Die elektronische Rechnungsstellung ist in vielen Ländern eine gesetzliche Vorschrift und entwickelt sich in Europa und darüber hinaus rasant zum Standard. Ab 2026 in Belgien und ab 2028 EU-weit wird die E-Rechnung für alle B2B-Transaktionen zur Pflicht.

Odoo bietet integrierte Unterstützung für die digitale Rechnungsstellung durch standardisierte Formate wie EDI (Electronic Data Interchange) und spezifische EDI-Frameworks wie Peppol.

Dies ermöglicht Unternehmen den automatischen Versand und Empfang strukturierter Rechnungen, Gutschriften und Lieferantenrechnungen konform mit den lokalen Vorschriften.

Inhaltsübersicht

Die E-Rechnung wird Pflicht in der EU

Odoo unterstützt die E-Rechnung für die Compliance mit EU-Standards

Odoo erlaubt die Formateinstellung basierend auf lokalen Regeln

So richten Sie konforme E-Rechnung über Peppol in Odoo ein

Peppol mit Odoo verbinden für End-to-End-Buchhaltung

Registrierung als Rechnungssteller oder Empfänger mit der Odoo Peppol App

Empfängerdaten vor dem Versand überprüfen

Rechnungen über Peppol versenden und Zustellung verfolgen

Die E-Rechnung wird Pflicht in der EU

Der Wandel hin zur obligatorischen elektronischen Rechnungsstellung ist bereits im vollen Gange. Belgien wird ab 2026 die E-Rechnung für alle nationalen B2B-Transaktionen vorschreiben. Der Rest der EU wird bis 2028 unter einem gemeinsamen Rahmenwerk folgen.

Unternehmen, die in diesen Märkten oder mit diesen Märkten Geschäfte tätigen, müssen Rechnungen in einem strukturierten digitalen Format ausstellen, das den lokalen und EU-weiten Anforderungen entspricht.

Die Verwendung veralteter oder nicht konformer Formate führt zur Ablehnung von Rechnungen, zu Zahlungsverzögerungen oder zu einem blockierten Zugang zu Kunden des öffentlichen Sektors. Der sicherste und zukunftssicherste Weg zur Compliance ist die Nutzung eines zertifizierten Systems mit integriertem Peppol-Zugang. Odoo bietet dies standardmäßig.

Odoo unterstützt die E-Rechnung für die Compliance mit EU-Standards

Odoo erfüllt die Anforderungen an die elektronische Rechnungsstellung in einer Vielzahl von Rechtsräumen. Das System unterstützt länderspezifische Formate wie Italiens FatturaPA, Spaniens Facturae sowie Deutschlands XRechnung und ZUGFeRD und weitere.

Diese Formate entsprechen den nationalen Gesetzen und ermöglichen es, strukturierte XML-Dateien maschinell zu lesen und von Finanzbehörden sowie Partnern automatisch zu verarbeiten.

Die E-Rechnung in Odoo basiert auf EDI-Standards. Diese stellen sicher, dass Dokumente wie Rechnungen und Gutschriften maschinenlesbar sind und ohne menschliches Eingreifen übertragen werden können. Dies ist unerlässlich für die Zusammenarbeit mit öffentlichen Institutionen und Großunternehmen.

Derzeit werden über 30 Länder unterstützt, darunter Belgien, Frankreich, Deutschland, Polen, die Niederlande und die nordische Region. Die jeweilige Länder-Lokalisierung umfasst die erforderlichen Formate und Automatisierungslogiken, um regionale Anforderungen zu erfüllen.

Odoo erlaubt die Formateinstellung basierend auf lokalen Regeln

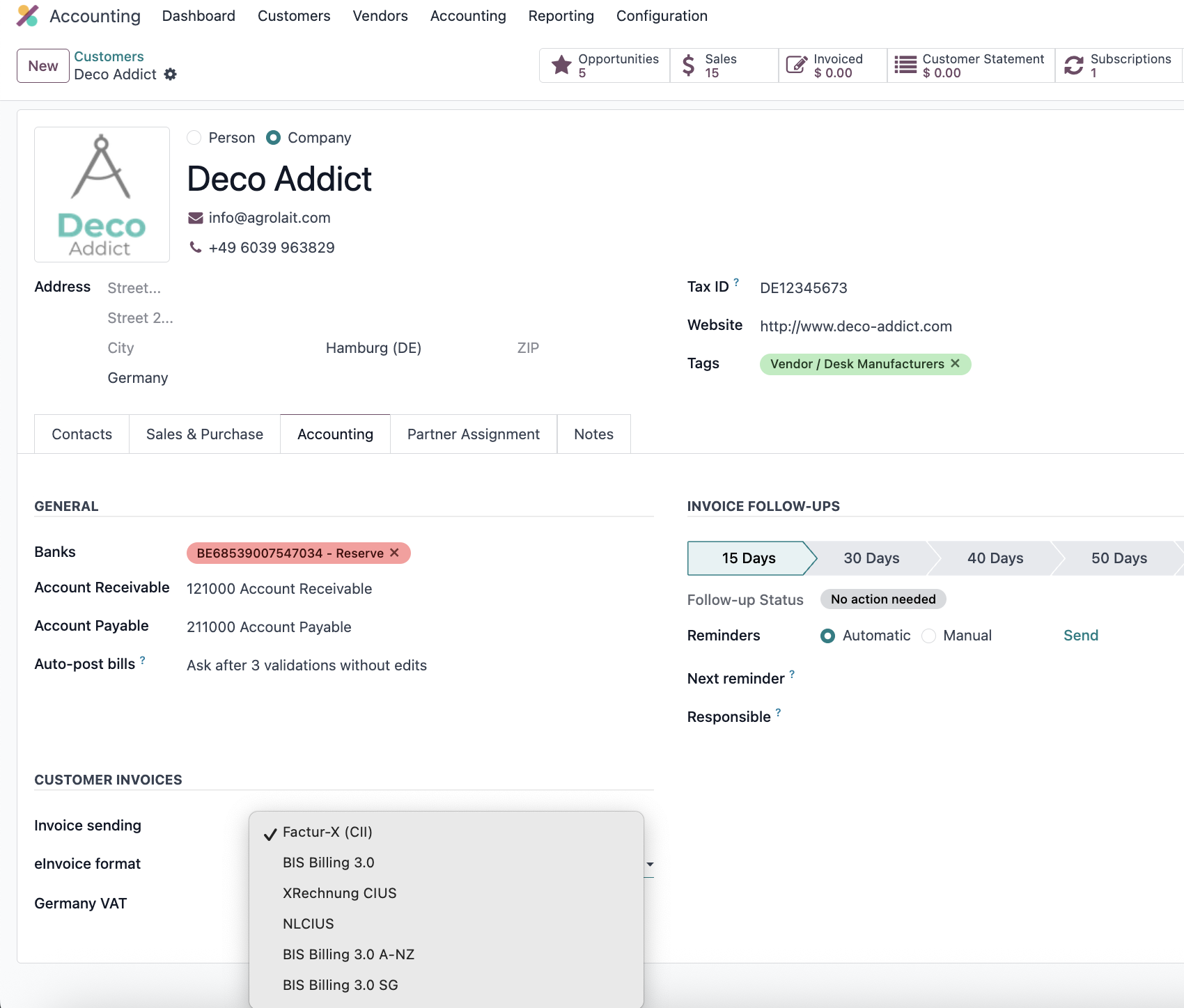

Odoo ermöglicht es Unternehmen, das korrekte E-Rechnungsformat für jeden Kunden festzulegen.

Dies wird in der Regel automatisch durch das Land des Kunden bestimmt, kann jedoch manuell im Kundenstamm unter dem Reiter Buchhaltung angepasst werden.

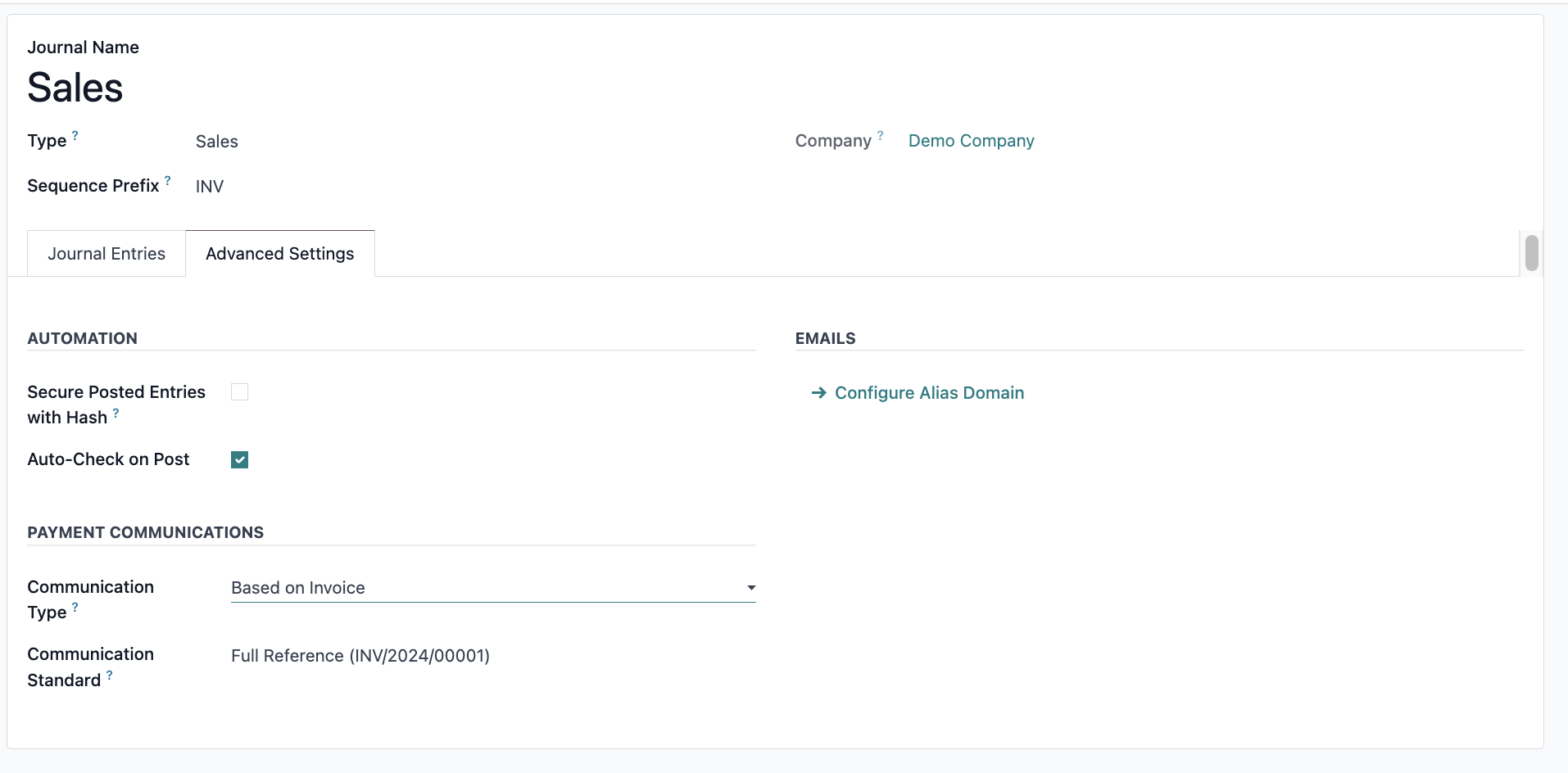

Auch Verkaufsjournale können mit einem Standard-E-Rechnungsformat konfiguriert werden. Dies ist nützlich für Länder, in denen alle ausgehenden Rechnungen einer spezifischen Struktur folgen müssen.

Die Journal-Einstellungen finden Sie unter Buchhaltung → Konfiguration → Journale → Verkauf → Erweiterte Einstellungen.

Durch die Definition der Formate sowohl auf Journal- als auch auf Kundenebene stellen Unternehmen sicher, dass ihre Rechnungen stets die erwarteten technischen und rechtlichen Standards erfüllen.

So richten Sie konforme E-Rechnung über Peppol in Odoo ein

Peppol (Pan-European Public Procurement Online) ist ein Netzwerk, das Unternehmen und öffentlichen Behörden den sicheren und verifizierten Austausch von Dokumenten wie Rechnungen, Gutschriften und Lieferantenrechnungen ermöglicht.

Odoo integriert sich direkt in Peppol. Es fungiert dabei sowohl als Access Point als auch als Service Metadata Publisher (SMP). Dies macht den Versand per E-Mail oder Post überflüssig und gewährleistet die vollständige Konformität der Formate.

Peppol mit Odoo verbinden für End-to-End-Buchhaltung

Peppol ist in der gesamten EU, in Großbritannien und mehreren weiteren Ländern weit verbreitet. Es ermöglicht die internationale E-Rechnung über eine gemeinsame Infrastruktur. Die Odoo-Integration unterstützt Formate wie BIS Billing 3.0, XRechnung (Deutschland) und NLCIUS (Niederlande).

Einmal registriert, können Unternehmen Rechnungen und Gutschriften versenden sowie Lieferantenrechnungen und Rückerstattungen direkt über ihre Odoo-Datenbank empfangen.

Registrierung als Rechnungssteller oder Empfänger mit der Odoo Peppol App

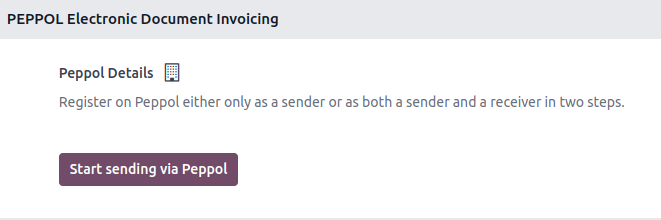

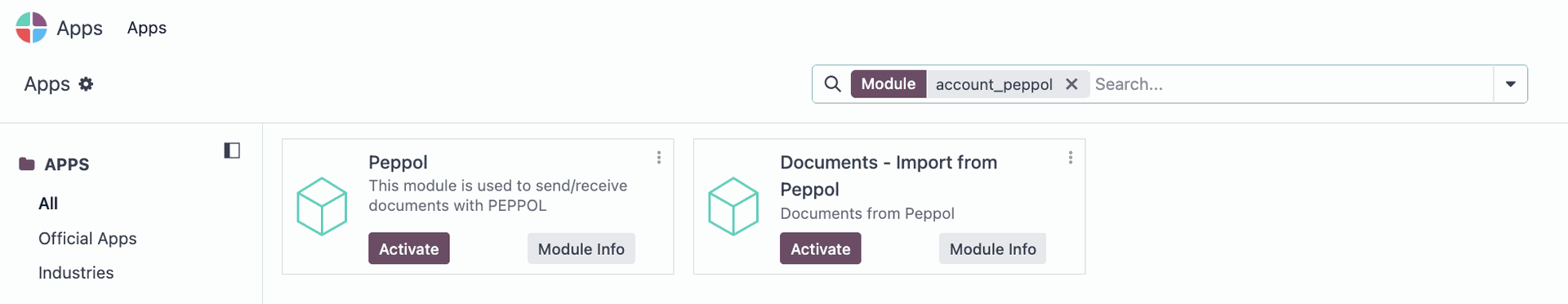

Starten Sie die Einrichtung Ihrer Odoo-Peppol-Verbindung, indem Sie das Peppol-Modul (account_peppol) installieren.

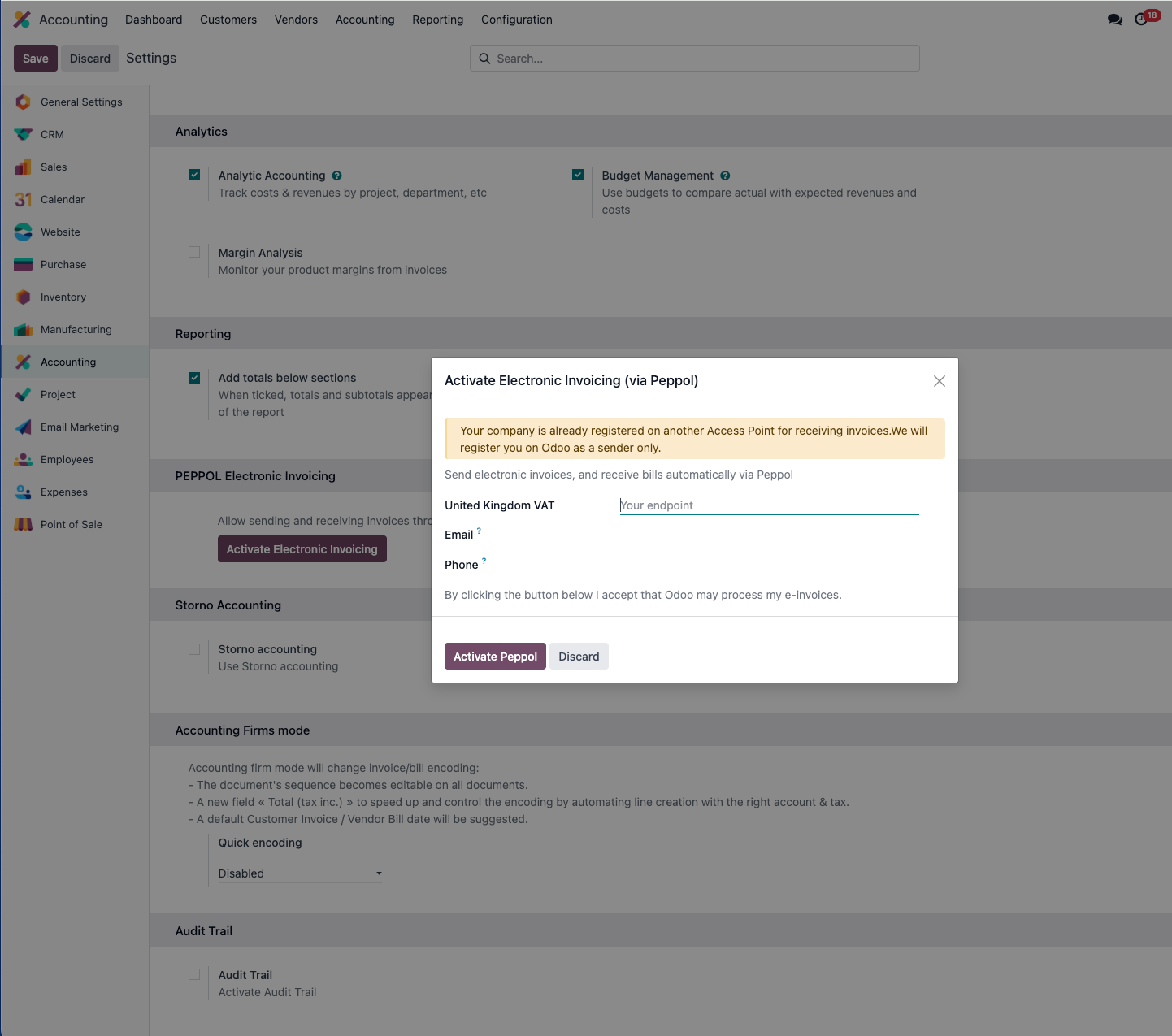

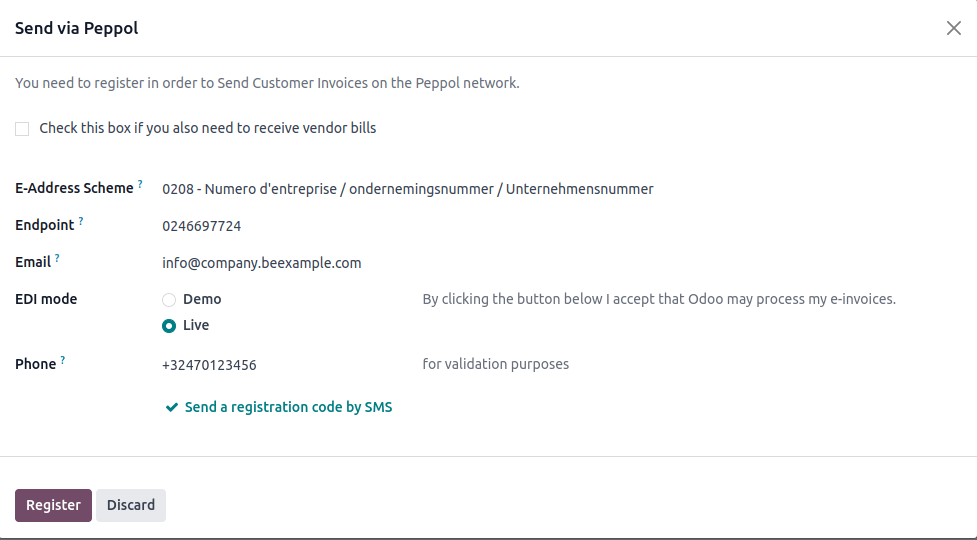

Gehen Sie dann zu Buchhaltung → Konfiguration → Einstellungen, aktivieren Sie die Peppol-Option und speichern Sie. Es erscheint ein Registrierungsformular, das die Registrierung als Sender, Empfänger oder beides ermöglicht.

Die Registrierung erfordert:

- EAS-Code (wird basierend auf dem Land vorausgefüllt)

- Endpunkt (in der Regel die Umsatzsteuer- oder Geschäftsnummer)

- Telefonnummer (mit Landesvorwahl)

- E-Mail-Adresse zur Verifizierung

Nutzer können zwischen dem Live-Modus und dem Demo-Modus für Tests wählen.

Auch die Migration von einem anderen Peppol-Anbieter ist durch Eingabe eines Migrationsschlüssels möglich.

Empfängerdaten vor dem Versand überprüfen

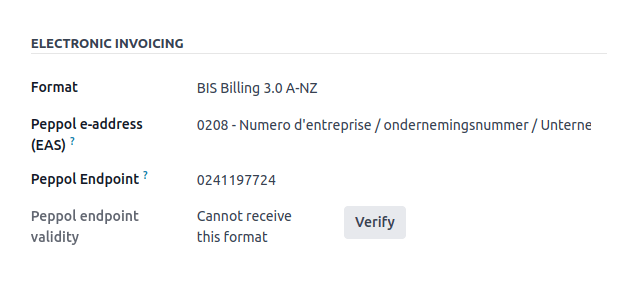

Rechnungen können nur über Peppol zugestellt werden, wenn der Empfänger ein registrierter Teilnehmer ist.

In Odoo wird dies im Kundenformular unter dem Abschnitt Buchhaltung → Elektronische Rechnungsstellung verwaltet.

Nutzer müssen den Peppol EAS-Code und den Endpunkt des Kunden eingeben und dann auf Überprüfen klicken. Das System bestätigt, ob der Empfänger das ausgewählte Format akzeptieren kann.

Eine Massenüberprüfung ist auch in der Listenansicht über Aktionen → Peppol überprüfen verfügbar.

Akzeptiert der Kunde zwar Peppol, jedoch nicht das spezifische Format, kennzeichnet Odoo dies in der Spalte "Gültigkeit des Peppol-Endpunkts".

Rechnungen über Peppol versenden und Zustellung verfolgen

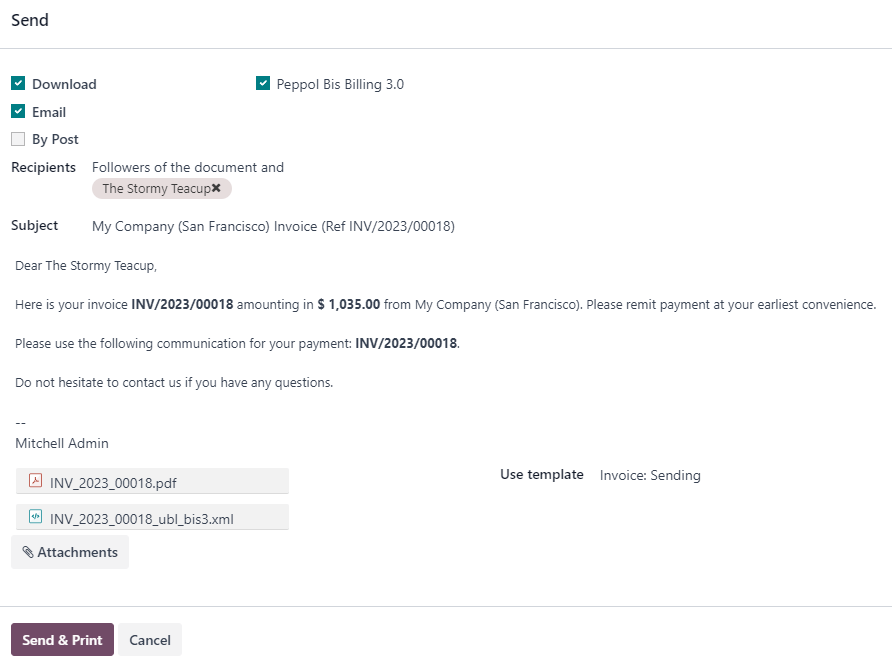

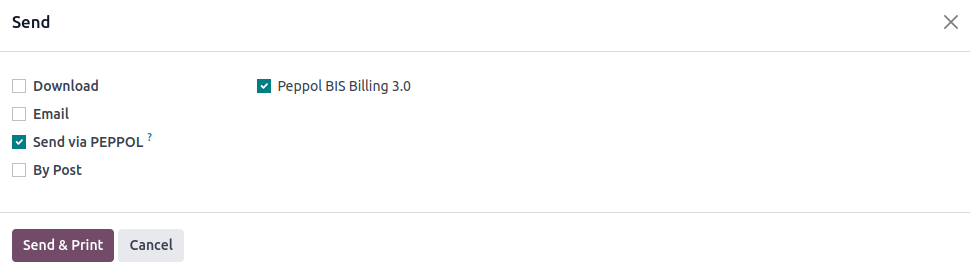

In Odoo verbuchte Rechnungen werden als Peppol Ready gekennzeichnet, wenn alle Daten korrekt sind. Zum Versenden öffnen Sie die Rechnung, klicken auf Senden & Drucken und aktivieren sowohl Über Peppol senden als auch das entsprechende Format (z. B. BIS Billing 3.0).

Über Aktionen → Senden & Drucken können mehrere Rechnungen gleichzeitig aus der Listenansicht gesendet werden. Odoo stellt diese im Hintergrund in eine Warteschlange und versendet sie.

Jede Rechnung zeigt einen Status:

- Verarbeitung: Gesendet, aber noch nicht bestätigt.

- Fertig: Erfolgreich über den Access Point des Empfängers zugestellt.

Die Status werden automatisch über einen Cron-Job aktualisiert. Für sofortige Aktualisierungen können Nutzer im Buchhaltungs-Dashboard auf Peppol-Rechnungsstatus abrufen klicken.

Lieferantenrechnungen von Peppol-Teilnehmern empfangen

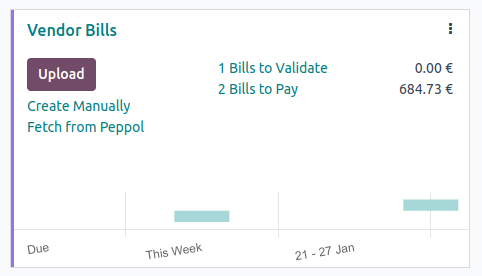

Odoo ruft eingehende Dokumente einmal täglich über das konfigurierte Einkaufsjournal ab. Diese werden automatisch in Entwürfe von Lieferantenrechnungen umgewandelt.

Um Dokumente vor der geplanten Ausführung des Jobs abzurufen, können Nutzer im Dashboard manuell auf Von Peppol abrufen im entsprechenden Journal klicken.

Um Dokumente vor der geplanten Ausführung des Jobs abzurufen, können Nutzer im Dashboard manuell auf Von Peppol abrufen im entsprechenden Journal klicken.

Odoo E-Rechnung erfüllt zukünftige Compliance-Standards

Die elektronische Rechnungsstellung ist in vielen Branchen und Regionen nicht mehr optional. Odoo bietet die Werkzeuge, um standardmäßig über Grenzen, Sektoren und Formate hinweg konform zu bleiben.

Mit der integrierten Unterstützung für länderspezifische EDI-Regeln und dem direkten Zugang zum Peppol-Netzwerk stellen Unternehmen sicher, dass jede gesendete oder empfangene E-Rechnung technisch valide, gesetzlich konform und bereit für die automatische Verarbeitung ist.

Bereiten Sie sich auf die E-Rechnungs-Pflicht in der EU vor!

Ob Sie Peppol-Anforderungen erfüllen, länderspezifische Formate konfigurieren oder den Rechnungs austausch in Odoo automatisieren müssen Compliance beginnt mit dem richtigen Setup.

Sprechen Sie mit unseren Experten und stellen Sie sicher, dass Ihr Odoo-System für die kommenden E-Rechnungs-Vorschriften und darüber hinaus gerüstet ist.