Accounting is the part of an ERP project that no business can afford to get wrong.

From incorrect VAT handling to broken bank reconciliation, a single misstep can lead to compliance issues or hours of manual corrections.

Odoo gives you all the tools you need to get it right, but only if the system is structured correctly from the start.

This guide walks you through every step in the process: how to prepare your UK accounting data, install and configure the system, and ensure compliance with Making Tax Digital and UK reporting rules from day one.

Disclaimer: This guide is based on practical experience with Odoo Accounting for UK businesses. It is not tax or legal advice. For compliance-related decisions, always consult your accountant or HMRC advisor.

Odoo offers a localisation package for the UK

When you select “United Kingdom” as your localisation during setup, Odoo installs a complete package tailored for UK accounting and tax rules.

This package is essential as it ensures your system is legally aligned and structurally sound from the start.

The UK localisation includes:

- a UK GAAP-compliant chart of accounts

- preconfigured VAT rates (standard 20%, reduced 5%, zero-rated, exempt)

- standard tax groups and fiscal positions for domestic, EU, and non-EU scenarios

- built-in support for Making Tax Digital (MTD), enabling digital VAT return submissions to HMRC templates for UK reports such as VAT returns, EC sales lists, and audit exports

Important: Always install the localisation package before importing or configuring any chart of accounts, taxes, or journals.

Get your accounting data ready

Before configuring Odoo, clarify your financial structure. These inputs determine your system design and reduce rework later.

- Prepare your UK Chart of Accounts: with account codes, types (e.g. asset, expense), default taxes, and tags

- Confirm your VAT rates and reporting rules: standard (20%), reduced (5%), zero (0%), reverse charge rules, etc.

- List all bank accounts and payment methods: including BACS, SEPA, Stripe, GoCardless, or PayPal

- Identify local fiscal requirements: such as MTD submissions, EC Sales List, and digital records

- Decide if you need multi-currency, multi-company, or analytic accounts (e.g. for project-based tracking)

Install Odoo Accounting in 6 Steps

These are the steps to follow to lay the right accounting foundation, whether you're new to Odoo or setting up a fresh UK database.

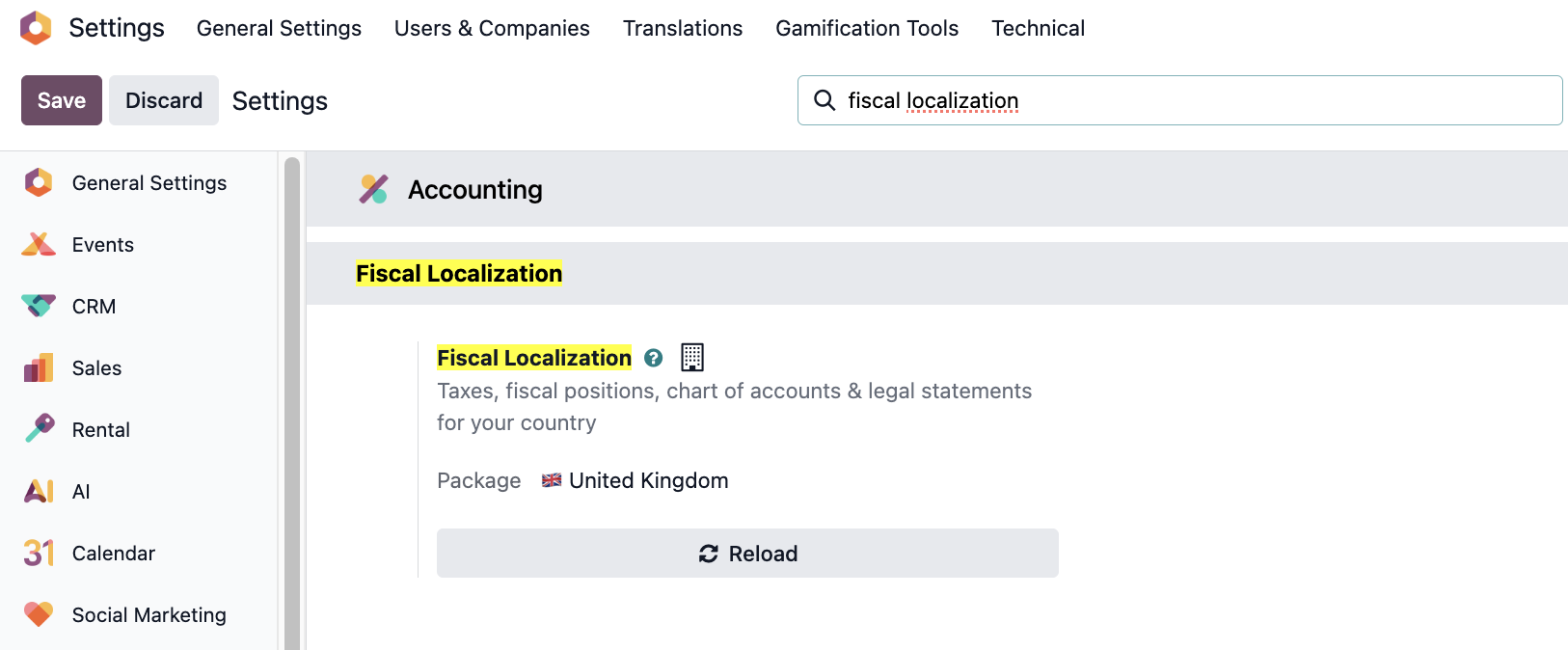

Step 1: Choose your localisation package

Go to Settings > Fiscal Localisation and check that the United Kingdom is configured based on your company’s location.

This automatically loads:

- A UK GAAP-compliant chart of accounts

- Standard VAT rates

- MTD-ready report

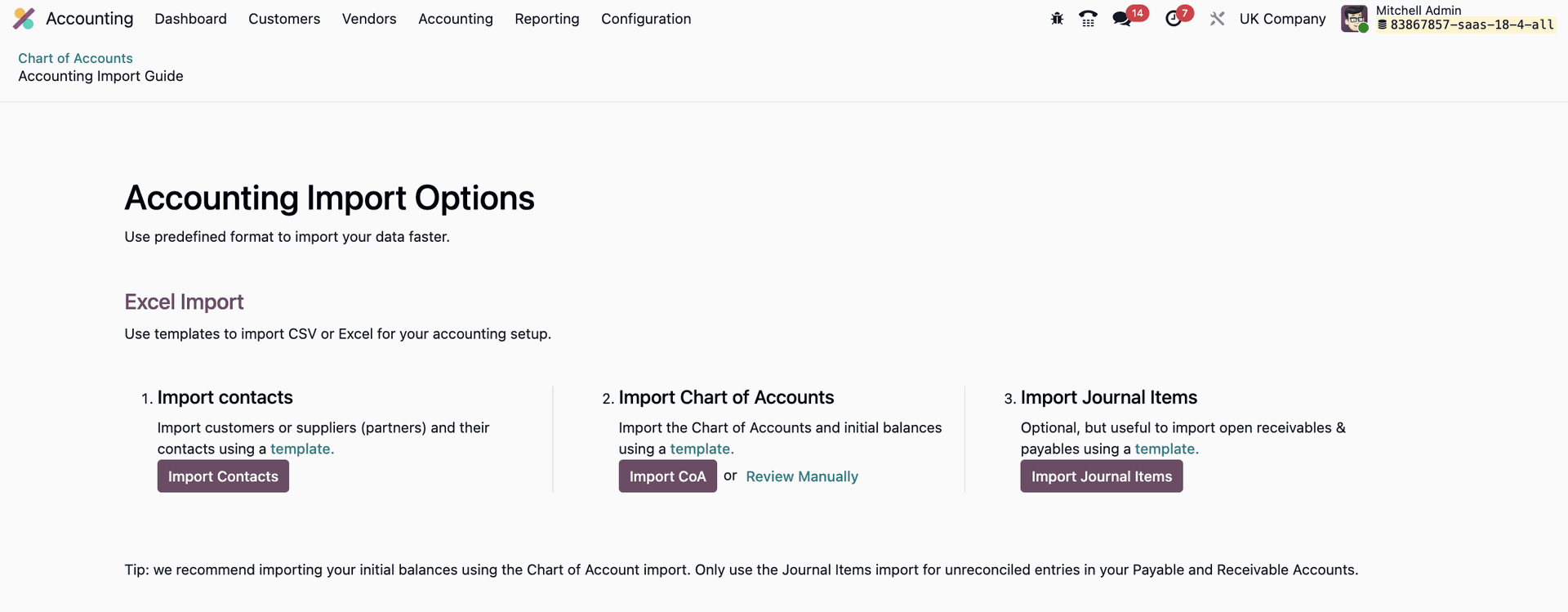

Step 2: Import your chart of accounts

Navigate to Accounting > Configuration > Accounting > Chart of Accounts. Import your chart via CSV/XLSX.

Check:

- Account types and groups

- Default VAT accounts

- P&L vs Balance Sheet classification

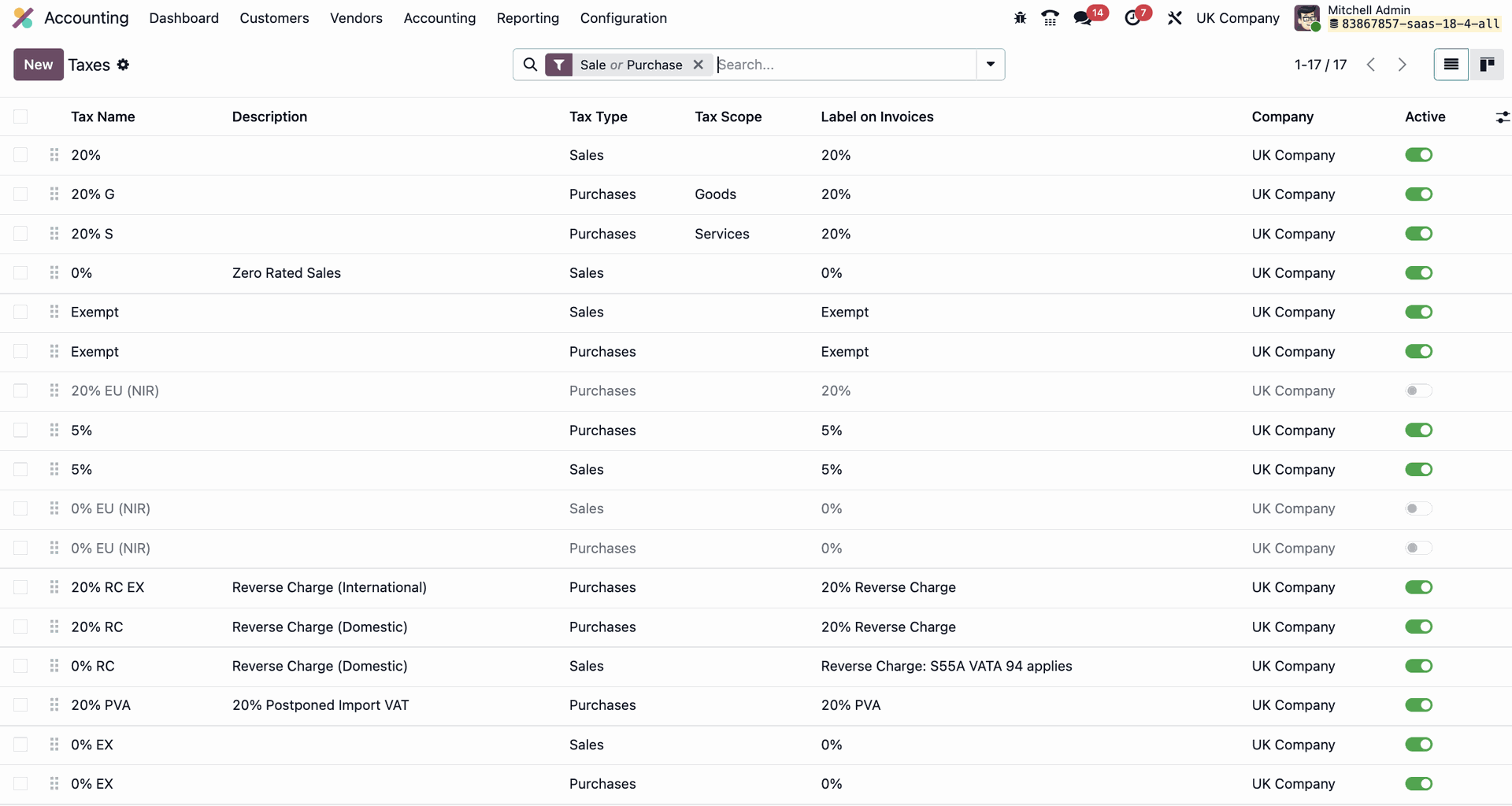

Step 3: Set up taxes

Go to Accounting > Configuration > Accounting > Taxes.

Add or adjust:

- UK VAT rules (standard, reduced, zero)

- Reverse charge and EC acquisition rules

- Tax groups to structure invoice printouts and reports

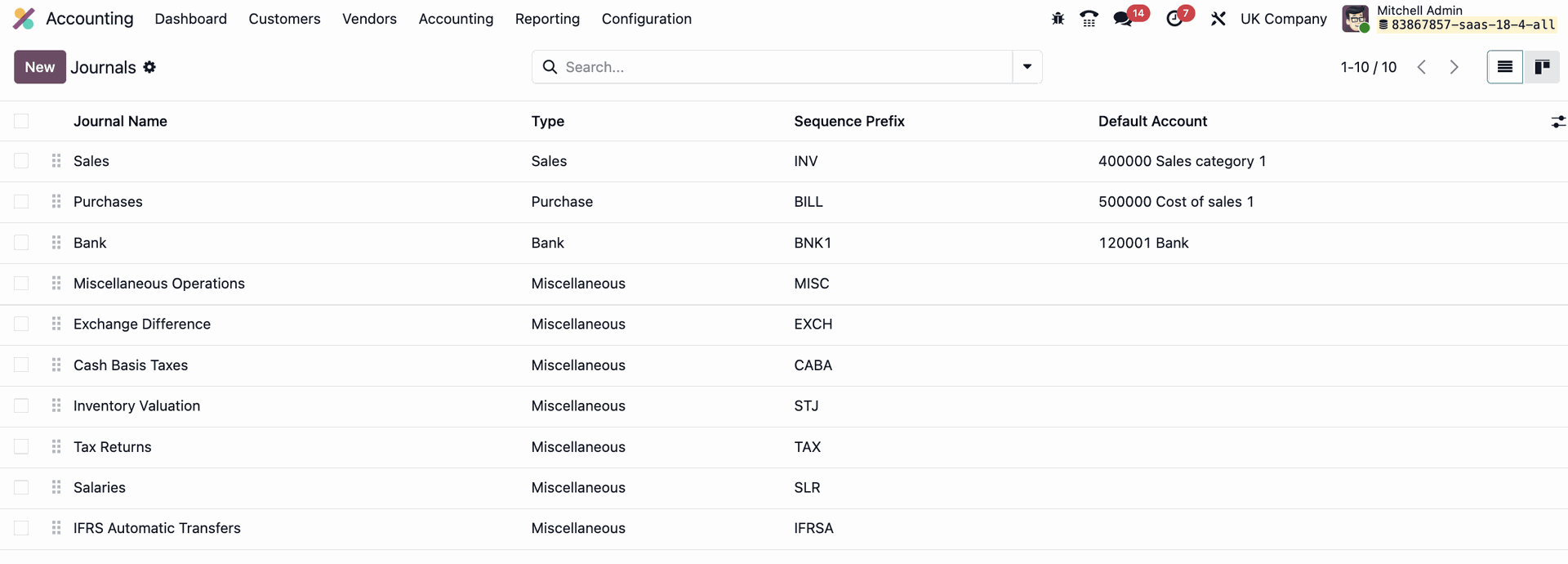

Step 4: Create journals

Define the following under Accounting > Configuration > Accounting > Journals:

- Sales

- Purchases

- Bank (one per account)

- Cash (if applicable)

- Miscellaneous (for journals like payroll or adjustments)

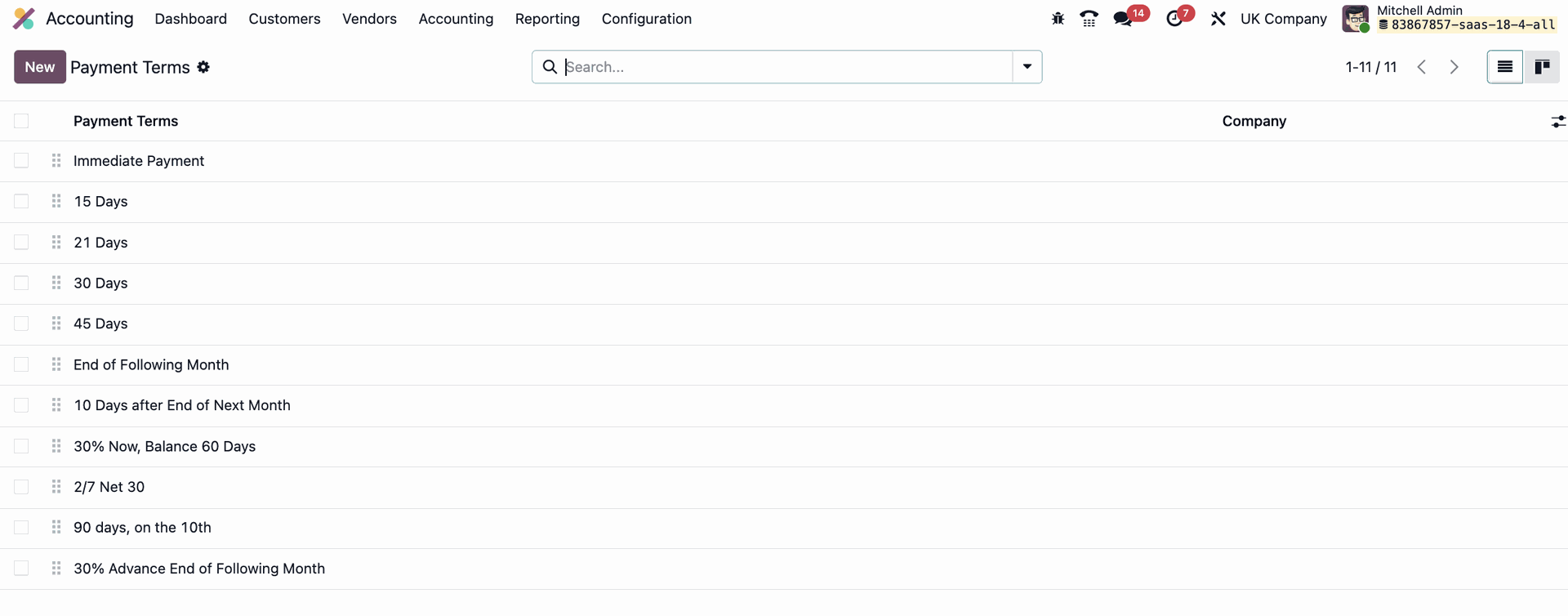

Step 5: Configure payment terms & methods

Under Accounting > Configuration > Invoicing > Payment Terms, set:

- Common terms (e.g. Net 30, 3% 10 Net 30)

- Payment providers: BACS, SEPA, PayPal, Stripe

Step 6: Set default values

In Settings, define:

- Default taxes (sales and purchase)

- Terms and conditions for invoices

- Incoterms

- Accounts for currency gains/losses, deferrals, discounts

Key checks before going live

Before going live with your Accounting setup, confirm that the core financial mechanics work as expected.

- Chart of Accounts: Correct account codes, types, and tax assignments

- Taxes & tax groups: Assigned to accounts and visible in documents

- Fiscal positions: Rules for EU B2B, non-EU B2C, and reverse charge logic+

- Journals: Coverage across operations, with proper default accounts

- Payment terms: Due dates and early-payment discounts work correctly

- Bank sync: Test feeds or statement imports and reconciliation flows

- Currency settings: Enable multi-currency and daily exchange rate fetch

- Rounding & cash basis: Set rounding method and enable cash accounting if required

Set up daily accounting tasks

Odoo supports the full cycle of daily accounting operations. Once your setup is complete, the goal is to keep your records accurate, compliant, and up to date through a consistent daily and weekly routine.

These tasks are mostly standard in accounting processes, but some have UK-specific context worth noting.

Customer invoices and payments

Issue and validate sales invoices with correct VAT treatment

Send invoices with appropriate payment terms and incoterms

Enable online payment options (e.g. SEPA, PayPal, Stripe)

Chase overdue payments using automated follow-ups or manual dunning

Apply payment matching and allocate receipts to the correct customer accounts

Ensure invoice templates include UK-required fields (e.g. VAT number, company number

Vendor bills and payments

Enter or import vendor bills and attach original documents

Use OCR or document scanning to reduce manual data entry

Activate 3-way matching (order–receipt–invoice) if purchasing via PO

Process payments via bank transfer (BACS for UK suppliers, SEPA for EU)

Use proper VAT codes for domestic and international suppliers

Schedule supplier payments with payment terms (e.g. net 30, due on receipt)

Reporting and oversight

Review daily balances in bank and VAT control accounts

Monitor cash flow via the dashboard and reporting menu

Keep draft entries and unposted journals to a minimum

Spot-check data completeness (e.g. unvalidated invoices or unpaid bills)

Journal entries and adjustments

Post payroll journals (manually or via third-party integration)

Record recurring entries (e.g. rent, insurance, accruals)

Create journals for FX adjustments if multi-currency is enabled

Keep depreciation schedules up to date via automated asset models

use analytic tags if you report by project, department, or cost centre

Bank feeds and reconciliation

Import bank statements daily via Open Banking or manual file upload

Review and match payments to invoices and bills using reconciliation models

Resolve unmatched entries and clear suspense accounts regularly

Ensure cash-based VAT accounting (if used) reflects real payment dates

Run partial reconciliation for instalments or under/overpayment

Stay audit-ready & compliant with UK Accounting regulations

Odoo offers tools for regulatory compliance, but only if configured with UK-specific rules in mind.

- Audit trail: Enable logging of journal entry changes

- Reporting structure: Use tags and report groups to reflect your P&L and Balance Sheet layout

- Fiscal periods: Set fiscal year (typically 6 April to 5 April) and custom periods

- Report localisation: Ensure MTD reports, VAT returns, and EC Sales Lists are structured to HMRC standards

- Access rights: Restrict who can post, modify, or validate entries

- VAT number validation & OSS: Use auto-checks and enable OSS if selling B2C across the EU

- Document digitisation: Reduce manual entry risk and store supporting documents

Odoo UK Accounting glossary

MTD – Making Tax Digital: HMRC’s digital VAT submission framework

HMRC – His Majesty’s Revenue and Customs: UK tax authority

VAT – Value-added tax: applied to goods and services in the UK

GAAP – Generally accepted accounting principles: UK standard for chart of accounts

BACS – Bank automated clearing system: used for UK domestic transfers

SEPA – Single euro payments area: cross-border euro transfers within the EU

P&L – Profit and loss: a core financial report showing income and expenses

OSS – One-stop shop: EU VAT scheme for B2C sales across member states

EC sales list – Required report for sales to VAT-registered EU businesses

Ready to get your Odoo UK Accounting setup right?

A clean setup aligned with UK standards means fewer workarounds, clearer reporting, and less manual correction for your finance team.

Reach out to our Odoo Accounting experts for support on how to configure your system correctly and stay compliant with UK accounting requirements from day one.