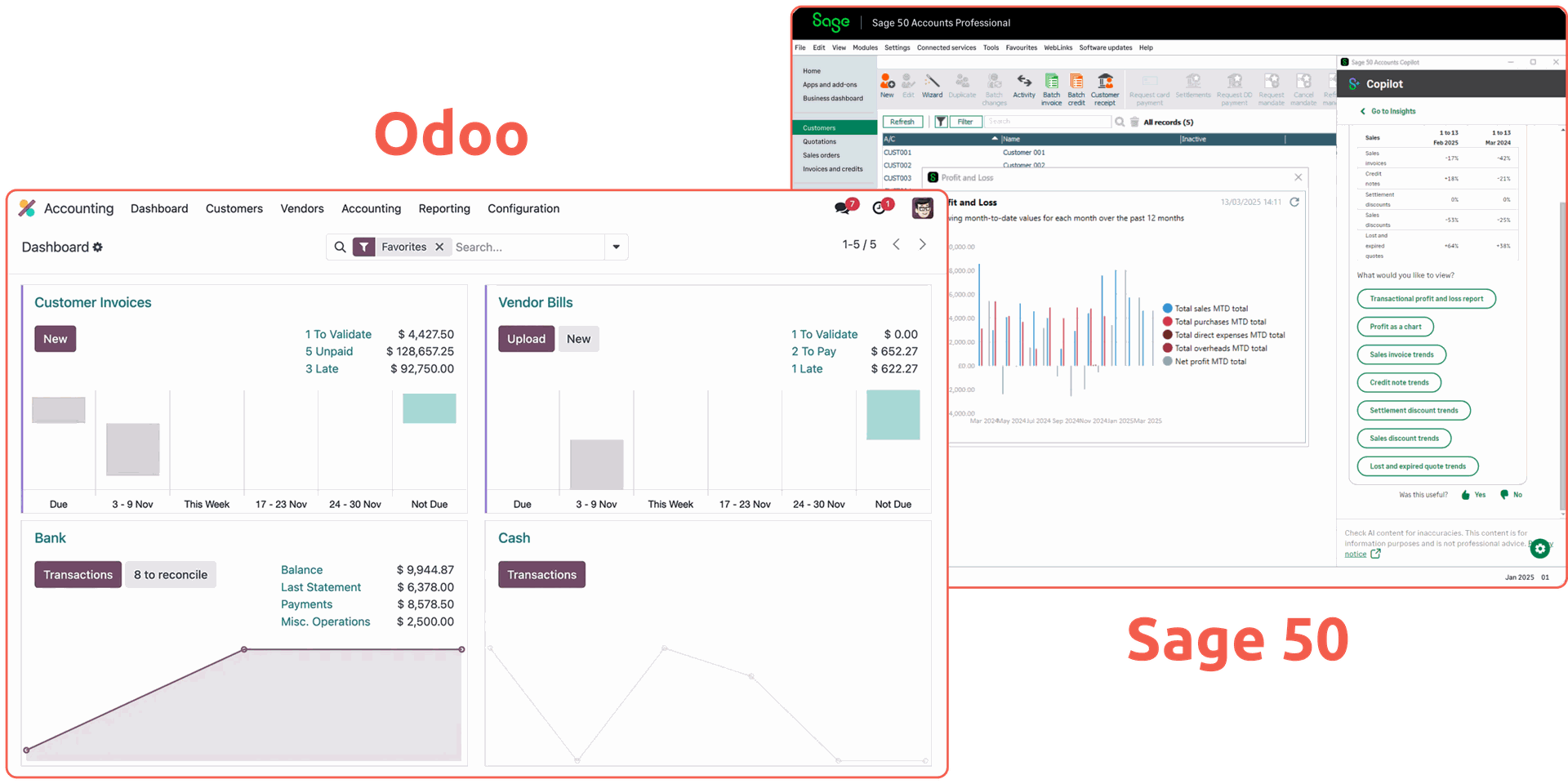

Wer Buchhaltungstools für ein wachsendes Unternehmen in Großbritannien vergleicht, stößt unweigerlich auf Sage und Odoo.

Sage ist bekannt für seine starke Compliance und seine langjährige Präsenz im britischen Finanzwesen.

Odoo hingegen ist ein Open-Source-ERP mit einer integrierten Buchhaltungssuite, die konsequent auf Automatisierung, Konsolidierung und KI ausgelegt ist.

Wir haben die Funktionen beider Tools direkt gegenübergestellt – für den Zeitpunkt, an dem die Buchhaltung zum zentralen Bestandteil Ihres operativen Geschäfts wird.

Haftungsausschluss:

Preise und Funktionsumfänge basieren auf öffentlich zugänglichen Informationen Stand Oktober 2025. Die tatsächlichen Kosten können je nach Region, Abrechnungsmodell, Benutzeranzahl und Setup variieren.

Gemeinsamer Benchmark für einen fairen Vergleich

Softwarehersteller bündeln Funktionen sehr unterschiedlich.

Während einige Kernfunktionen wie SEPA oder Rechnungsabgrenzung inklusive sind, bieten andere diese nur als Add-ons oder gar nicht an.

Dieser Vergleich konzentriert sich auf Funktionen, die für britische Unternehmen kritisch werden, sobald die Buchhaltung komplexer wird:

- Mehrwährungsfähigkeit: Notwendig für die Zusammenarbeit mit internationalen Lieferanten oder Kunden.

- BACS & SEPA-Zahlungsformate: Erforderlich für reibungslose Zahlungen innerhalb des UK und grenzüberschreitend in die EU.

- Rechnungsabgrenzung (Deferred Revenue): Entscheidend für Abonnements oder Vorauszahlungsmodelle.

- Automatisierung (OCR, Mahnwesen): Reduziert manuellen Aufwand und Fehlerquellen bei der Dateneingabe.

- Benutzerzugriffsrechte: Wichtig für die Sicherheit und Rollentrennung (z. B. Schreibschutz für abgeschlossene Perioden).

- Mandantenfähigkeit & Konsolidierung: Erforderlich für den Abschluss mehrerer Rechtseinheiten und den Überblick über die finanzielle Gesundheit der gesamten Gruppe.

- Custom Berichte & KPIs: Nützlich für Investoren-Reporting, Board-Packs und Prognosen.

- Intelligenter Abgleich: Zeitersparnis durch Matching-Logik und KI-Regeln.

Diese Versionen haben wir verglichen:

- Odoo Enterprise: Vollständige Buchhaltung inkl. Automatisierung, SEPA und Reporting.

- Sage 50 Accounting: Das gängige UK-Paket für kleine und mittlere Betriebe.

Beide Lösungen sind der typische nächste Schritt, wenn einfache Basis-Tools nicht mehr ausreichen.

Zusätzlich blicken wir auf Sage Intacct, die High-End-Cloud-Lösung von Sage für große Konzerne. Während Odoo Enterprise und Sage 50 feste Preise haben und sofort einsatzbereit sind, gibt es Sage Intacct nur auf Anfrage nach einer Beratung.

Britische Steuerkonformität mit HMRC und MTD

Die HMRC (His Majesty's Revenue and Customs) ist die britische Steuerbehörde.

Odoo ist offiziell von der HMRC anerkannt und erfüllt alle Anforderungen für „Making Tax Digital“ (MTD): die britische Initiative zur Digitalisierung von Steuererklärungen und Buchführung.

Mit Odoo können britische Firmen:

- Digitale VAT-Erklärungen direkt einreichen.

- Digitale Steuerunterlagen führen.

- MTD-konform bleiben, ohne zusätzliche Plugins kaufen zu müssen.

Sage unterstützt MTD seit der ersten Stunde und ist ebenfalls voll zertifiziert.

In Sachen Compliance sind also beide Systeme eine sichere Wahl..

Odoo vs. Sage: Die wichtigsten Funktionen im Check

Hier ist der Überblick über die Features, auf die es bei britischen Finanzteams ankommt.

Feature | Odoo | Sage |

Mehrere Firmen (Multi-company) | ✅ | ⚠️ Nur in Intacct / Sage 300 |

Konsolidierung | ✅ | ⚠️ Nur in Intacct |

Mehrere Journale | ✅ | ✅ |

SEPA-Lastschrift | ✅ | ✅ |

Rechnungsabgrenzung | ✅ | ⚠️ Nur in Intacct |

OCR-Erkennung (Belege) | ✅ | ✅ |

Abo-Rechnungen | ✅ | ✅ |

Abo-KPIs (MRR, Churn) | ✅ | ❌ |

Zahlungserinnerungen | ✅ | ✅ |

Pivot-Berichte | ✅ | ✅ |

Granulare Nutzerrechtkontrolle | ✅ | ⚠️ Nur rollenbasiert |

Integrierte KI-Workflows | ✅ | ⚠️ Basis-KI (Gemini) |

Mehrere Steuersätze pro Zeile | ✅ | ✅ |

Bank-Feeds | ✅ | ✅ |

Unterm Strich:

Sage deckt die klassischen Bedürfnisse ab.

Odoo bietet zusätzlich Automatisierung, SEPA, KI und Konsolidierung direkt in einer Lizenz.

Fakturierung & Forderungsmanagement

Wie schlagen sich die Tools bei Abos und Kundenkommunikation?.

Feature | Odoo | Sage |

Proforma-Rechnungen | ✅ | ✅ |

SEPA-Lastschrift | ✅ | ✅ |

Mehrere Steuersätze pro Zeile | ✅ | ✅ |

Abo-Rechnungen | ✅ | ✅ |

Upsells & Verlängerungen | ✅ | ❌ |

Abo-KPIs (MRR, Churn) | ✅ | ❌ |

Zahlungserinnerungen | ✅ | ✅ |

Unterm Strich:

Odoo ist die bessere Wahl für Firmen mit Abos oder komplexen Abrechnungsmodellen.

Sage ist gut für klassische Rechnungen, hat aber keine Logik für Upsells oder Verlängerungen an Bord.

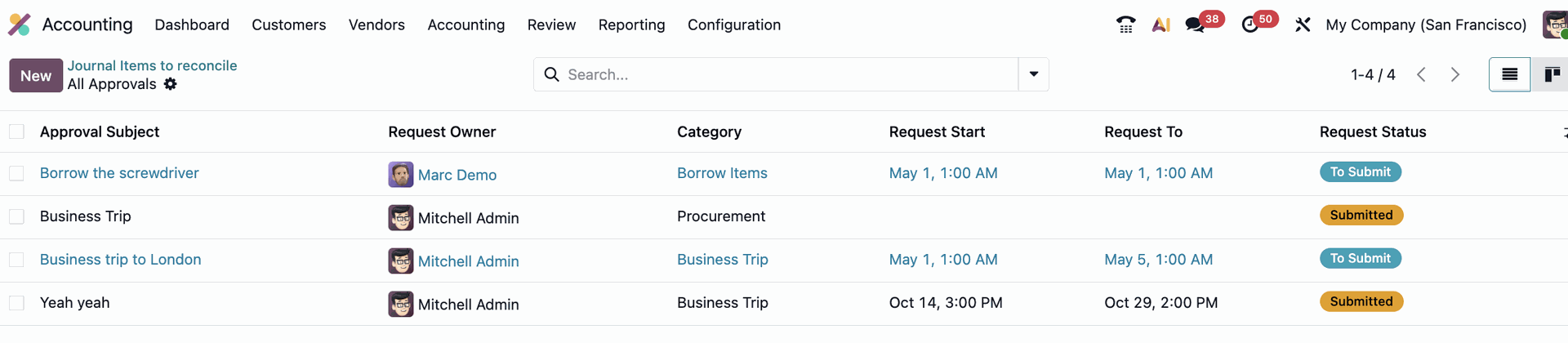

Lieferantenrechnungen & Zahlungsverkehr

So regeln Odoo und Sage den Einkauf und die Bezahlung:

Feature | Odoo | Sage |

OCR für Belege | ✅ | ✅ |

SEPA & BACS Zahlungen | ✅ | ❌ |

Kaufverträge | ✅ | ❌ |

Genehmigungsworkflows | ✅ | ⚠️ Nur in Sage Intacct |

Mobile Spesen-App | ✅ | ⚠️ Nur in Sage HR |

Unterm Strich:

Odoo automatisiert den kompletten Prozess vom Scan bis zur Zahlung.

Bei Sage gibt es moderne Zahlungsformate und Genehmigungs-Checks erst in der teureren Intacct-Version.

Purchase approvals and purchase agreements, ready to be reconciled in Odoo Accounting.

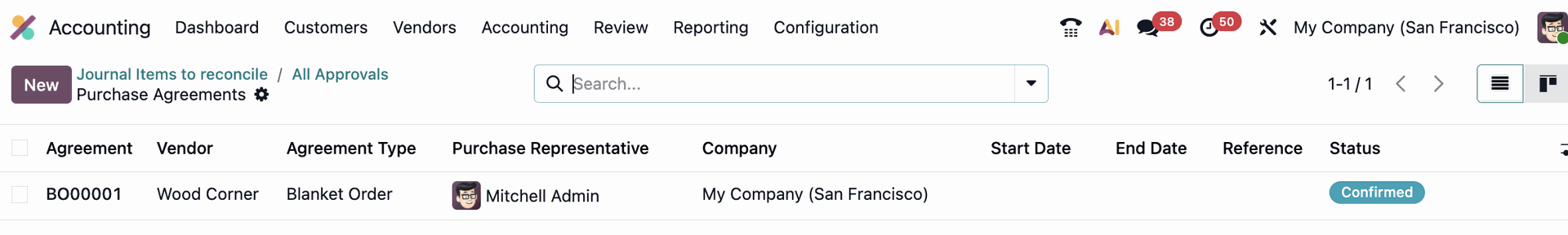

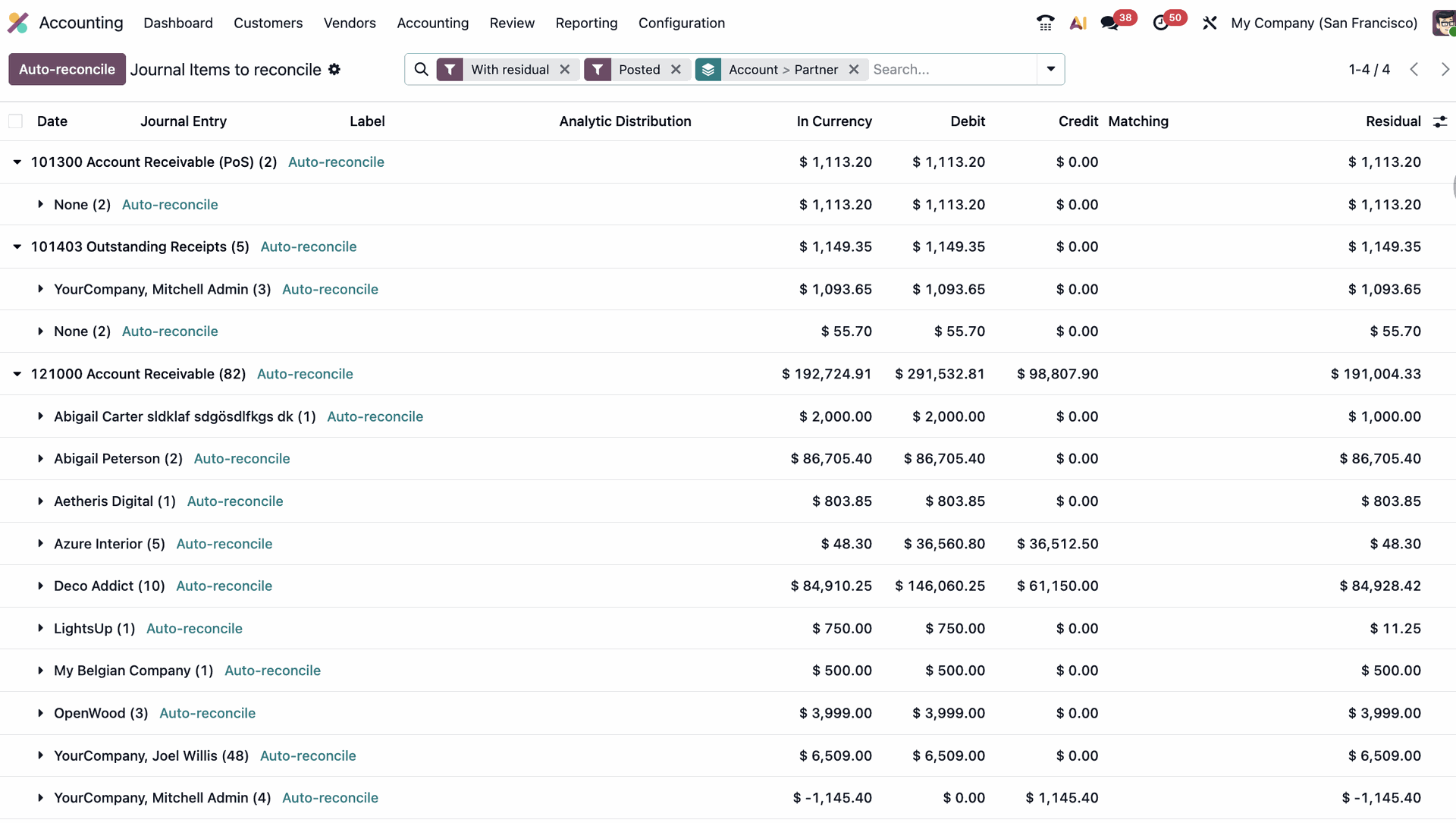

Bank-Feeds & Abstimmung

Hier geht es darum, wie schnell die Bankdaten im System landen und zugeordnet werden:

Feature | Odoo | Sage |

Abgleich & Matching | ✅ | ✅ |

Import-Formate (OFX, CODA, CAMT) | ✅ | ⚠️ Nur OFX & CAMT |

Automatische Wechselkurse | ✅ | ✅ |

Unterm Strich:

Sage bietet sehr gute britische Bank-Feeds.

Odoo ist flexibler bei den Formaten und nutzt KI-Regeln, was besonders bei mehreren Firmenstandorten Zeit spart.

Auto reconciliation in Odoo 19.

Berichte & Dashboards

Wie gut lässt sich mit den Finanzdaten arbeiten?.

Feature | Odoo | Sage |

GuV, Bilanz, Cashflow | ✅ | ✅ |

Pivot-Tabellen | ✅ | ❌ |

Eigene KPIs | ✅ | ⚠️ Begrenzt |

Geschäftsjahresabschluss (fortlaufend) | ✅ | ✅ |

Kommentare in Berichten | ✅ | ✅ |

Individuelle Dashboards | ✅ | ✅ |

Unterm Strich:

Sage liefert starke, gesetzeskonforme Berichte mit einer sauberen Optik.

Odoo punktet vor allem durch die mehrdimensionale Pivot-Analyse und ein tieferes KPI-Tracking - ideal für wachsende Teams und das Reporting innerhalb einer Unternehmensgruppe.

Automatisierung & KI

Ein Blick auf die intelligenten Funktionen:

Feature | Odoo | Sage |

OCR-Belegerkennung | ✅ | ✅ |

Autom. Abgrenzungen | ✅ | ⚠️ Nur Intacct |

KI-Mahnlogik | ✅ | ❌ |

KI-Tagging / Buchungshilfe | ✅ | ⚠️ Gemini AI |

Automatisierte Aktionen | ✅ | ❌ |

Unterm Strich:

Sage nutzt Google Gemini für einfache Hilfe.

Odoo geht weiter mit nativer KI für Buchhaltung und Abstimmung. Da Odoo Open Source ist, können Nutzer zudem eigene Automatisierungen hinzufügen.

Ein Beispiel dafür ist unser KI-Modul für automatisierte Aktionen,das KI auf jeden Workflow in Odoo ausweitet.

Preise & Hosting

Plattform | Preis | Beinhaltet | Nutzer | Hosting | Weitere Anforderungen |

Odoo | £25–30/Mo* | Buchhaltung + ERP + KI | Unbegrenzt | Cloud oder lokal | CRM, Lager, HR, Fertigung etc. |

Sage 50 | £39/Mo | Kern-Buchhaltung | 1–19 | Cloud | Keine |

Sage Intacct | Auf Anfrage | High-End Finance | 20+ | Nur Cloud | Keine |

*Umfang abhängig vom Abonnement (von monatlicher Abrechnung bis zu 5-Jahres-Verträgen)

Unterm Strich:

Odoo bietet ein All-in-one-ERP zum Flatrate-Preis.

Sage skaliert über Produkte: Sage 50 für KMU, Sage Intacct für Konzerne (allerdings teurer und weniger flexibel).

Wann Odoo und wann Sage?

Wählen Sie Odoo, wenn...

Sie Automatisierung, SEPA und die Konsolidierung mehrerer Firmen brauchen.

Sie über die Buchhaltung hinaus auch andere Bereiche (wie CRM oder Lager) digitalisieren wollen.

Sie Wert auf die Flexibilität von Open Source und Kostentransparenz legen.

Sie ein einziges, integriertes System für alle Prozesse suchen.

Wählen Sie Sage, wenn...

Sie ein spezialisiertes Tool nur für die britische Buchhaltung suchen und schnell starten wollen.

Sie nur eine einzige Firma verwalten.

Sie bereits voll im Sage-Ökosystem arbeiten.

Möchten Sie Ihre Buchhaltung mit Odoo optimieren?

Odoo Buchhaltung bietet Automatisierung und Echtzeit-Reporting in einem Guss. Sprechen Sie mit unseren Experten, um Ihr Odoo-Setup perfekt auf Ihr Business zuzuschneiden.