internal transactions.

- In Point of Sale, cash journals handle retail or restaurant sales and are reconciled with daily closings

- In Expenses, employees can record purchases made in cash for later reimbursement through Accounting.

Invoices or receipts paid can be processed faster with Odoo’s OCR scanning features. For example, when a physical invoice paid in cash is uploaded, Odoo automatically recognises it, records it under the right Cash journal, and prepares it for reconciliation.

This combination of automation and manual control simplifies handling cash in Odoo for businesses that handle smaller transactions or reimbursements alongside digital payments.

Payment terminals for POS

For in-person sales, Odoo integrates with a wide range of payment terminals in the Point of Sale app. It connects payment software with POS terminal hardware out of the box.

Companies can accept card payments securely alongside cash transactions. Supported providers include:

- Adyen

- Ingenico

- Mercado Pago

- QFPay

- Razorpay

- SIX

- Stripe

- Tyro

- Viva.com

- Worldline.

At checkout, customers can pay via the connected terminal, and once the transaction is processed, it is automatically validated in POS.

If the connection fails, the transaction is cancelled to avoid inconsistencies.

The variety of Odoo payment methods in Point of Sale means that clients can easily pay digitally or with cash. This is ideal for retail, restaurants, and other in-person sales environments that rely on fast, reliable checkouts.

New in Odoo 19 - Odoo Expense card

The new Odoo Expense card was introduced in Odoo 19, as a collaboration with Mastercard.

Odoo Expense card, developed in collaboration with Mastercard.

It lets employees pay directly for business expenses.

Each transaction is logged automatically as an expense, with reports and accounting entries generated in real time.

This removes the need for manual expense claims and keeps a company's spending transparent.

Odoo links payment providers to the right accounting methods

Odoo payment methods are automatically tied to the correct accounting journal, be they digital or manual:

- Bank-ledger payments: Online transactions from providers like Stripe, Adyen, or SEPA transfers are automatically recorded in bank journals and reconciled with invoices or bills once confirmed

- Cash transactions: Payments made in cash or recorded in POS are logged in dedicated cash journals, ensuring every on-site sale or reimbursement is traceable

- Hybrid setups: Companies that mix online providers with cash handling can reconcile both independently, meaning that each payment type maps to its own journal, keeping the chart of accounts aligned.

This link between payment providers and bookkeeping ensures that all payment data - including all digital payments and hard cash - stays synchronised across Odoo’s Accounting, Sales, POS, and Expense apps.

Test mode lets you try Odoo payment workflows before go-live

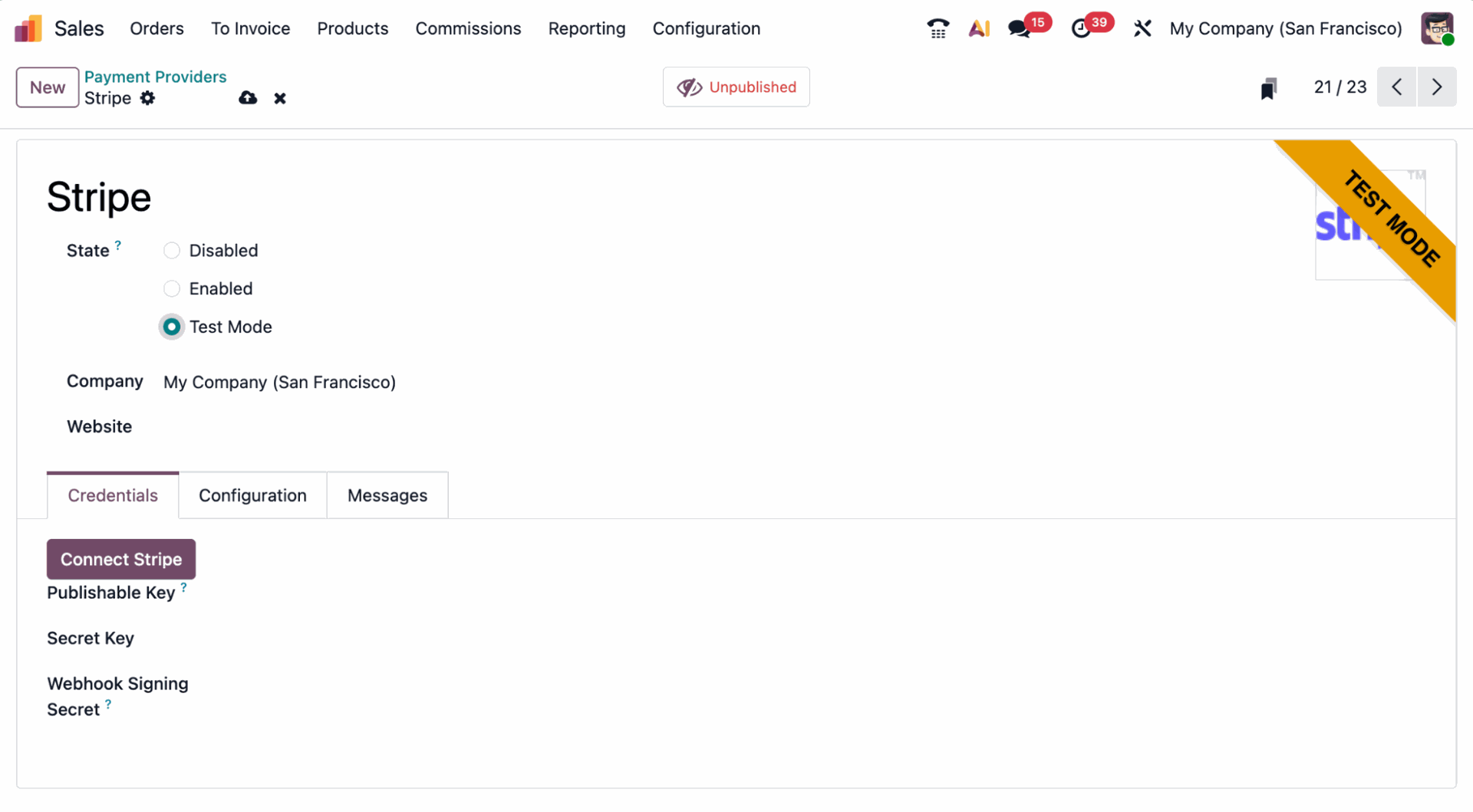

Odoo lets you connect payment providers in Test mode to safely test transactions before going live.

In this mode, you can set up your Odoo using your payment provider’s sandbox credentials instead of real ones.

This allows you to validate the full payment flow from authorisation to refund without charging customers.

To enable Test mode, set the State field of a payment provider to Test mode and enter the corresponding sandbox keys in the Credentials tab.

Setting up Stripe as a payment provider in Test mode in Odoo 19.

When a provider is in test mode, it remains unpublished by default, so it won’t appear on your website or to customers.

Odoo recommends using a duplicate or staging database for testing to prevent issues such as invoice numbering conflicts.

Test mode lets you guarantee that your payment setup, error handling, and reconciliation logic work correctly before going into production.

Odoo can be integrated with many more payment providers

Beyond the providers that come with Odoo standard, if you do not find your preferred payment methods, you can also integrate via API.

We typically have quite extensive experience in this field. For example, we developed an official PayPal module. This official extension, developed in collaboration with PayPal, adds Pay Later instalments, connects with Venmo, and enables full debit and credit card processing directly in Odoo.

Overall, Odoo lets you adapt payment flows to your exact needs, from connecting with your preferred regional provider to aligning payment methods with your customer expectations in specific markets.

Set up your payment methods in Odoo 19

We can help you configure Odoo payment methods, from online providers and POS terminals to bank transfers and expenses. Talk to our team about the right setup for your business.