Wer in Deutschland Buchhaltungslösungen für ein wachsendes Unternehmen vergleicht, kommt an Odoo und NetSuite kaum vorbei.

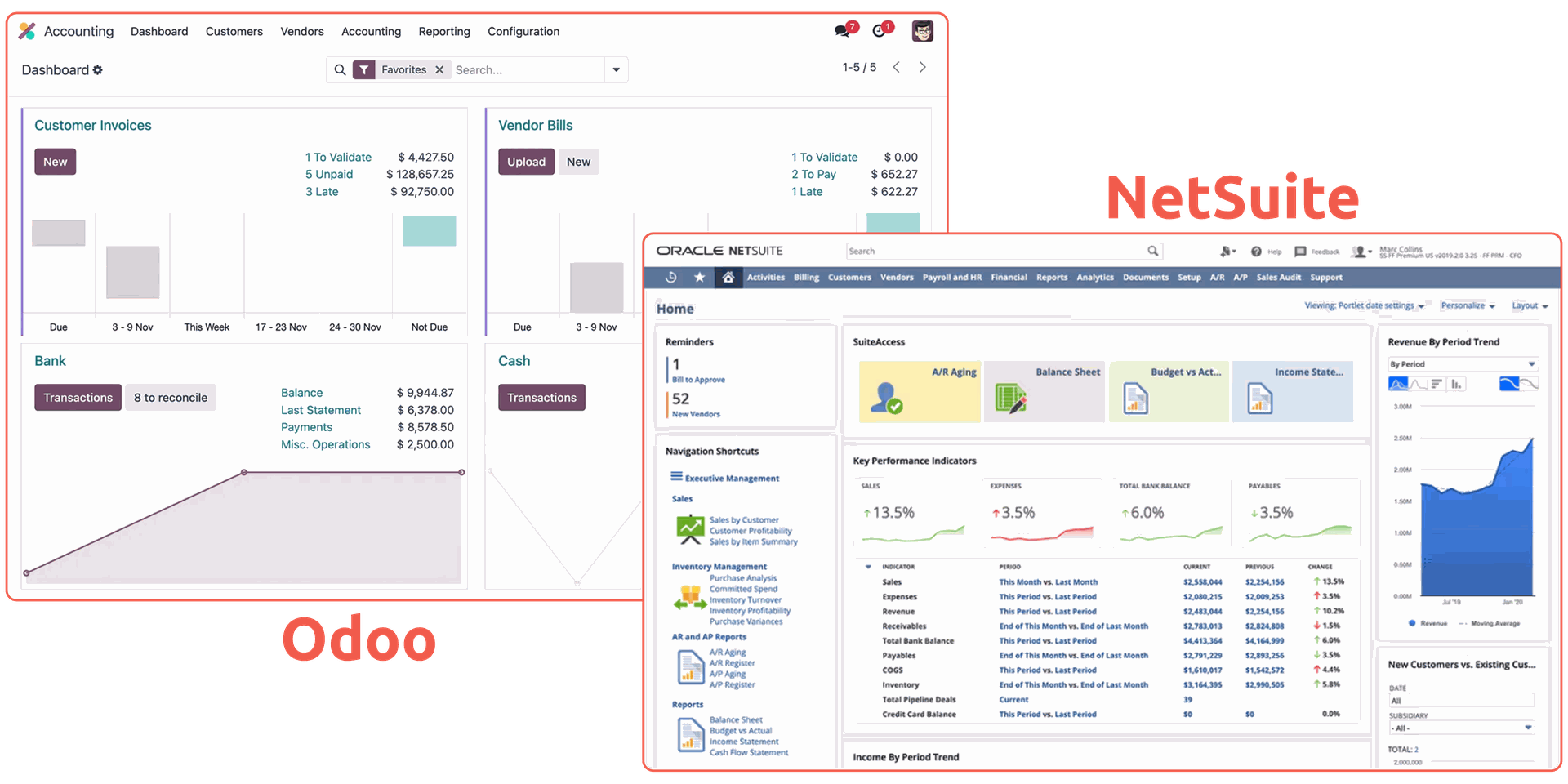

Odoo ist eine modulare ERP-Plattform, die Buchhaltung, Compliance und Automatisierung integriert unter einer einzigen Lizenz bündelt. NetSuite hingegen ist Oracles Cloud-ERP-Lösung mit internationaler Reichweite und Funktionen zur Deutschland-Lokalisierung. .

Wir haben beide Systeme direkt verglichen: nicht nur anhand der Kernfunktionen, sondern vor allem im Hinblick auf die Anforderungen, die Finanzteams in Deutschland an die Einhaltung der Vorschriften (Compliance), die Automatisierung und die DATEV-Übergabe stellen.

Allgemeine Anforderungen für deutsche Lokalisierung

Die meisten ERP-Anbieter bieten eine Lokalisierung an. Doch Funktionsumfang, Liefermodelle und Workflows variieren stark.

Dieser Vergleich betrachtet die Funktionen, die notwendig sind, sobald die Anforderungen der deutschen Buchhaltung operativ relevant wird, also wenn Finanzberichte exportiert, übermittelt oder geprüft werden müssen.

Dazu gehören typischerweise::

- Kontenrahmen SKR03 / SKR04

- GuV und Bilanz im deutschen Format

- GoBD-konforme Exporte (nicht nur CSV oder TXT)

- Umsatzsteuer- und Intrastat-Meldewesen

- Behandlung von abgegrenzter Umsatzsteuer und Erträgen

- Integration deutscher Bank-Feeds (HBCI/PSD2)

- PDF-Vorlagen in deutscher Sprache

- DATEV-kompatible Exporte für den Jahresabschluss

Dies sind die Basisfunktionen, Add-ons oder Partner-Module sind hierbei nicht berücksichtigt.

Odoo vs NetSuite: Vergleich der Lokalisierungs-Funktionen

Funktionsseitig sind Odoo und NetSuite weitgehend vergleichbar.

Allerdings werden viele Elemente, die in Odoo standardmäßig enthalten sind (wie die Logik für abgegrenzte Posten oder strukturierte Exportvorlagen), in NetSuite als optional oder kostenpflichtiges Add-on geführt.

Einige dieser Zusatzkosten werden oft erst nach der Implementierung offengelegt.

Die öffentliche Dokumentation zur Lokalisierung von NetSuite ist ebenfalls begrenzt.

Basierend auf Nutzer-Feedback und internen Vergleichen bietet NetSuite den gleichen Kernfunktionsumfang, erfordert jedoch eine stärkere Abhängigkeit von spezifischen Konfigurationen, Partner-Tools oder Middleware.

Funktion | Odoo | NetSuite |

SKR03 / SKR04 Kontenrahmen | ✅ Standard | ✅ Standard |

USt- & Intrastat-Meldung | ✅ Standard | ✅ Standard |

GoBD-Exportformat | ✅ XLSX mit Metadaten 📊 | ✅ Nur TXT-Datei 🗎 |

Abgegrenzte USt und Erträge | ✅ Standard-Logik | ⚠️ Add-on erforderlich |

Deutsche PDF-Vorlagen | ✅ Editierbar | ✅ Basisversion |

Bankintegration (HBCI/PSD2) | ✅ Standard | ⚠️ Oft Partner-basiert |

Multidimensionales Controlling | ✅ Analytische Tags | ❌ Nicht verfügbar |

Umsatzsteuer, Intrastat und ELSTER-Meldewesen

Bei der Übermittlung an Behörden folgen beide Systeme dem gleichen Muster und bieten nur eine teilautomatisierte Lösung. Die zugrundeliegende Logik und Dateistruktur sind ähnlich, der Prozess identisch.

ELSTER ist das offizielle elektronische Übermittlungssystem der deutschen Finanzbehörden für Umsatzsteuer-Voranmeldungen, Jahresabschlüsse und andere Erklärungen.

Es erfordert lokale Übermittlungswerkzeuge mit Hardware-basierter Authentifizierung, was die direkte Integration von Cloud-ERPs verhindert.

Die ELSTER-Schnittstelle setzt weiterhin lokale Infrastruktur und Hardware-Token voraus. Weder Odoo noch NetSuite bieten eine native ELSTER-Übermittlung.

Beide Systeme exportieren die Umsatzsteuer-Voranmeldungen im XML-Format, das dann manuell über ELSTERTransfer oder einen zertifizierten Desktop-Client hochgeladen werden muss.

Berichtstyp | Prozess (Odoo und NetSuite) |

USt-Voranmeldung | XML erstellen → herunterladen → manueller Upload über ELSTERTransfer |

Intrastat | CSV erstellen → herunterladen → Upload zum BAFA-Portal In Google Sheets exportieren |

Jahresabschluss und DATEV-Übermittlung

Weder Odoo noch NetSuite bieten den gesetzlichen Jahresabschluss, da dieser extern über DATEV erfolgt.

Beide Systeme stellen die Vorbereitung und den Export der Finanzdaten bereit, sind jedoch auf DATEV angewiesen für:

- Generierung und Übermittlung der E-Bilanz

- Körperschafts- und Gewerbesteuererklärungen

- Erstellung der Handels- und Steuerbilanz

- Finale ELSTER-Übermittlung

Schritt | Odoo | NetSuite |

DATEV-Export | ✅ XLSX oder CSV | ⚠️ Erfordert Integration oder Partner |

E-Bilanz-Vorbereitung | ✅ Extern über DATEV | ✅ Extern über DATEV |

ELSTER-Übermittlung (Abschluss) | 🔌 Odoo DATEV-Modul kann an ELSTER übermitteln | ❌ Nicht unterstützt |

Öffentliche Dokumentation zu Einschränkungen | ✅ Transparent | ⚠️ Eingeschränkt oder unklar |

Viele Unternehmen erkennen erst während der Implementierung von NetSuite, dass eine DATEV-Schnittstelle separat erworben und konfiguriert werden muss.

In Odoo sind DATEV-Exporte über standardmäßige Exportvorlagen verfügbar. Bei NetSuite verlassen sich Nutzer typischerweise auf Partner-entwickelte Konnektoren, um Abschlussdaten zu übergeben.

Da Odoo Open-Source ist, sind Drittanbieter-Integrationen leicht zugänglich und können einfach per API angebunden werden. Dies erleichtert die Verbindung zu DATEV und ELSTER.

much. Consulting ist zertifizierter Integrationspartner für DATEV in Odoo

Der Konnektor ermöglicht den Nutzern einen vollständig automatisierten Export von Journaleinträgen, Stammdaten, Dokumenten und Kostenstelleninformationen, wobei die Einhaltung der deutschen Buchhaltungsvorschriften gewährleistet bleibt.

Wann Odoo wählen und wann NetSuite?

Aus Sicht der Lokalisierung bieten Odoo und NetSuite nahezu identische Kernfunktionen, sofern man nur die Standard-Features betrachtet.

Beide sind für den Abschluss auf DATEV angewiesen und verfügen ab Werk über keine native ELSTER-Integration.

Der Hauptunterschied liegt in der Transparenz und der Integrationsfähigkeit:

- Odoo enthält mehr deutsche Kernfunktionen in der Basiskonfiguration und kommuniziert transparent, was nicht enthalten ist. Als Open-Source-Software ermöglicht es eine einfache Anbindung von Drittanbieter-Lösungen über die API.

- NetSuite liefert ein vergleichbares Ergebnis, erfordert jedoch oft zusätzliche Konfiguration oder Partner-Tools und legt dies nicht immer frühzeitig offen.

Wählen Sie Odoo, wenn...

Sie zentrale deutsche Funktionen ohne zusätzliche Add-ons wünschen.

Sie strukturierte GoBD-Exporte (z.B. XLSX mit Metadaten) benötigen.

Sie die DATEV-Übergabe direkt ohne Middleware abwickeln möchten.

Sie Analytische Tags für das Controlling benötigen.

Sie Wert auf eine transparente Dokumentation des Lieferumfangs legen.

Wählen Sie NetSuite, wenn...

Sie NetSuite bereits global einsetzen.

Sie mit den Einschränkungen des TXT-Formats und minimalem Reporting arbeiten können.

Sie externe BI-Tools für das Controlling verwenden.

Sie dedizierte Ressourcen haben, um Dokumentationslücken zu füllen.

Möchten Sie Ihre deutsche Buchhaltung mit Odoo auf den neuesten Stand bringen?

Wenden Sie sich an unser Odoo-Expertenteam, um ein Buchhaltungs-Setup maßzuschneidern, das zu Ihren Finanz-Workflows und den deutschen Anforderungen passt.